Thinking about localizing your game for Japan? Unlock key insights into one of the world’s most influential gaming markets. From cultural nuances to the latest trends in esports and VR, learn how to make your game resonate with Japanese players.

General Information

| Official name | State of Japan (Wikipedia) | |

| Capital | Tokyo (Wikipedia) | |

| Population | 122,561,941 (Worldometers) | |

| Total area | 377,975 km² (Wikipedia) | |

| Average age | 49.1 (Worldometers) | |

| GDP | USD 4212.95 billion (Trading Economics) | |

| GDP per capita | USD 37079.11 (Trading Economics) | |

| Official language | Japanese |

Japan, as of 2023, is one of the world’s leading economic powers, ranking fourth globally in both nominal GDP and GDP based on purchasing power parity. It also stands as the fourth-largest exporter and the sixth-largest importer worldwide.

A developed country with a very high standard of living, Japan ranks nineteenth on the Human Development Index. The country also boasts one of the highest life expectancies (85.3 years in 2017) and one of the lowest infant mortality rates globally. As a member of the G7 and APEC, Japan plays an active role in global affairs and is regularly elected as a non-permanent member of the UN Security Council. Although it has renounced the right to wage war, Japan maintains self-defense forces, which are also deployed in peacekeeping operations. By the 2020s, Japan had one of the largest military budgets in the world.

Gaming Market

Japan’s gaming market is among the most prominent and influential globally. Despite its smaller population compared to other major markets, Japan ranks as the third-largest gaming market by revenue and the eighth largest by the number of players.

A highly technologically advanced nation, Japan’s widespread smartphone ownership is a key driver of the mobile gaming segment. Additionally, the presence of leading gaming companies such as Bandai Namco, Sega, Sony, and Konami significantly boosts the market.

According to Niko’s East Asia Games Market Model Report, while the mobile gaming market in Japan is expected to stagnate over the next five years, the markets for PCs (with a 5-year CAGR of 8.8%) and consoles (5-year CAGR of 2.5%) are projected to grow.

One of the most notable trends in Japan’s gaming market is the rapid growth of esports. Esports tournaments and events have surged in popularity, attracting professional players and large audiences. This trend has fostered the development of esports teams and organizations and has led to increased investments in the sector. The rise of streaming platforms has further fueled this growth, as gamers can now watch their favorite players and teams in real time.

Another significant trend is the increasing focus on virtual reality (VR) and augmented reality (AR) gaming. Japanese companies have been pioneers in developing innovative VR and AR games, leveraging the country’s advanced technology and deep gaming expertise.

Local market characteristics:

Gaming in Japan is more than just entertainment; it’s a deeply ingrained social activity. Many Japanese gamers enjoy playing with friends and family, often engaging in online multiplayer modes. This social aspect has cultivated a strong community and a dedicated fan base. Japan also has a rich history of game development, with many iconic franchises originating there. This legacy fosters a sense of pride and loyalty among Japanese gamers, who remain enthusiastic about both domestic and international game releases.

Macroeconomic factors:

Japan’s developed economy and high income levels contribute significantly to the growth of its gaming market. The country has a large population, with a high proportion of young people who form the major consumer base for video games. Furthermore, Japan’s advanced technological infrastructure and widespread internet access provide a robust foundation for the gaming industry.

Statista forecasts

- Japan’s gaming market is projected to reach a revenue of USD 44.41 billion by 2024.

- The compound annual growth rate (CAGR) for revenue from 2024 to 2029 is expected to be 6.66%, potentially expanding the market to USD 61.31 billion by 2029.

- User penetration is projected to rise from 48.5% in 2024 to 55.3% by 2029.

- Average revenue per user (ARPU) is projected to reach USD 1,673.

- The industry is dominated by innovative mobile games, reflecting Japan’s technological sophistication and the popularity of digital entertainment.

Market Development Dynamics

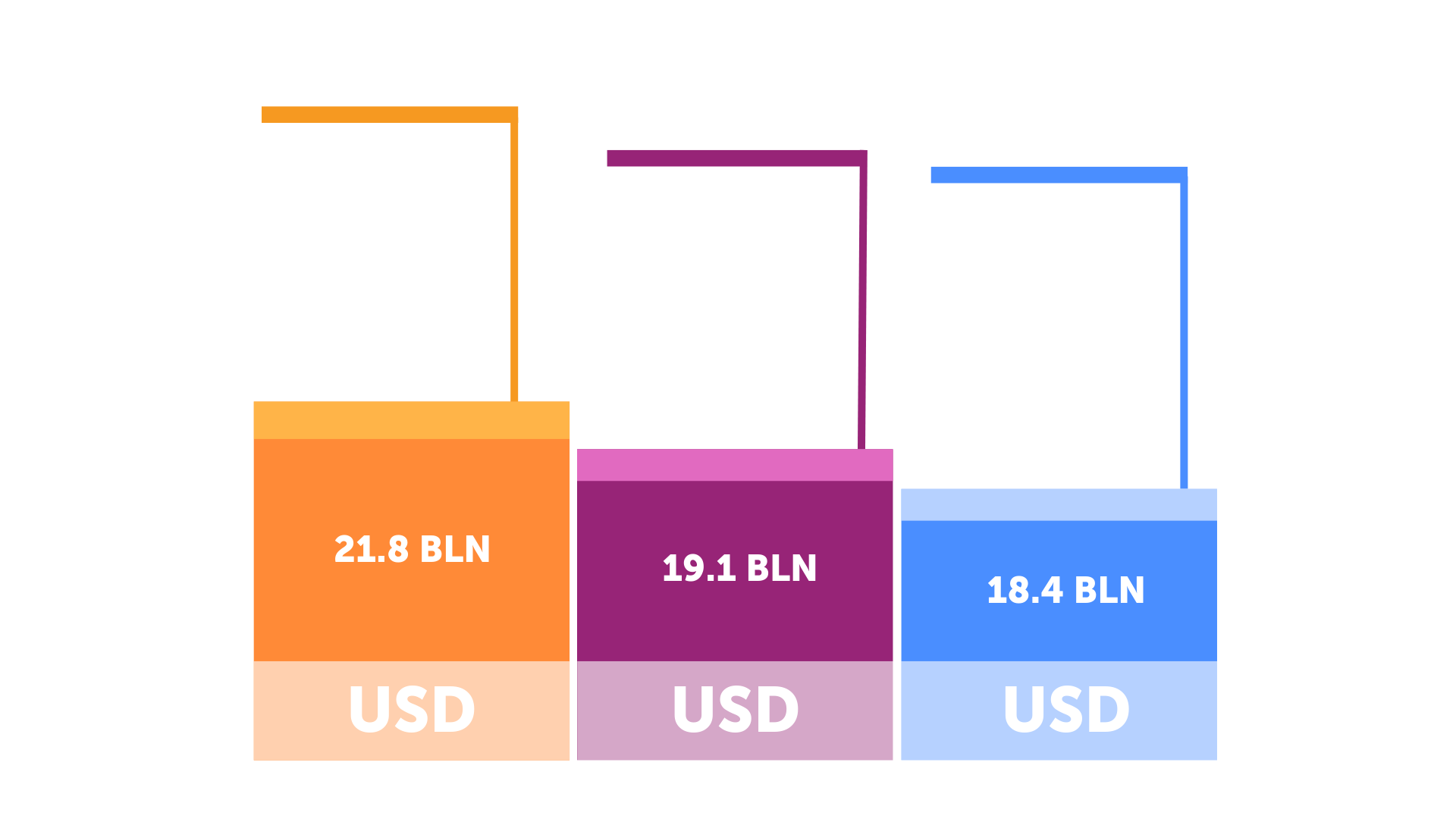

Source: platform.newzoo.com

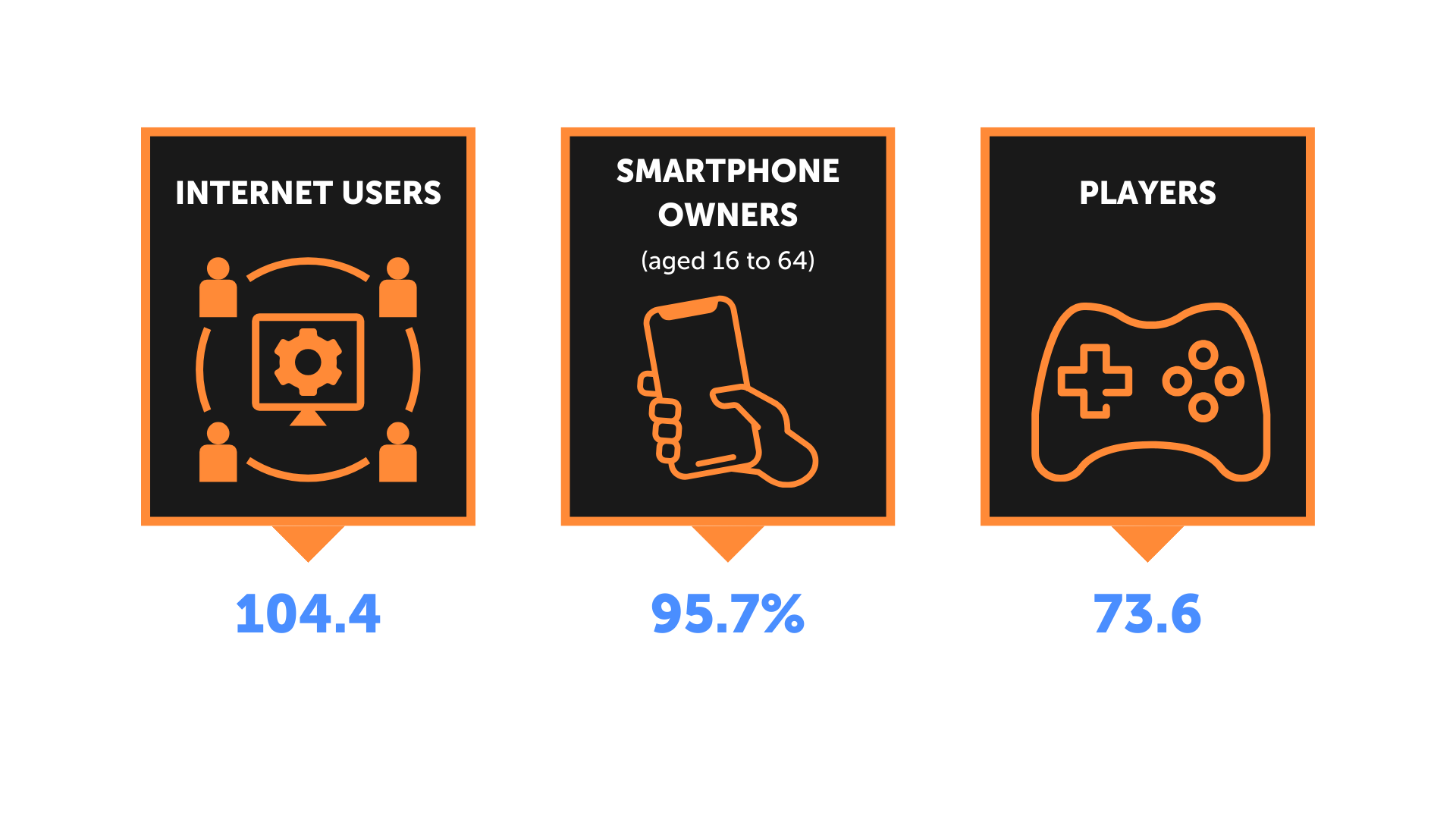

Source: platform.newzoo.comPopulation

Source: Worldometers.info, DataReportal.com, Statista.com, Platform.newzoo.com

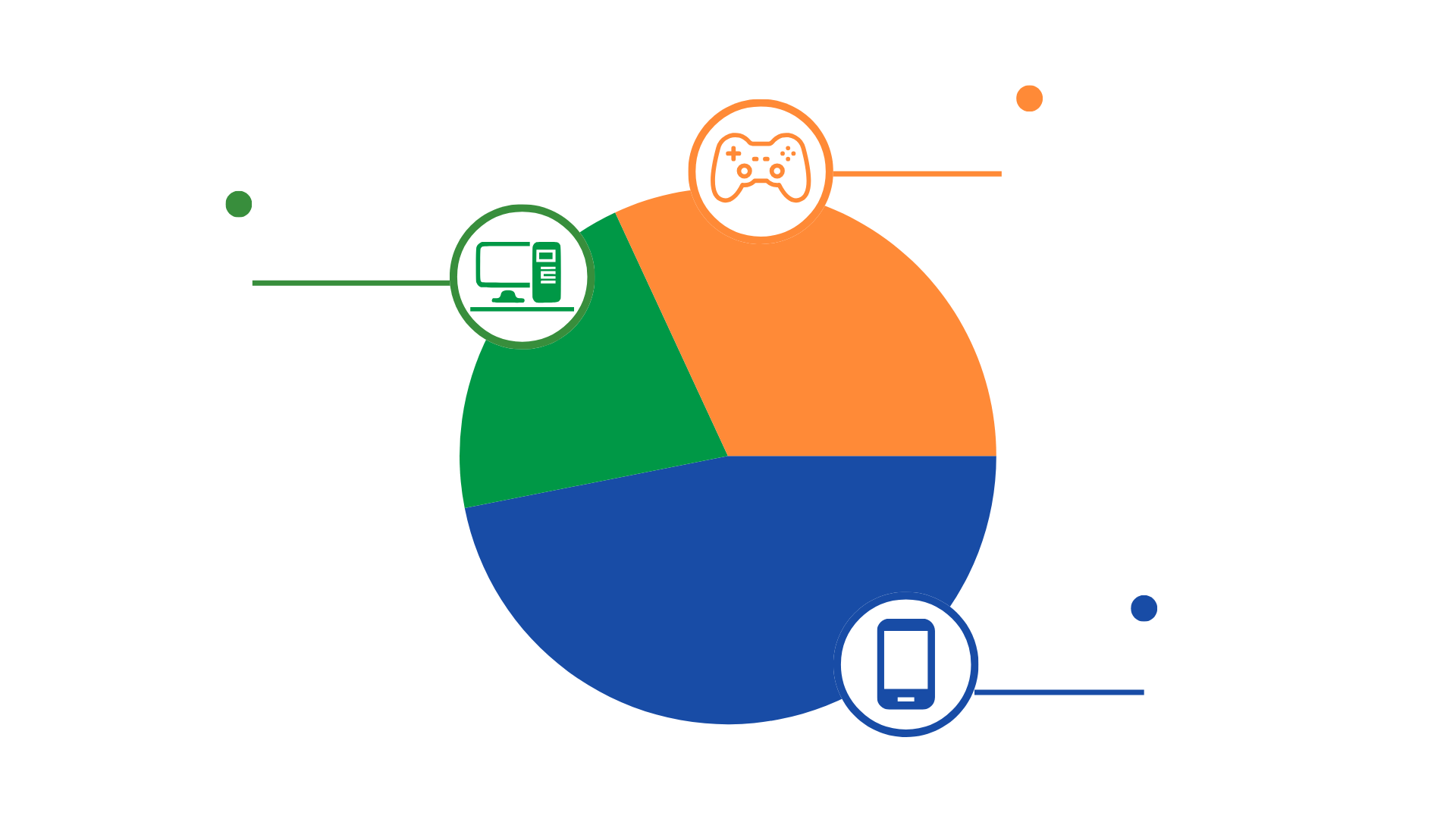

Source: Worldometers.info, DataReportal.com, Statista.com, Platform.newzoo.comPlayers by Platform (2023)

Source: platform.newzoo.com

Source: platform.newzoo.comNumber of Players (2023)

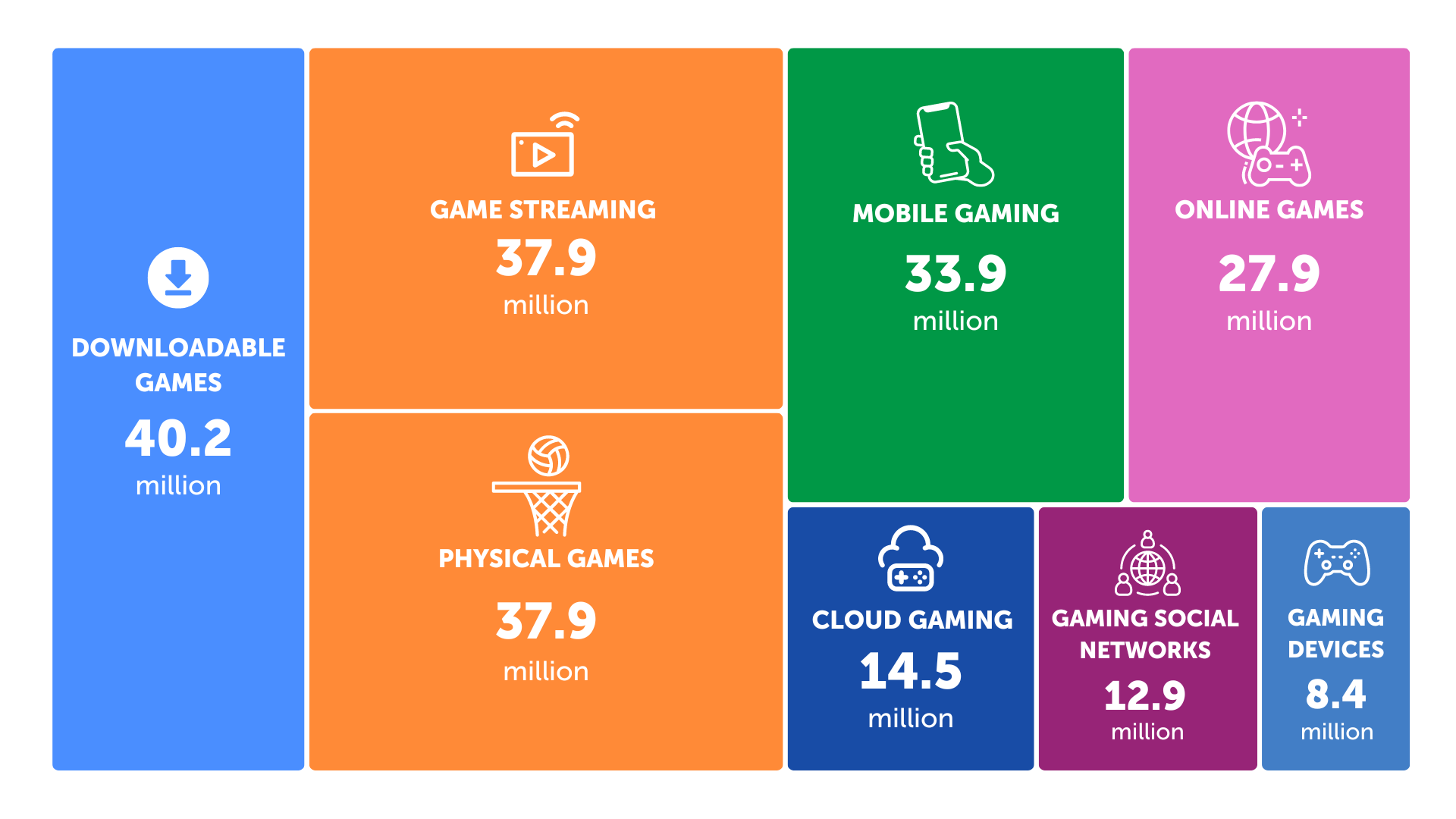

Source: statista.com

Source: statista.comPlayer Spending (Newzoo)

Source: platform.newzoo.com

Source: platform.newzoo.comPlayer Profile

Gaming has become a cultural cornerstone in Japan, with strong consumer attachment to games. Console gaming remains highly popular, and mobile gaming is widespread thanks to the high rate of smartphone ownership. Japanese gamers particularly enjoy role-playing games (RPGs) and strategy games.

Two key factors drive Japanese gamers to try new games: familiarity with new genres and a compelling storyline, with over 60% of gamers emphasizing their importance. Additionally, more than 31% of Japanese gamers watch game broadcasts, making it one of the most crucial marketing tools in Japan. While YouTube is the dominant platform for gaming content across Asia, Japan’s local platform Niconico reaches over 20% of gamers.

A portrait of young players

- Most young gamers in Japan play on consoles (72%), followed by mobile devices (64%) and PCs (15%). Parents prefer consoles due to the greater control they offer over game content.

- Young gamers play on average for 8 hours per week on mobile devices, compared to 6.5 hours on PCs and consoles.

- Japanese youth are more loyal than adults to foreign games, esports, game broadcasts, and VTubers.

- Nearly 46% of young gamers are engaged in esports and competitive gaming, compared to 12% of the overall gaming population.

- Premium games remain popular, especially due to the enduring popularity of consoles, and are the most common individual purchases among young gamers.

- Parents of young gamers generally accept video games as a form of entertainment and are likely to be gamers themselves.

- Most parents and young people believe that control over gaming time should be managed by families rather than the government or gaming companies, with 66.9% of parents and 45.8% of youth agreeing.

General Player Statistics

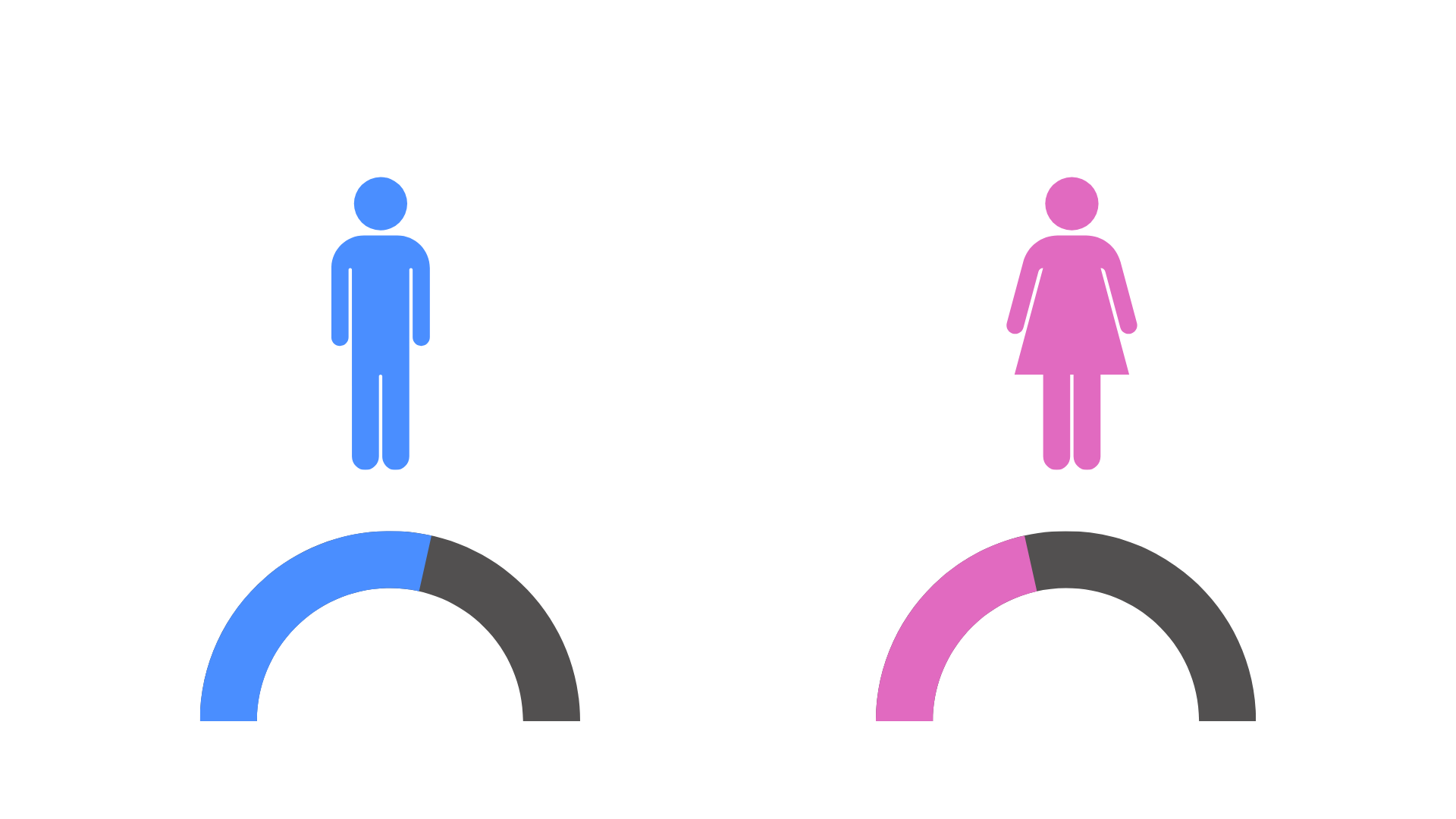

Gender Distribution

Source: statista.com

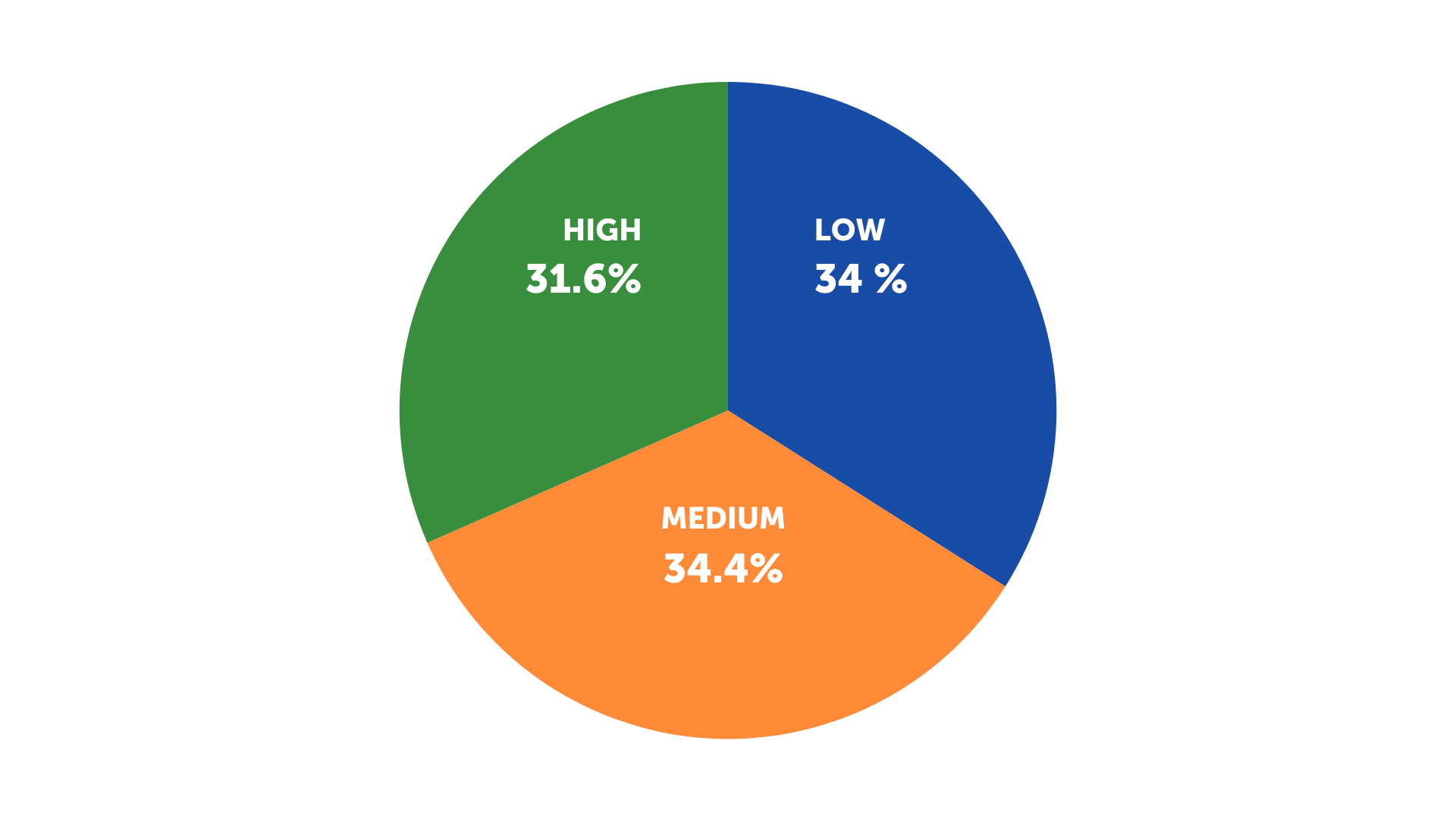

Source: statista.comPlayer Distribution by Income

Source: statista.com

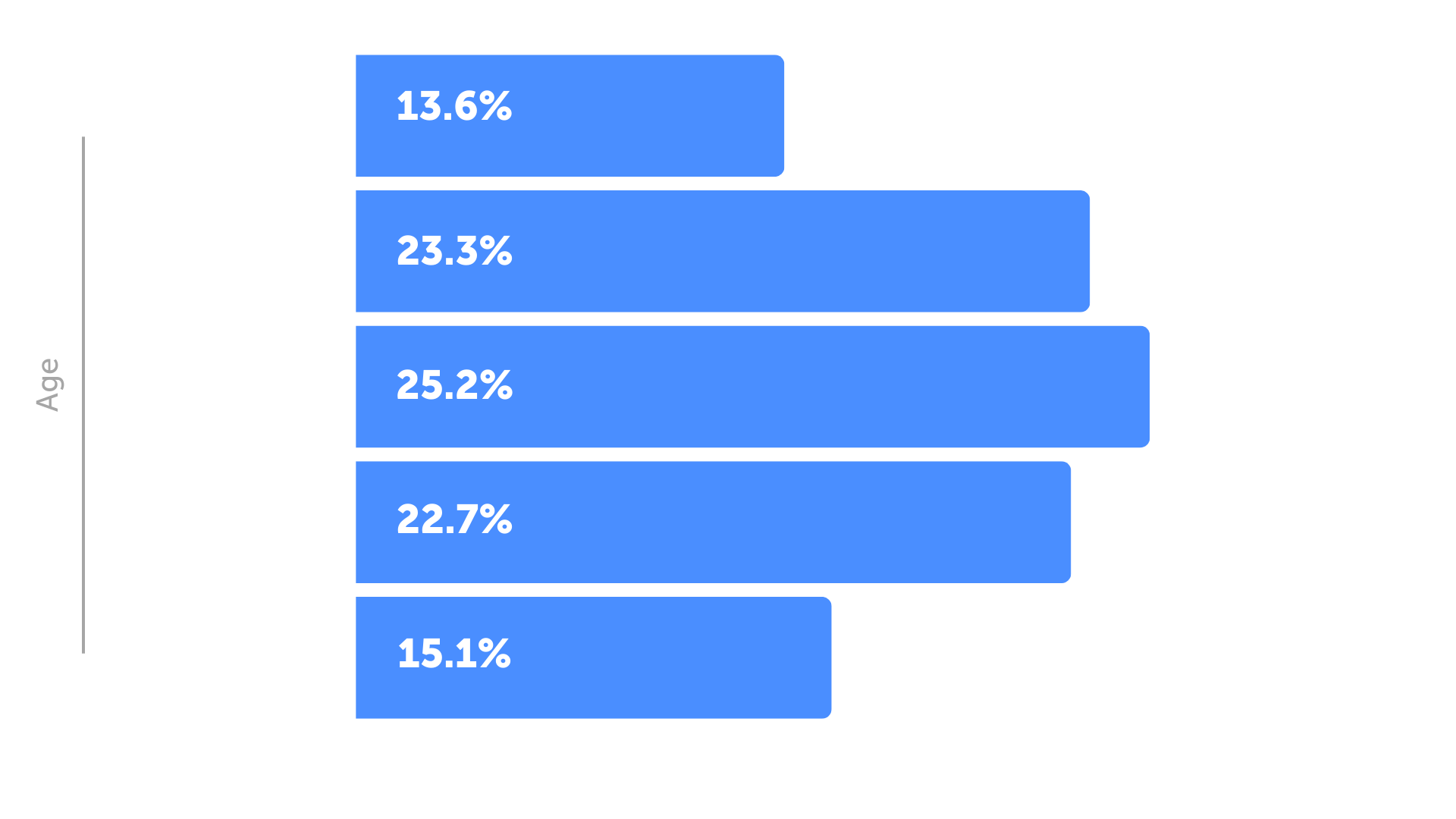

Source: statista.comAge Distribution

Source: statista.com

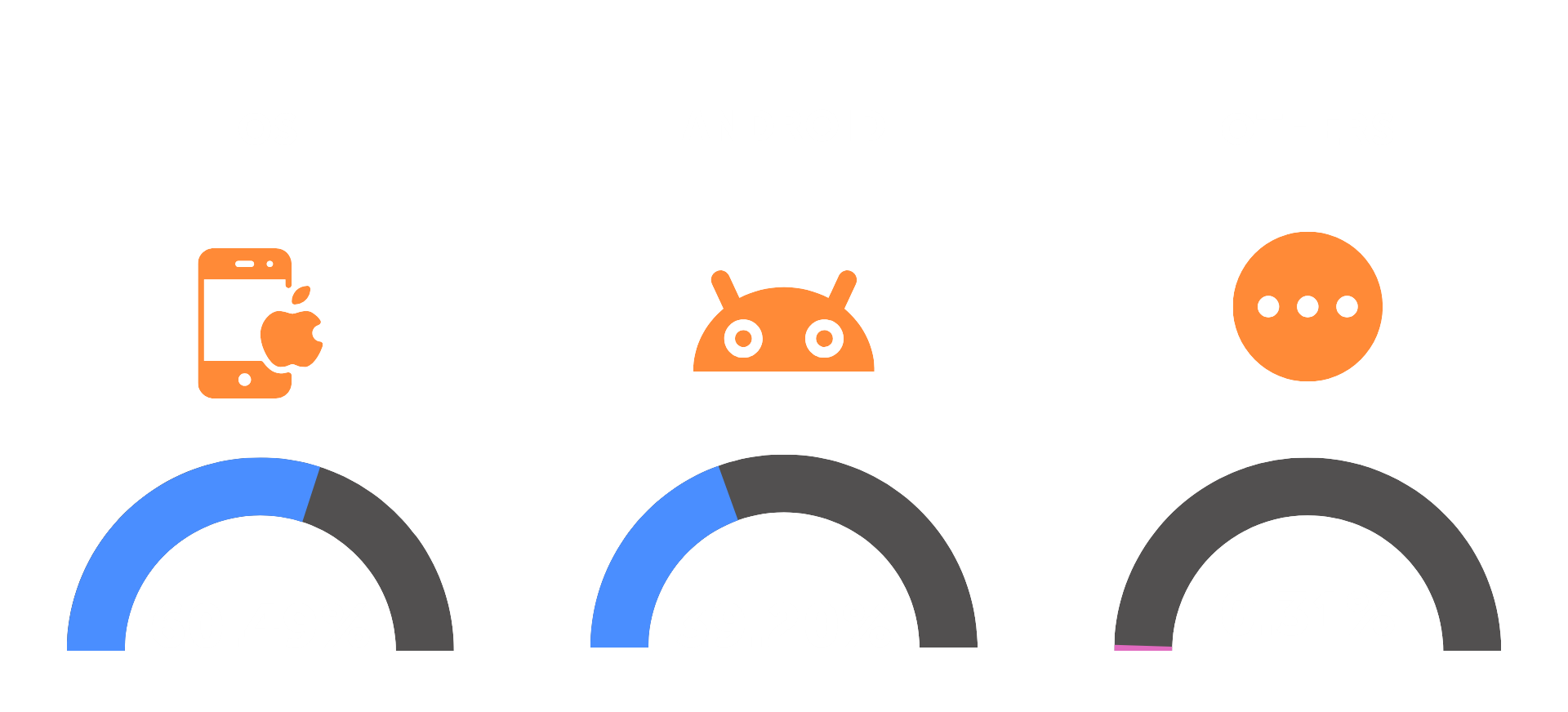

Source: statista.comOS Distribution

Source: gs.statcounter.com

Source: gs.statcounter.comAverage Annual Traffic and Average Internet Speed

Source: cisco.com, speedtest.net

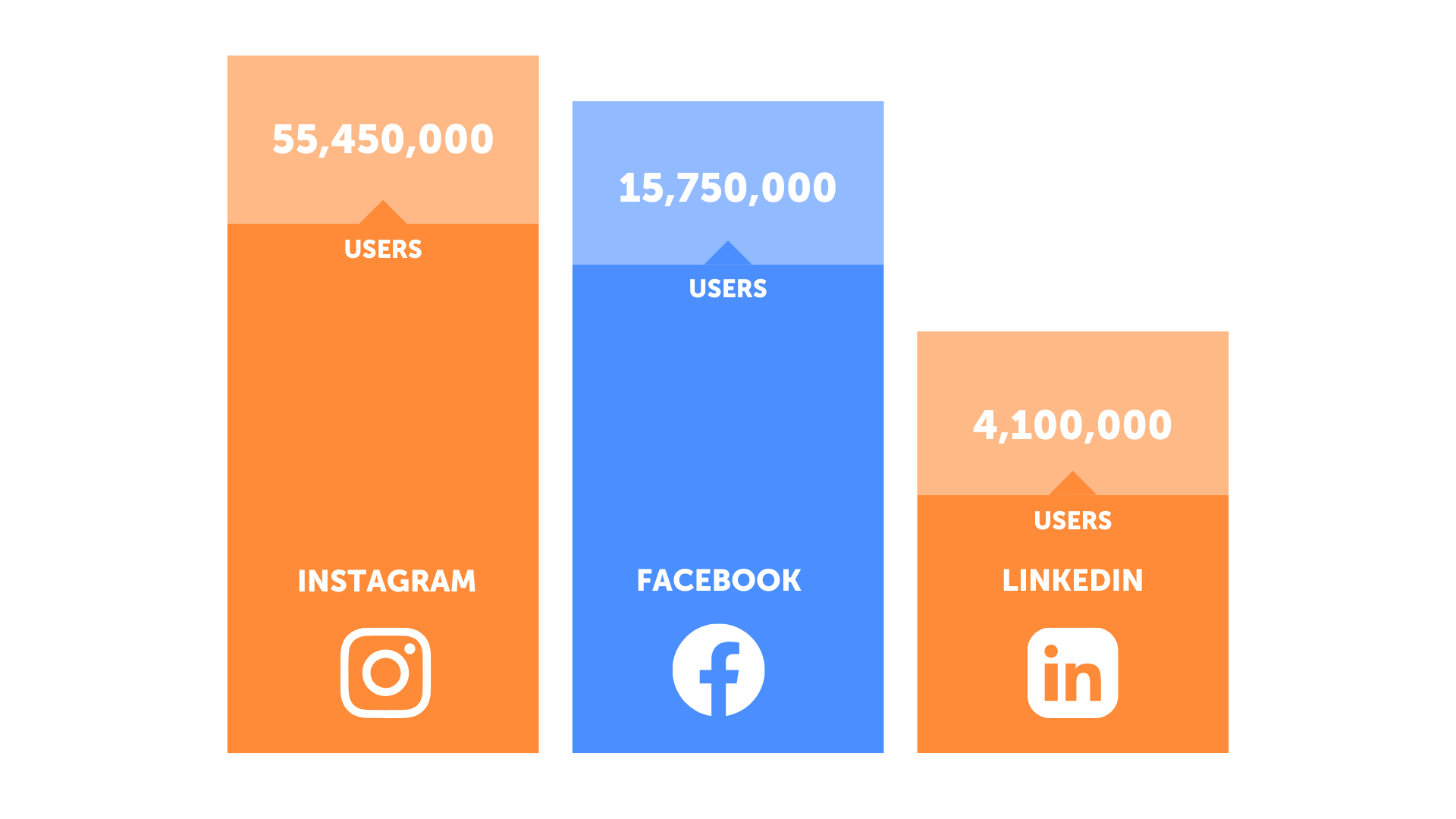

Source: cisco.com, speedtest.netPopular Social Media (DataReportal 2024)

Source: datareportal.com

Source: datareportal.comRevenue of Key Market Companies in Japan (USD billion)

| - | 2018 | 2019 | 2020 | 2021 | 2022 |

| Activision Blizzard | 7.50 | 6.49 | 8.09 | 8.80 | 8.09 |

| Bandai Namco Holdings | 6.14 | 6.80 | 8.33 | - | - |

| Electronic Arts | 4.95 | 5.54 | 5.63 | 6.99 | 7.43 |

| Microsoft | 125.80 | 143 | 168.1 | 198.3 | 211.9 |

| Nintendo | 10.87 | 12 | 16.47 | 15.45 | 14.13 |

| Sega Sammy Holdings | 2.93 | 3.04 | 2.6 | 2.92 | - |

| Sony | 78.48 | 75.77 | 84.28 | 90.4 | 101.8 |

| Take-Two Interactive Software | 2.67 | 3.09 | 3.37 | 3.51 | 5.35 |

| Tencent Holdings | 47.26 | 54.61 | 69.86 | 86.85 | 90.81 |

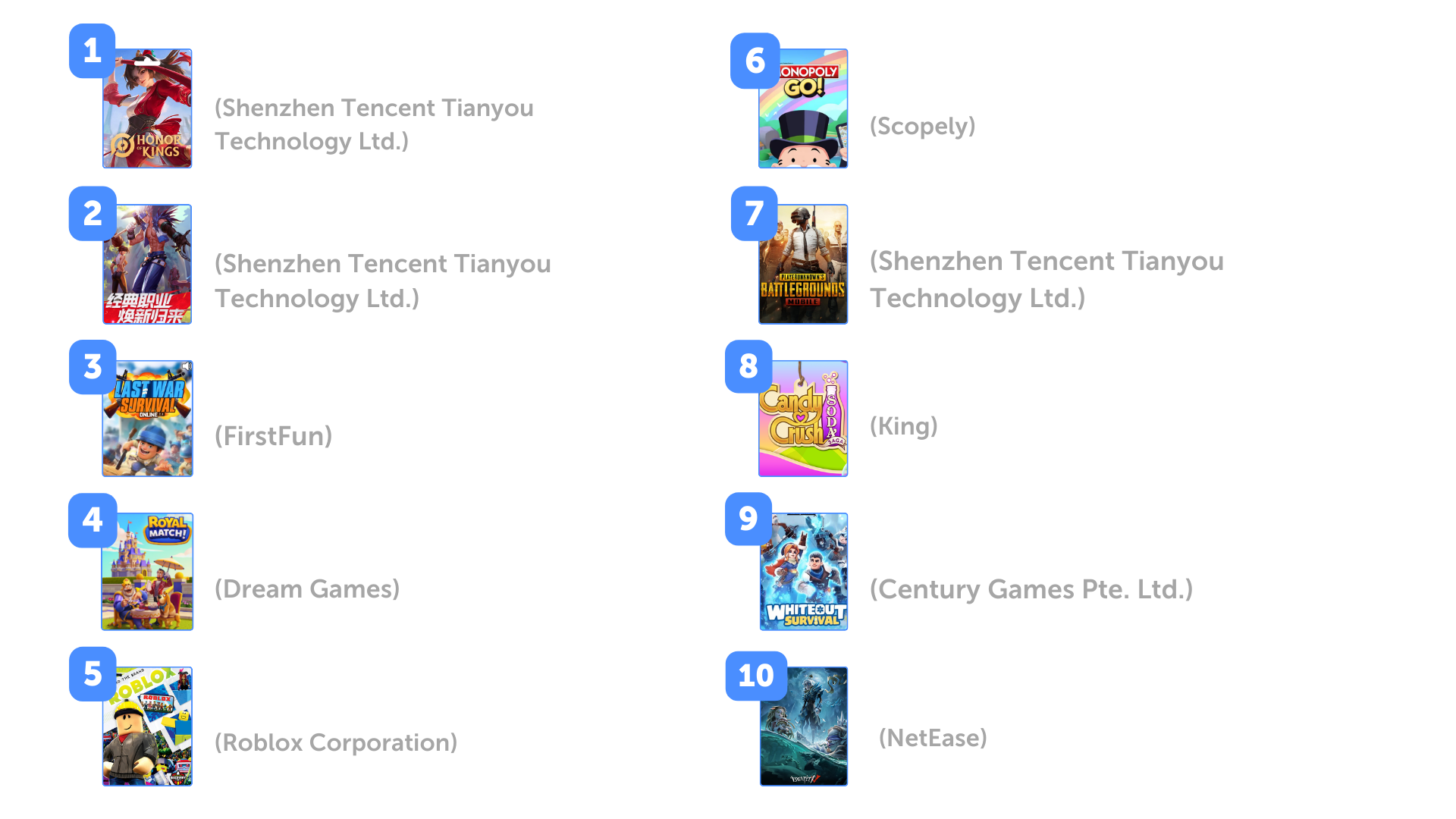

Top Mobile Games (August 2024):

1. Honor of Kings (Shenzhen Tencent Tianyou Technology Ltd.)

2. 地下城与勇士:起源 (Shenzhen Tencent Tianyou Technology Ltd.)

3. Last War:Survival (FirstFun)

4. Royal Match (Dream Games)

5. Roblox (Roblox Corporation)

6. MONOPOLY GO! (Scopely)

7. PUBG MOBILE (Shenzhen Tencent Tianyou Technology Ltd.)

8. Candy Crush Saga (King)

9. Whiteout Survival (Century Games Pte. Ltd.)

10. Identity V (NetEase)

11. Brawl Stars (Supercell)

12. Pokémon GO (Niantic, Inc.)

13. Coin Master (Moon Active)

14. Call of Duty®: Mobile (Activision Publishing, Inc.)

15. モンスターストライク (XFLAG, Inc.)

16. Honkai: Star Rail (COGNOSPHERE PTE. LTD.)

17. 三国:谋定天下 (Shanghai Hode Information Technology Co. Ltd.)

18. Dragon Ball Z: Dokkan Battle (Bandai Namco Entertainment Inc.)

19. Fate/Grand Order (English) (Aniplex Inc.)

20. Gardenscapes (Playrix)

Source: appmagic.rocks

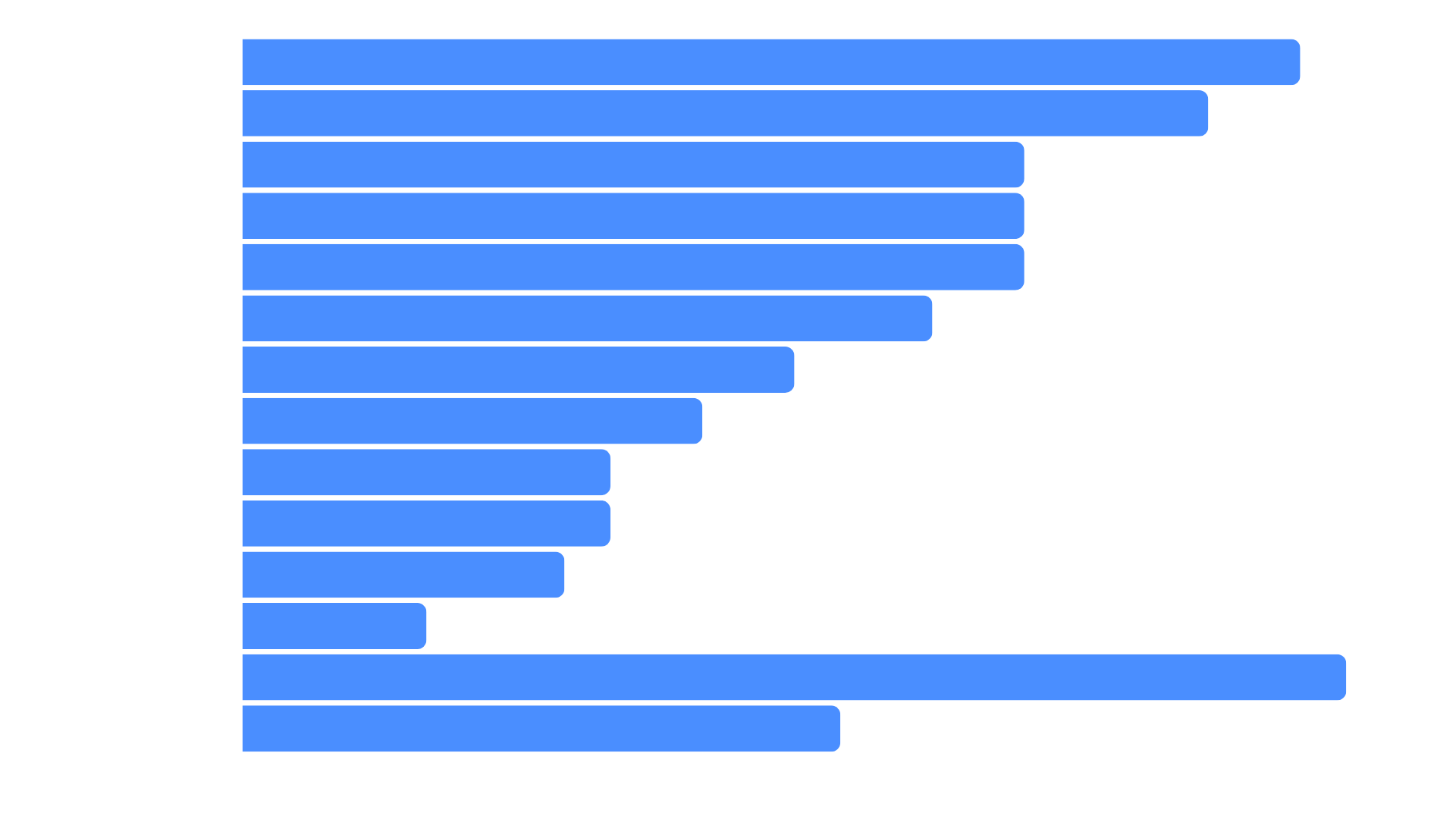

Source: appmagic.rocksPreferred Video Game Genres in Japan (June 2024)

Source: statista.com

Source: statista.comLocalization and Culturalization for the Japanese Market

In Japan, English proficiency is low, with less than 30% of the population able to speak English and less than 10% fluent. Despite extensive English education in schools, Japan ranks 87th in the world on the EF EPI index.

These statistics underscore the importance of localization for foreign games entering the Japanese market. Localization in Japan involves not just translating content but adapting it to align with cultural norms and expectations.

Key considerations for localization in Japan include:

1. Lexical and linguistic features.

Japanese has several writing systems (kanji, hiragana, katakana, romaji) and two methods of computer input, making localization complex. The official spelling of kanji and kana is also periodically revised by the Japanese Ministry of Education.

2. Speech style.

Japanese is highly regimented with varying levels of politeness based on the hierarchical position, relationships, and social status of interlocutors. What is considered “neutral” Japanese can often sound overly polite and unnatural.

3. Gender-specific language.

The Japanese language has specific expectations for the tone and manner in which men and women speak.

4. Sensitive topics.

Certain topics, such as religion, depictions of tobacco products, and drugs, should be avoided in games.

5. Symbols and colors.

Symbols and colors carry significant meaning in Japan. For example, the number four is associated with death.

6. In-game violence.

While games are rarely banned in Japan, they are subject to censorship, particularly regarding scenes containing violence or nudity.