Learn more about why India’s gaming market is attracting the attention of major companies and what the future holds for the gaming industry in one of the most dynamic countries in the world!

Interest in video games in India grows exponentially each year, which is no surprise, given the huge potential in a country of 1.45 billion people! Despite its ethnic and cultural uniqueness and multitude of official languages, India has seen impressive economic growth and demand for digital entertainment.

General Information

| Official name | Republic of India (Wikipedia) | |

| Capital | New Delhi (Wikipedia) | |

| Population | 1,454,068,439 (Worldometers) | |

| Total area | 3 287 263 km² (Wikipedia) | |

| Average age | 28.4 (Worldometers) | |

| GDP | USD 3549.92 bln (Trading Economics) | |

| GDP per capita | USD 2239.25 (Trading Economics) | |

| Official language | Hindi, English |

The Constitution of India defines 21 official languages that are spoken by a large proportion of the population or have classical status. Hindi is considered the official language, while English is referred to as an “auxiliary official language.” The country is characterized by significant ethnic and cultural diversity.

Gaming Market

Key findings from Niko Partners’ report on gamer behavior in India and market analysis.

1. Monetization opportunities: more Indian gamers are willing to spend money on games:

- 77.3% of PC gamers reported spending more money on PC games in Q1 2024 compared to the same period last year.

- Female gamers spend 8.5% more per month on gaming than men.

- Disposable income is expected to increase, as well as smartphone penetration and mobile-focused esports tournaments, leading to higher engagement and higher ARPU.

2. The continued popularity of battle royale and shooter games

- 57% of mobile gamers in India have played a battle royale game in the past 3 months, with BGMI and Free Fire leading the way, while 6 out of 10 respondents spent money on mobile games and purchased a battle pass or season pass.

3. Cybersports fever in India

- 65.4% of respondents are involved in cybersports in one way or another: playing, watching, or participating in tournaments. Those who are involved in cybersports spend an average of 12% more on gaming than those who are not interested in cybersports.

4. The power of peers and influencers:

- 57.2% of Indian gamers find new games through streamers and influencers.

- The ability to play with or against friends online, and popularity among peers and reviewers were the two most influential factors in choosing a new game for gamers in India, suggesting that social elements and community support have a significant impact on game selection.

Statista Key Trends and Growth Indicators

- Revenue in the Indian gaming market is projected to reach USD 8.7 billion in 2024.

- The revenue is expected to show a Compound Annual Growth Rate (CAGR 2024-2029) of 10.36%, leading to a projected market size of USD 14.3 billion by 2029.

- The gaming market in India is expected to have 328.9 million users by 2029.

- User penetration will be 18.9% in 2024 and is expected to reach 21.9% by 2029.

- The average revenue per user (ARPU) in India is expected to be USD 43.44 per year by 2029.

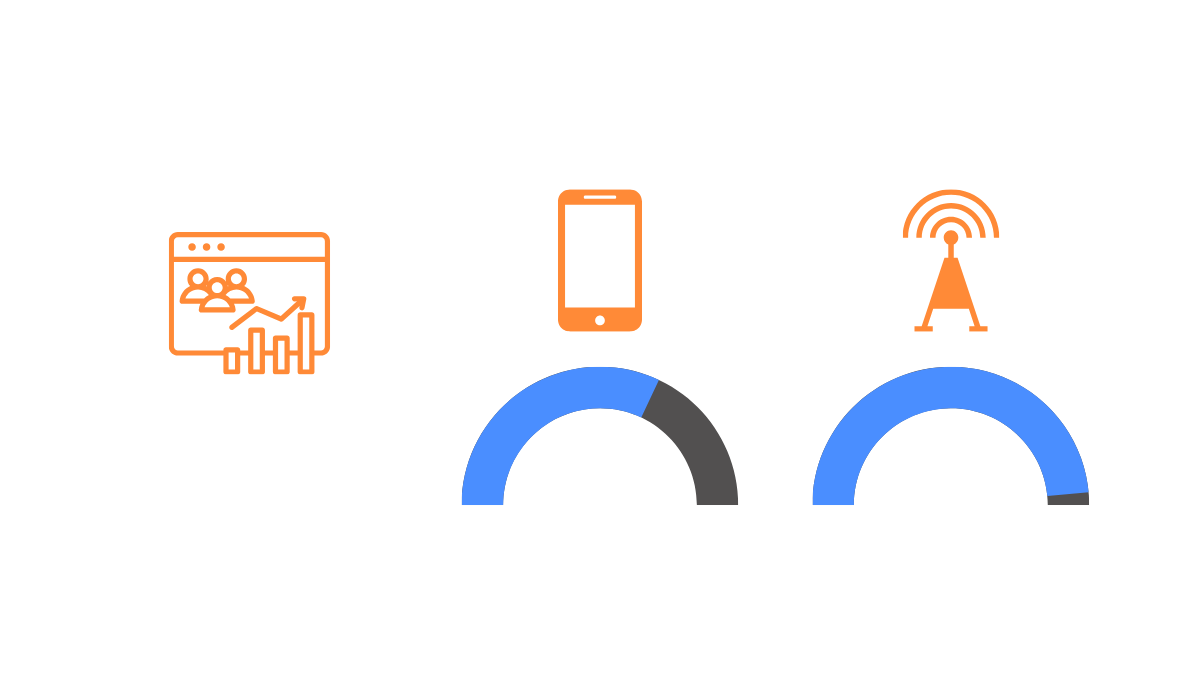

- The gaming media market in India is witnessing a surge in the popularity of mobile gaming due to the availability of smartphones and widespread internet access.

Legislative and Policy Incentives for Industry Growth

The online gaming industry in India is currently experiencing rapid growth in the number of platforms, gamers, and developers, but it’s not certain whether these new endeavors are sustainable. The main reasons for this uncertainty are an unstable regulatory framework, inefficient tax regulations, and high retrospective taxes.

Therefore, an important task for the government now is to create favorable conditions for the growth and development of human resources in the industry. First and foremost is the need to provide a stable and predictable regulatory environment to attract more investment. Another focus is the allocation of private and public funds for infrastructure development, which in turn can help create jobs and innovation in game development and product development for the global market. In this way, India, with its skilled professionals, can become a hub for developers, especially in online gaming.

Chinese Game Bans

On October 22, 2008, Microsoft announced that Fallout 3 would not be released in India for the Xbox 360 platform. The reason given was religious and cultural restrictions. Although the specific reason was not disclosed, it may have to do with the fact that the game features two-headed mutated cows called Brahmins. Brahmin is the name of a caste of Indian priests and religious scholars. The spelling of the word “Brahmin” is also nearly identical to “Brahman,” which denotes the supreme universal principle, the ultimate reality in the universe in Hinduism.

“Brahmin”

“Brahmin”PUBG MOBILE has been banned due to excessive violence. The move follows a request from the states of Gujarat and Jammu and Kashmir demanding a ban on the game, as it was believed to have a negative impact on their youth. The game was banned in the cities of Ahmedabad, Surat, Vadodara, Bhavnagar, and Rajkot in Gujarat, as well as across Jammu and Kashmir. Players were even prosecuted for participating in the game. The game was later banned completely on September 2, 2020 due to mishandling of data, along with games like Rules of Survival, Mobile Legends: Bang Bang, and Clash of Kings as part of the Indian government’s ban on 59 Chinese apps following border clashes between the two countries. The government believed the apps were “stealing and secretly transferring user data in an unauthorized manner to servers located outside India.” Later, an exclusive version of PUBG MOBILE for India called Battlegrounds Mobile India was released.

Battlegrounds Mobile India by PUBG MOBILE. Source: play.google.com

Battlegrounds Mobile India by PUBG MOBILE. Source: play.google.comGarena Free Fire, another popular game in the country, was also banned in February 2022 for national security reasons.

Garena Free Fire by Garena International. Source: play.google.com

Garena Free Fire by Garena International. Source: play.google.comBans on Online Betting Games

Authorities in several states in India have imposed bans on online gambling involving betting with money. In Andhra Pradesh in 2020, these bans were enacted in response to concerns about gamers resorting to suicide due to financial debts associated with the games. In 2021, the Tamil Nadu state government announced a ban (which was later ruled unconstitutional by the Madras High Court) on online versions of skill games such as chess, quizzes, fantasy, rummy, and poker. Karnataka, the center of India’s technology industry, also proposed a ban on online betting games in 2021. Karnataka’s ban was extended to online games that require users to pay an entry fee.

Despite bans and restrictions, illegal gambling applications continue to exist.

There is also a large, active market of skill-based games in the country, which are also connected with real money gambling. But the key difference is that the chances of two players are equal, and they play against each other. This segment is actively developing, and its volume is estimated at USD 2–3 billion. This is higher than the volume of “traditional” gaming.

In 2023, a regulation was introduced for this market segment. The government introduced a 28% tax on deposits, which greatly affected companies in this industry. To date, Indian companies are trying to lobby to repeal the law.

India’s Ministry of Electronics and Information Technology (MeitY) plans to take action against advertisements that indirectly promote illegal betting and gambling. The government has instructed the ministry to identify violators and take legal action, including fines and blocking of apps.

At the end of 2023, the government banned 174 gambling and betting apps.

There are over 500 million gamers in India, indicating significant growth in both the audience and gaming revenue.

There are currently over 117,000 startups in India, many of which are related to the video game and cybersports sector.

According to the Department of Domestic Industry and Internal Trade (DPIIT), the gaming industry in India continues to grow, making cybersports and gaming a promising career for gamers and entrepreneurs. Prime Minister Narendra Modi has urged developers to strengthen their global presence and focus on creating their own products.

Market Development Dynamics

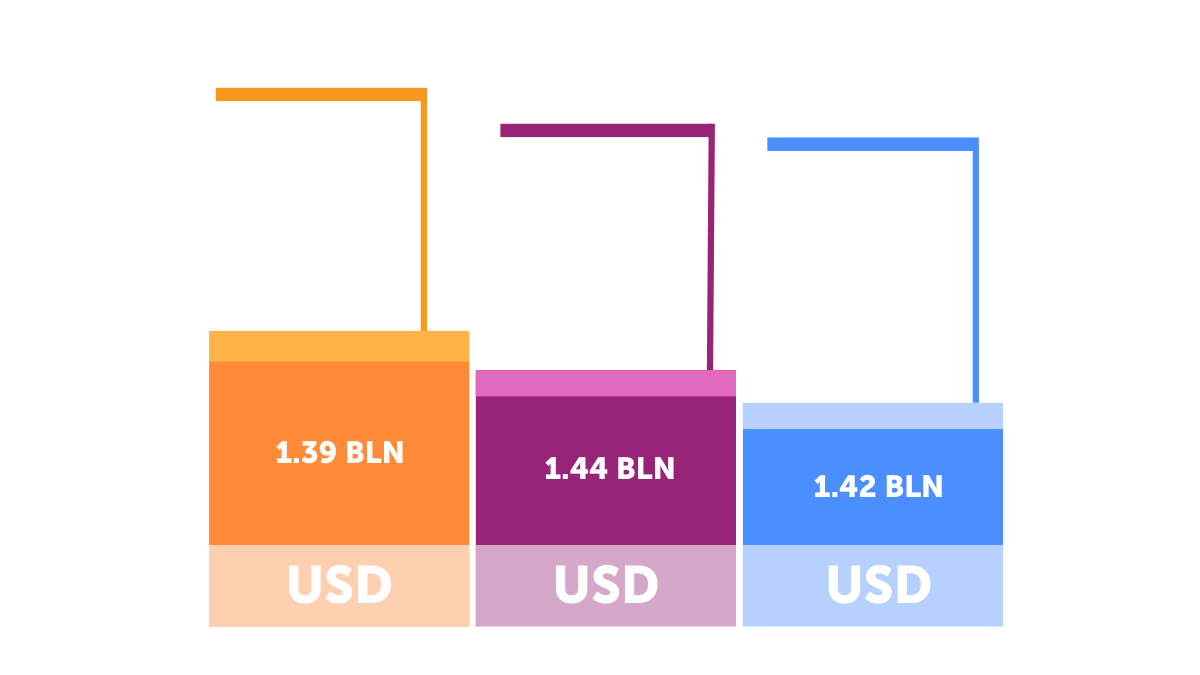

Source: platform.newzoo.com

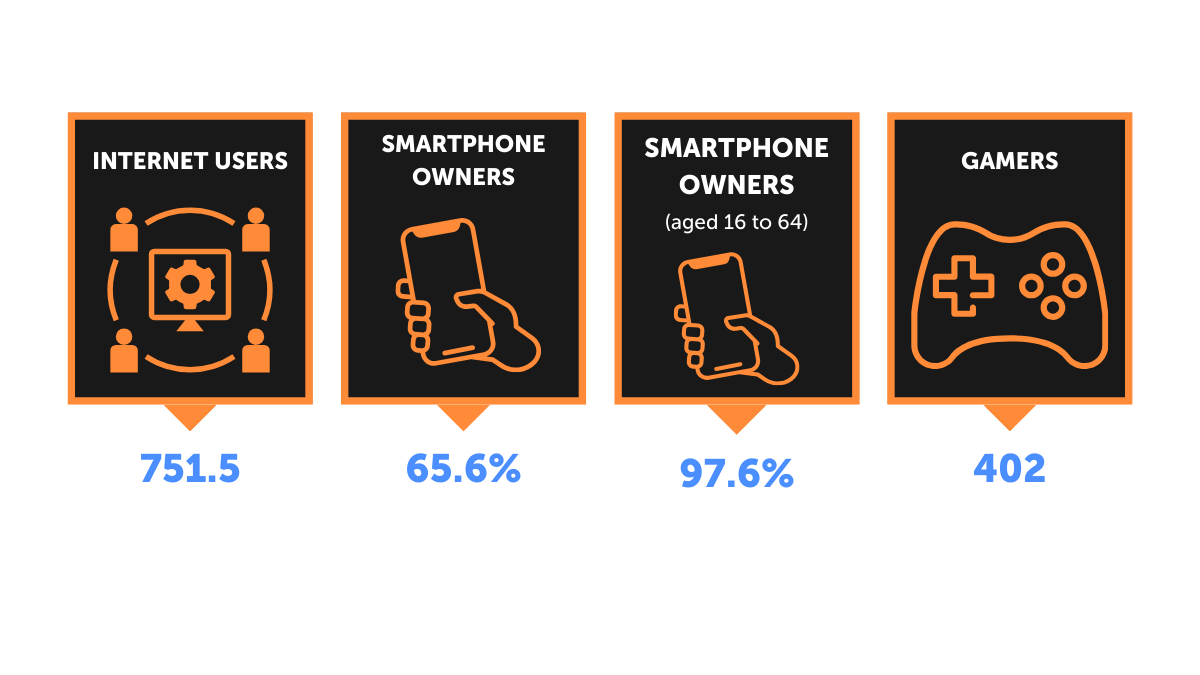

Source: platform.newzoo.comPopulation

Source: datareportal.com

Source: datareportal.comNumber of Gamers (2023)

Source: platform.newzoo.com

Source: platform.newzoo.comPlayer Spending

Source: platform.newzoo.com

Source: platform.newzoo.comPlayer Profile

The number of online gamers in India has skyrocketed to an impressive 442 million, making the country the second largest gaming user base in the world, surpassed only by China.

According to a report by Niko Partners, 2 out of 3 gamers in India across all platforms state that having fun playing a game is their primary motivator to spend their money, as opposed to other factors such as discounts and being able to play with friends. Super hardcore gamers (those who play more than 30 hours a week) spend an average of 2.2 times more on video games each month than regular gamers who play only 1–10 hours a week.

The results of Lumikai’s report on gamer behavior:

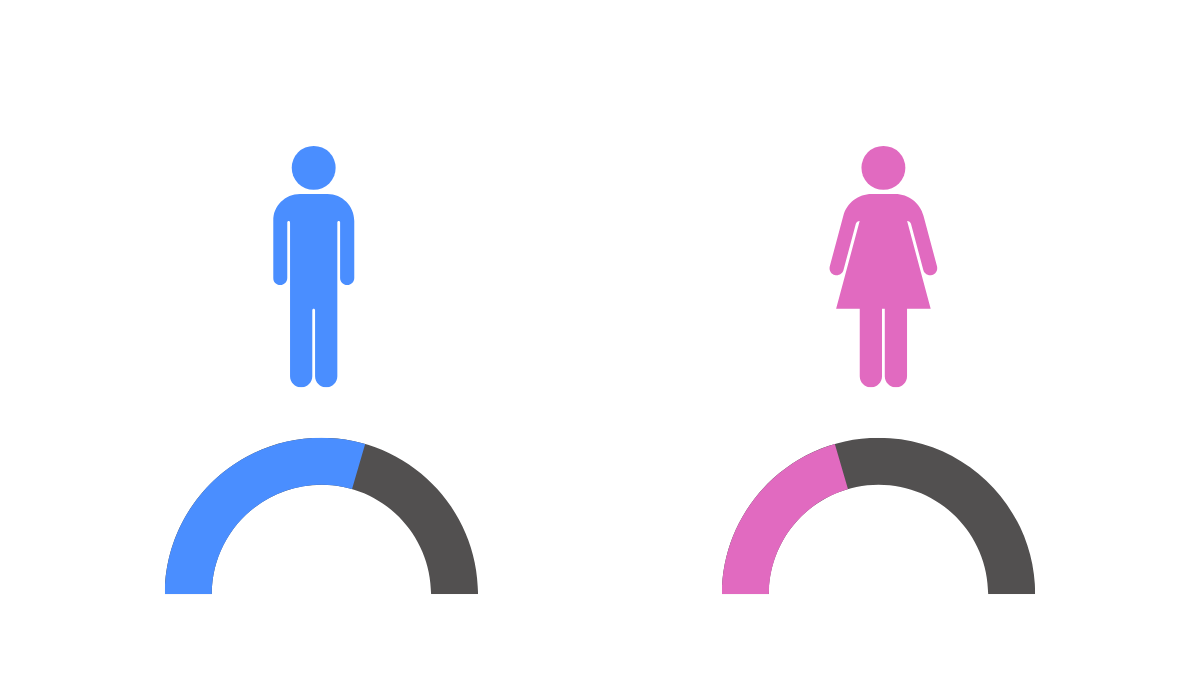

- 50% of gamers in the country are 18 to 30 years old, with a male-to-female ratio of approximately 60:40.

- The average time spent gaming increased by 20% year-on-year to 10–12 hours per gamer per week.

- Users stated that their main reasons for playing games were to relax and socialize with other gamers. Completing in-game tasks and watching too many ads were cited as the top reasons for discontinuing play.

- Over 40% of users stated that they have now moved beyond casual games to play other genres.

- Approximately 60% of users stated that they made in-game purchases, and 62% stated that UPI was their preferred payment method.

General Player Statistics

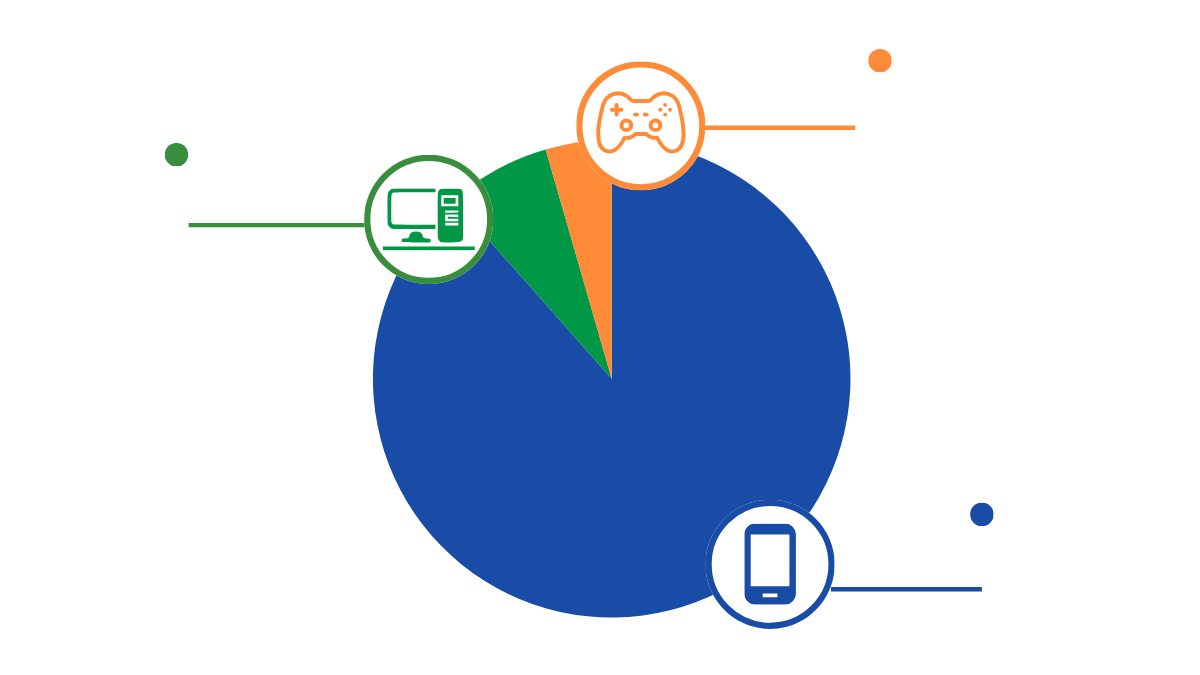

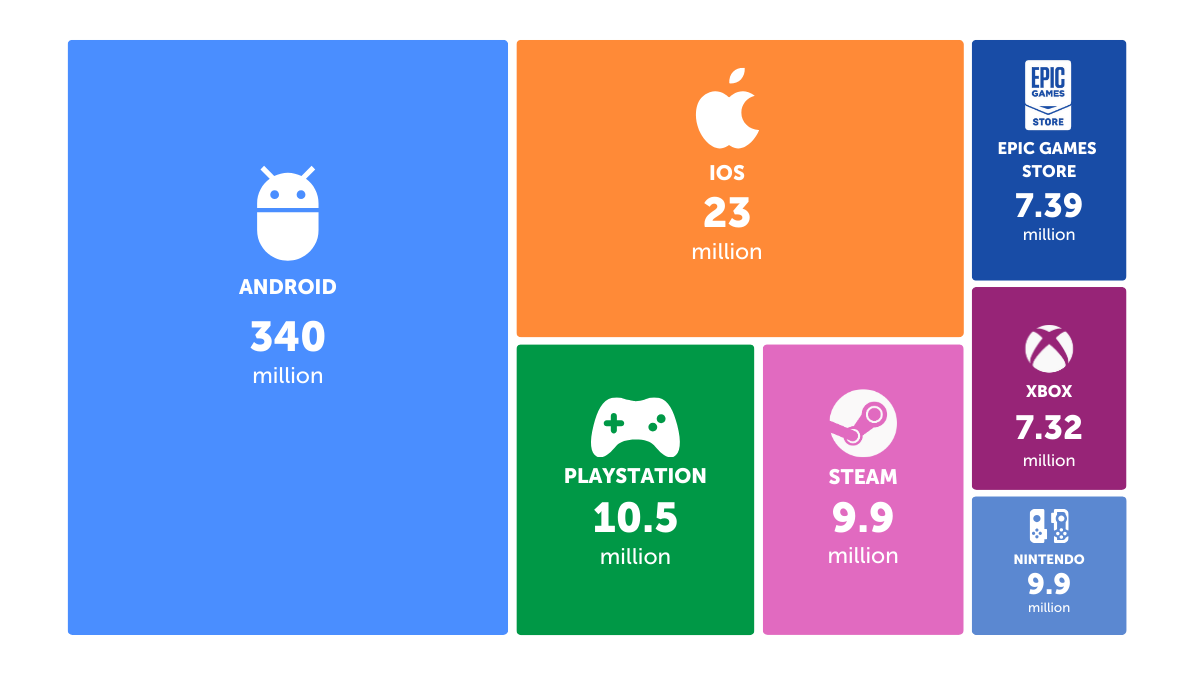

Players by platform

Source: platform.newzoo.com

Source: platform.newzoo.comGender Distribution

Source: indianexpress.com

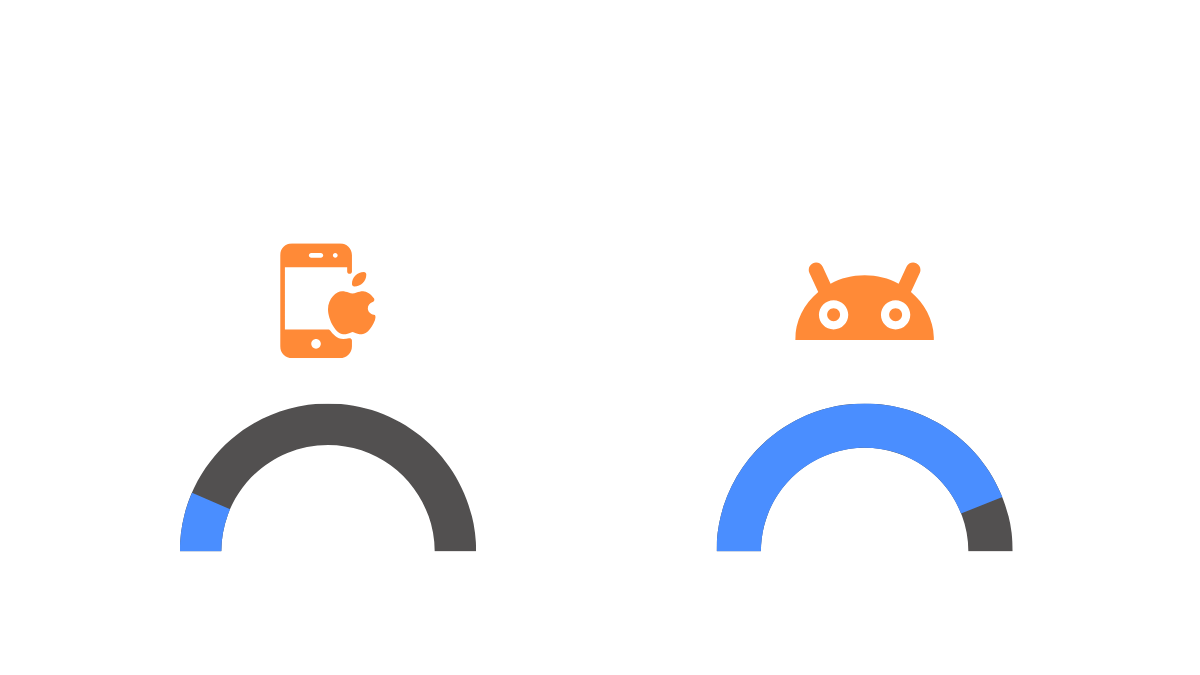

Source: indianexpress.comOS Distribution:

Source: gs.statcounter.com

Source: gs.statcounter.comAverage Annual Traffic and Average Internet Speed

Source: www.speedtest.net

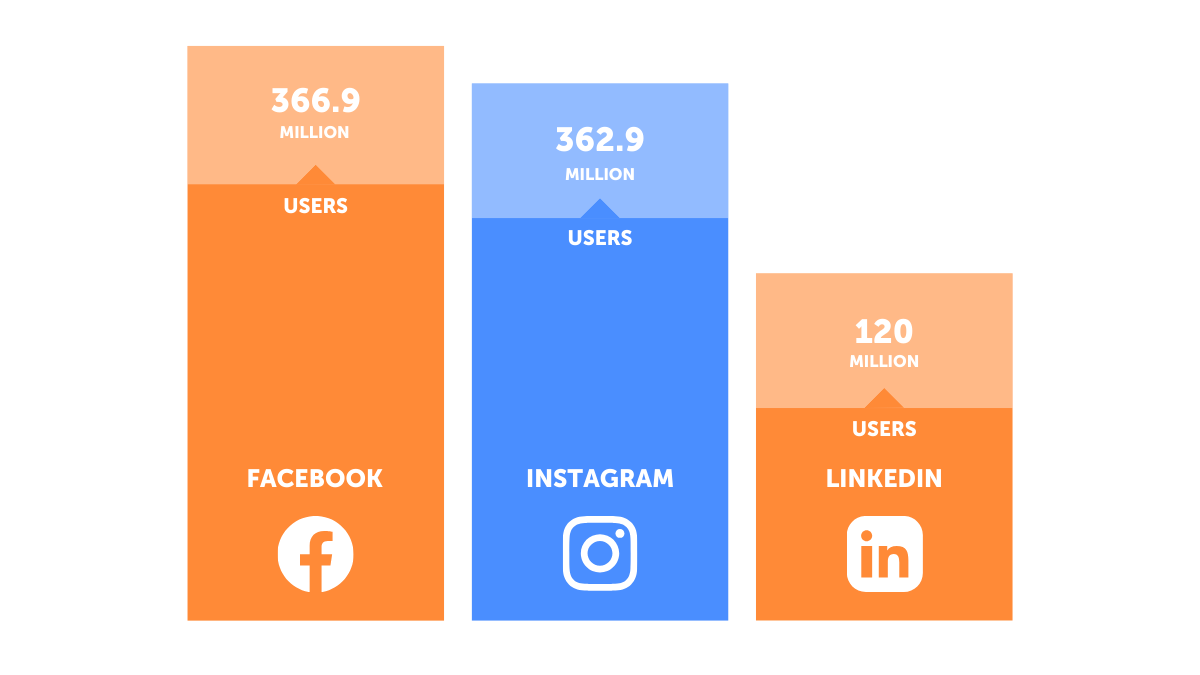

Source: www.speedtest.netPopular Social Media

Source: datareportal.com

Source: datareportal.comPopular Game Genres in India

Source: statista.com

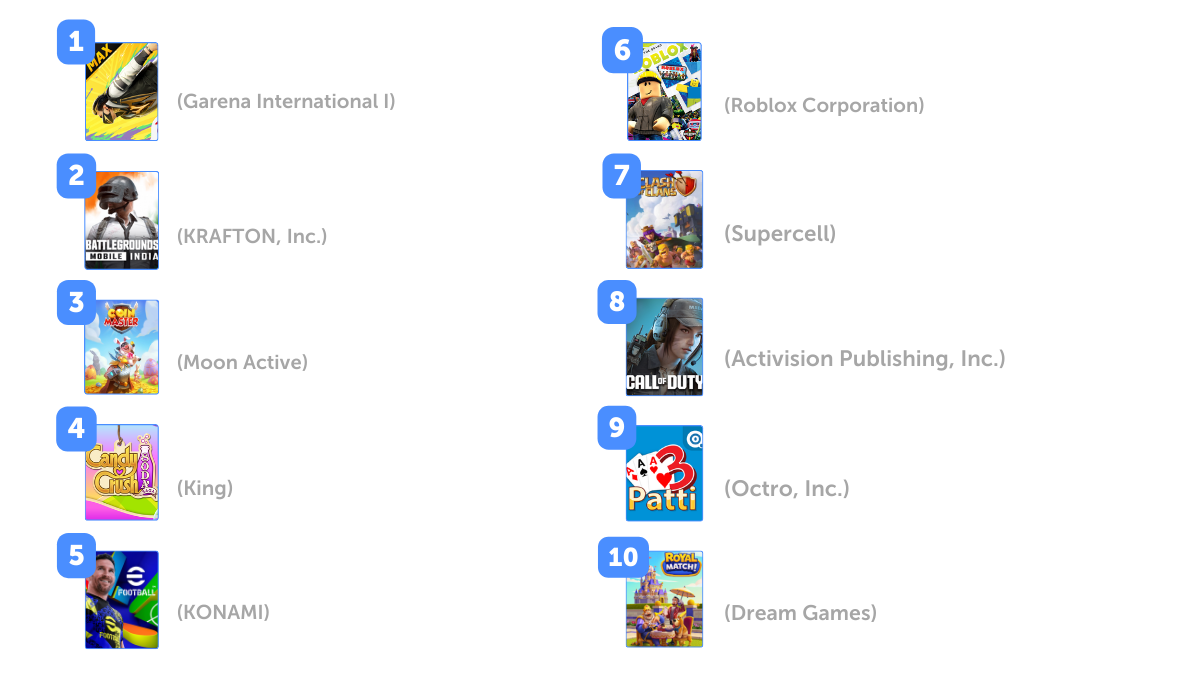

Source: statista.comAppMagic’s Top Mobile Games, September 2024:

1. Free Fire MAX (Garena International I)

2. Battlegrounds Mobile India (KRAFTON, Inc.)

3. Coin Master (Moon Active)

4. Candy Crush Saga (King)

5. eFootball™ (KONAMI)

6. Roblox (Roblox Corporation)

7. Clash of Clans (Supercell)

8. Call of Duty®: Mobile (Activision Publishing, Inc.)

9. Teen Patti Octro Poker & Rummy (Octro, Inc.)

10. Royal Match (Dream Games)

11. Whiteout Survival (Century Games PTE. LTD.)

12. Pokémon GO (Niantic, Inc.)

13. EA Sports FC™ Mobile Soccer (Electronic Arts Inc.)

14. Last War: Survival (FirstFun)

15. Gardenscapes (Playrix)

16.Evony: The King’s Return (TG Inc.)

17. Travel Town – Merge Adventure (Magmatic Games LTD)

18. Yalla Ludo – Ludo&Domino (Yalla Technology FZ-LLC)

19. Township (Playrix)

20. Teen Patti Gold:3 Patti Rummy (Moonfrog)

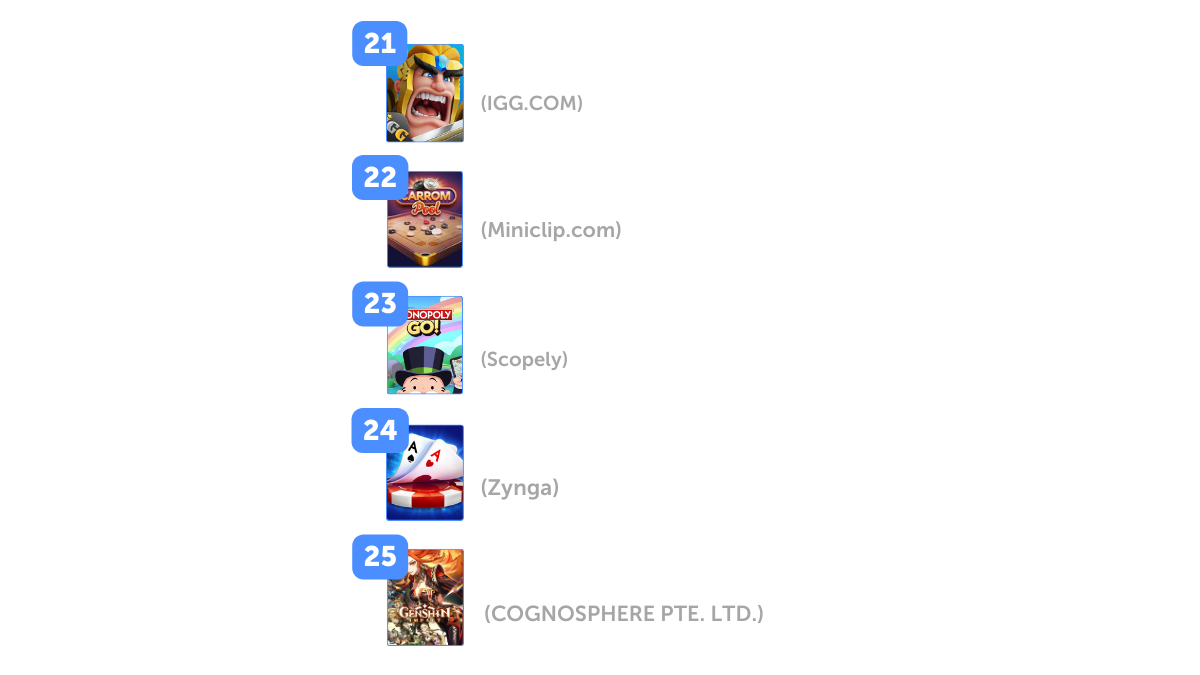

21. Lords Mobile: Last Rise of Qin (IGG Inc.)

22. Carrom Pool: Disc Game (Miniclip.com)

23. MONOPOLY GO! (Scopely, Inc.)

24. Zynga Poker – Texas Holdem Game (Zynga)

25. Genshin Impact: Natlan Launch (COGNOSPHERE PTE. LTD.)

Source: appmagic.rocks

Source: appmagic.rocks