2019 was not a revolutionary year for the games industry. If anything, it saw the continuation of the already consolidated trends, the dominant of which was the growth of the mobile market.

To a great extent, this owed a lot to the explosive surge of interest towards hypercasual games. If at the beginning of 2019, people only began talking about such projects and Voodoo Games was considered a pioneer within the niche, then by the end of the same year, even marketing companies such as ironSource joined the hypercasual dev ranks with their own Supersonic Studios.

It is also important to note that Steam was no longer monopolizing the online PC market, as Epic Games, who had made a substantial profit from Fortnite and their game engine, decided to create their own online store. At the moment of composing this material, an open war transmuted into a strategic competition, a phenomenon that had not occurred in the games market since, well, 2004 when Valve had launched Steam.

This year’s research spans fewer countries than the previous ones, although we did analyze the data in more detail. We did not solely account for the direct indicators of the games markets presented here but also macro- and microeconomic factors that have a significant impact on whether a project or game localizationis released in a certain region.

| № | Country | Games market revenue, mln USD | Internet penetration (%) | Number of gamers (millions) | Mobile market, mln USD | Average yearly spending on mobile games (USD) | EF EPI (English Proficiency Index) |

| 1 | China | 36540 | 59,30% | 640 | 21140 | 14,69 | 53,44 (Moderate) |

| 2 | United States of America | 36500 | 86,50% | 215,15 | 9937 | 30,02 | 100,00 (Native) |

| 3 | Japan | 18683 | 93,20% | 79,6 | 6528,4 | 51,65 | 51,51 (Low) |

| 4 | South Korea | 6194 | 86,50% | 41,9 | 5810 | 113,48 | 55,04 (Moderate) |

| 5 | Germany | 6000 | 94,50% | 58,59 | 606,3 | 7,24 | 63,77 (Very High) |

| 6 | UK | 5600 | 90,80% | 46,1 | 1240 | 18,29 | 100,00 (Native) |

| 7 | France | 4810 | 92,60% | 48,9 | 1231 | 18,88 | 57,25 (Moderate) |

| 8 | Canada | 2700 | 91,60% | 29,1 | 309,2 | 8,20 | 100,00 (Native) |

| 9 | Spain | 2583 | 91% | 37,8 | 301 | 6,45 | 55,46 (Moderate) |

| 10 | Italy | 2363,25 | 90,50% | 47,7 | 1344 | 22,25 | 55,31 (Moderate) |

| 11 | Russia | 2000 | 81% | 66 | 700 | 4,80 | 52,14 (Low) |

| 12 | Taiwan | 1992 | 85,20% | 20,9 | 1023 | 42,98 | 54,18 (Moderate) |

| 13 | Australia | 1900 | 79% | 18,1 | 959 | 38,06 | 100 – Australian English |

| 14 | Brazil | 1600 | 70,20% | 180,2 | 334,1 | 1,58 | 50,10 (Low) |

| 15 | India | 1500 | 40,50% | 1237,1 | 1300 | 0,94 | 55,49 (Moderate) |

| 16 | Philippines | 1500 | 72,10% | 102,93 | 437 | 3,99 | 60,14 (High) |

| 17 | Indonesia | 1084 | 62,70% | 251,16 | 1000 | 3,66 | 50,06 (Low) |

| 18 | Turkey | 830 | 81,90% | 34 | 400 | 4,74 | 46,81 (Very Low) |

| 19 | Saudi Arabia | 758 | 89,39% | 30,9 | 158 | 4,54 | 41,60 (Very Low) |

| 20 | Malaysia | 673 | 81,40% | 20,1 | 504,75 | 15,63 | 58,55 (High) |

| 21 | Thailand | 667 | 81,60% | 49,4 | 446,89 | 6,40 | 47,61 (Very Low) |

| 22 | Poland | 596 | 72,70% | 19 | 216,2 | 5,72 | 63,76 (Very High) |

| 23 | Hong Kong | 502 | 91% | 6,1 | 31,5 | 4,26 | 55,63 (Moderate) |

| 24 | Vietnam | 472 | 70,40% | 87,57 | 77,8 | 0,80 | 51,57 (Low) |

| 25 | Iran | 458 | 80,50% | 30 | 198 | 2,36 | 48,69 (Low) |

| 26 | United Arab Emirates | 342 | 99% | 7,84 | 78,7 | 8,03 | 48,19 (Very Low) |

| 27 | Singapore | 319 | 84% | 4,8 | 52 | 8,97 | 66,82 (Very High) |

| 28 | South Africa | 224,58 | 67,70% | 50,9 | 43,6 | 0,74 | 65,38 (Very High) |

| 29 | Nigeria | 85 | 61,10% | – | 56 | 0,27 | 58,26 (High) |

Rankings Table Explained

- The countries are presented in descending order with respect to total market volume.

- Average yearly spending on mobile games is calculated by dividing Average yearly spending on video games by the number of mobile gamers.

Comparison Of Games Markets In China And The United States

Games Industry Facts

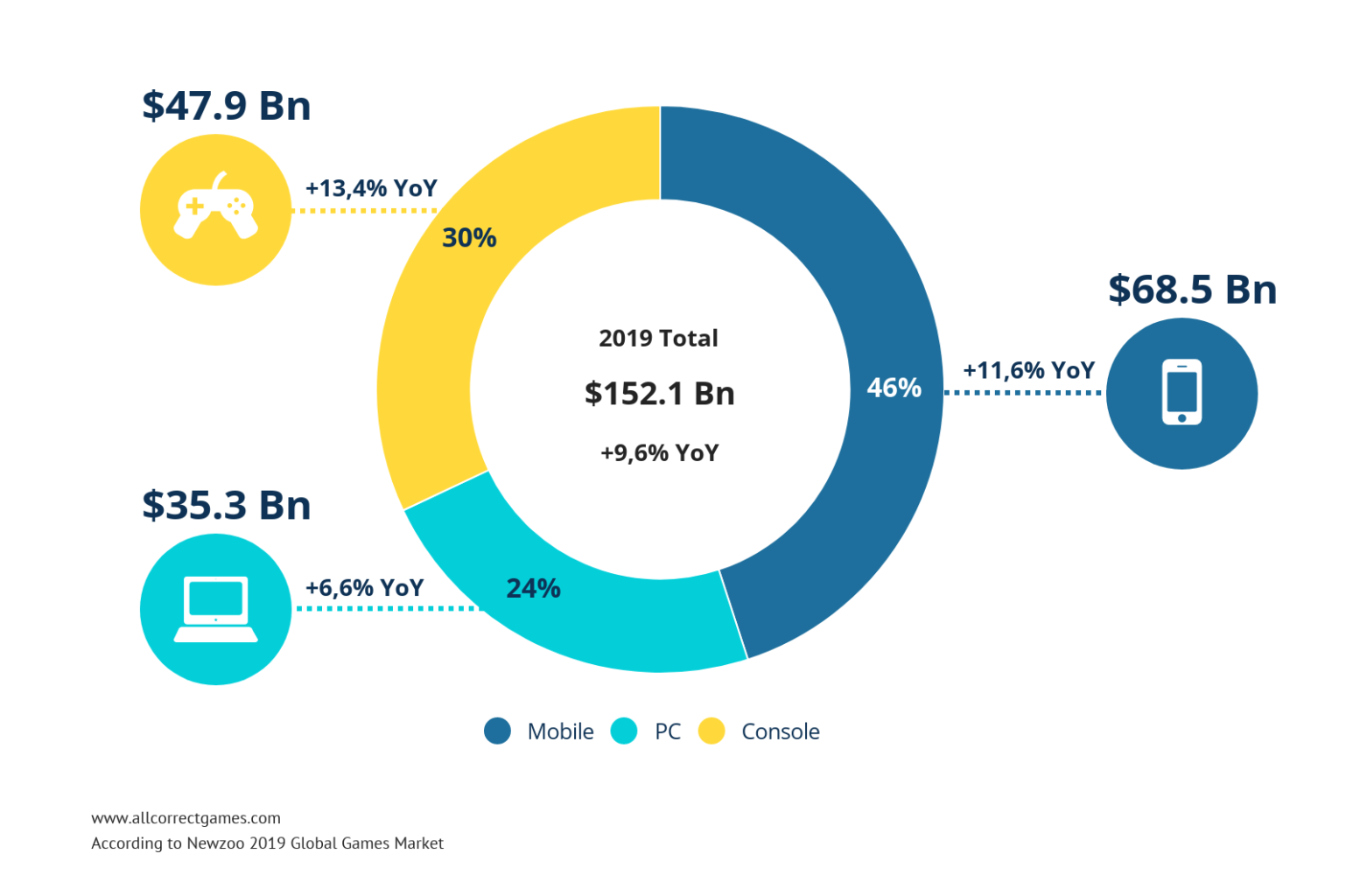

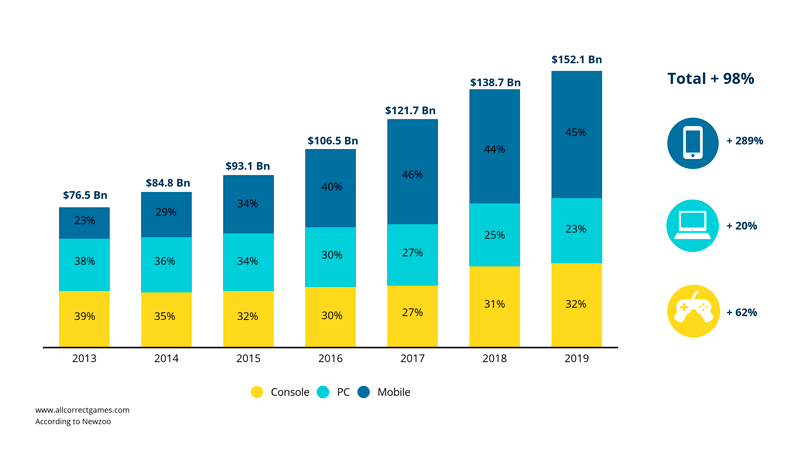

According to Newzoo, the market volume in 2019 equated to $152.1 billion, the highest share of which belongs to the mobile games sector (45%).

Overall, the games market experienced a 9.6% growth. The main drivers of this were mobile games – they overtook the general market growth rate (+11.6% YoY).

Growth Of Revenues By Segments

The main trends of the industry in 2019 can be summarized as follows:

- The mobile games market strengthened its position.

- The growth of the Chinese games market slowed, primarily because of government regulations.

- The games market had gradually transitioned to its maturity stage and its growth rate generally slowed.

- The number of mergers and acquisitions increased, which indicates a budget surplus for large companies and their dire need to search for new concepts, business models, and genres.

- Battle Royale solidified its position as a separate subgenre, which proves that there is still room for experimentation in the market even to this day.

If we are to make any forecasts for 2020, then we believe it will turn out to be one of the most unpredictable periods over the last five years. This can be explained by the following factors:

- The decline of global economy (by 7%, according to the Fitch forecast) as a result of the coronavirus pandemic and ensuing problems. In some countries, the global games market revenue may tumble back to the last year or year before last value (depending on the actual state of the economy). In other countries, the opposite can be true and it may grow, primarily thanks to the increase in the currency-to-dollar exchange rates caused by the quantitative easing measures of the US Federal Reserve.

- A decrease in the growth rate of the mobile games market. This is linked to the fact that in many countries, the majority of the population has already purchased smartphones, meaning that the growth of mobile ownership has practically reached zero there. A similar situation can be observed with regards to the total number of internet users.

- Potential growth of Chinese mobile app stores for Android in developing and third world countries. This is the result of Chinese smartphone manufacturers being pushed by American trade sanctions. Chinese producers are already forming alliances with the mutual objective of promoting their app stores outside China.

- The emergence of Apple out of China’s grey zone (now companies will have to get an ISBN for their game to have it released on iOS in the region).

- Increased investment activity of large companies. Acquisitions made in 2018–2019 will begin releasing their projects in 2020–2021.

- Possible displacement of advertising monetization models with in-game microtransactions, as well as potential content growth of hypercasual gaming.

- The global shift to telecommuting caused by the coronavirus pandemic – we assume that this may greatly affect the development process.

- Increase in demand growth for cloud gaming, as well as a surge in the activity of developers based in Southeast Asia (and corresponding growth of popularity of the languages spoken in this region).

- Release of next-gen consoles (even though this will probably occur near the year end).

Research Methodology

Here is a list of our main sources of data on games markets:

- Newzoo

- Publications of local games associations

- PwC

- Statista

- We Are Social.

Each separate indicator was analyzed and evaluated individually. We tried not to use any predictive values or cross-check forecasts across different sources simultaneously, because oftentimes such data for every country may vary significantly from platform to platform. This is due to variations in their approaches when collecting and analyzing data.

The macroeconomic data used in this study was taken from the following sources:

- World Bank

- Worldometers

- EF EPI

- Statcounter

- Statista.

Just like with other games market indicators, we did not consult any predictive analyses and examined each country individually while cross-checking all the data.

It is worth noting that these materials are intended to be used exclusively for fact-finding purposes. The Allcorrect company does not bear any responsibility for potential losses or other negative consequences incurred by companies or individuals using these materials for their business or other purposes.