We’ve gathered some insights on the Gaming Market in China, covering player profiles, emerging trends, and some localization strategies on building a lasting and authentic connection with its massive audience. Enjoy the read!

China’s gaming industry isn’t just the largest in the world, it’s also one of the most complex. For many game developers and publishers out there, the question isn’t whether to enter this market, but how to do it effectively.

General Information

| Official name | People’s Republic of China, PRC (Wikipedia) | |

| Capital | Beijing (Wikipedia) | |

| Population | 1,418,029,740 (Worldometer) | |

| Total area | 9.6 million km² (Wikipedia) | |

| Average age | 39.6 (Worldometer) | |

| GDP | 17,794.78 billion USD (Trading Economics) | |

| GDP per capita | 12,174 USD (Trading Economics) | |

| Official language | Chinese |

China is the fourth-largest country in the world by area, behind Russia, Canada, and the USA.

Excluding Taiwan, Hong Kong, and Macau, it is also the second most populous country after India. Its urbanization level is 65%. China is a multi-ethnic state, though the majority of its population today is ethnic Han Chinese.

Most of the country speaks Mandarin Chinese, though there are many other languages present. Some of them belong to the same Sino-Tibetan language family, such as the Tibetan language, while others might come from more distant backgrounds—like Turkic Uyghur in the Xinjiang Uyghur Autonomous Region.

According to its constitution, the People’s Republic of China is a socialist country. In practice, it operates under a centralized, authoritative governance model.

China is a member of several key international organizations, including the United Nations (UN), World Trade Organization (WTO), Asia-Pacific Economic Cooperation (APEC), Group of 20 (G20), BRICS, and the Shanghai Cooperation Organization (SCO). Additionally, China initiated the development of the Belt and Road Initiative (BRI), a major global infrastructure and economic development project.

The economy of China is ranked second in the world in terms of nominal GDP and first in GDP adjusted for purchasing power parity (PPP). China is the world leader in manufacturing most kinds of industrial products, the world’s largest exporter (“the world’s factory”), and a major sales market. It has the world’s largest foreign exchange and gold reserves.

In 2020, China accounted for 24.8% of global R&D spending. In 2023, it invested 2.65% of its GDP in science and technology—surpassing its military expenditure. In 2024, China topped the Nature Index and ranked 11th in the Global Innovation Index. The country is also home to 26 of the world’s top 100 science and technology clusters, with four of them ranked in the top ten: Shenzhen-Hong Kong-Guangzhou, Beijing, Shanghai-Suzhou, and Nanjing.

The gaming market

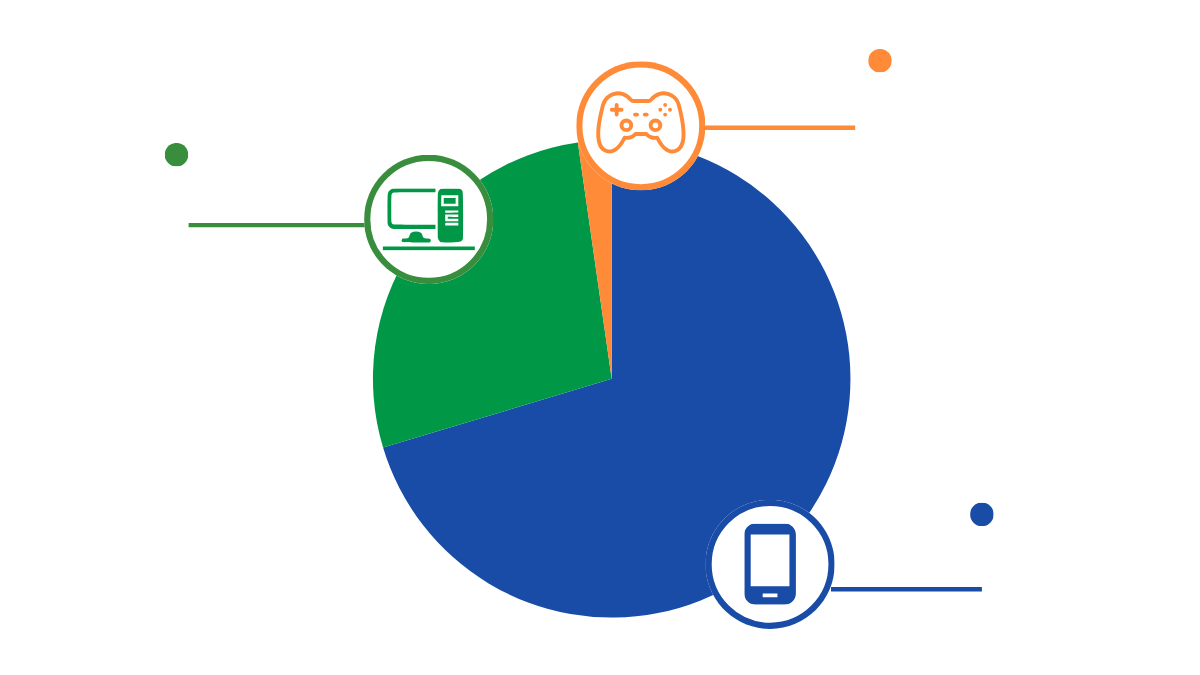

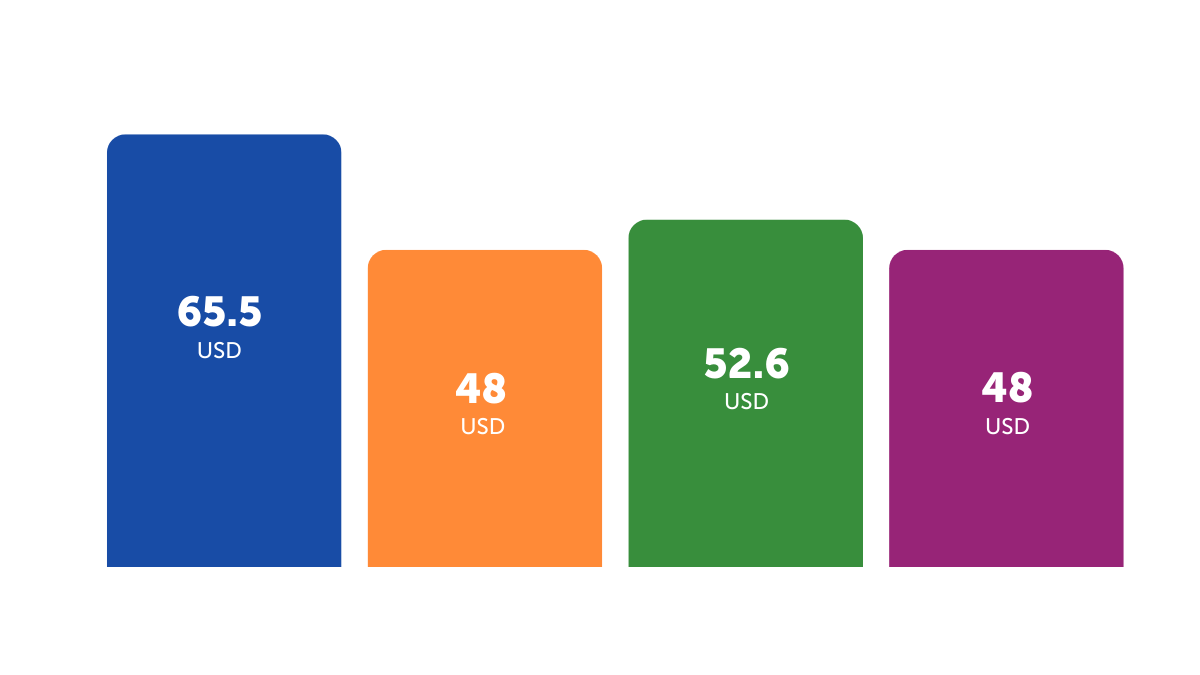

The gaming industry in China has been growing rapidly, boasting some 668 million players who spend an average of 453 yuan (about 62.4 USD) each on video games. China has one of the largest gaming markets in the world. On the one hand, rising consumer expenses and active investing have provided much fuel for this sector. On the other hand, the industry had to pivot to meet China’s stringent video game regulations introduced in 2019, reshaping everything from game development and market strategies to financial outcomes for both domestic and international studios.

China firmly holds its place as a powerhouse in the global gaming market. At the moment, it’s commanding a third of all mobile gaming revenue. As of today, 46% of China’s population actively plays video games, of which about 300 million are women. The average age of Chinese gamers is 35, and the average salary per user (ARPU) is 64 USD.

In 2023, China ranked second in gaming industry revenue, just behind the United States. In terms of sheer player numbers, China is in first place.

According to China Daily, China’s gaming industry reached record revenue of 91.77 billion yuan (12.89 billion USD) in the third quarter of 2024—which is 8.95% higher than a year earlier.

Thanks to the outstanding performance of China’s first AAA game, Black Myth: Wukong, the actual sales revenue of China’s self-developed games in overseas markets reached 5.17 billion USD in the third quarter, surging by 20.75% year-on-year, according to a report released jointly by China’s Game Publishing Committee and a research institute on the gaming industry CNG.

Moreover, in the third quarter, the actual sales revenue from China’s mobile games, self-developed games in the domestic market, and the esports sector increased quarter-on-quarter, reaching 65.66 billion yuan, 72.21 billion yuan, and 35.76 billion yuan respectively.

Statista forecasts

- By 2024, revenue in the video games market is projected to reach 94.49 billion USD.

- The compound annual growth rate (CAGR 2024-2027) is expected to climb at a CAGR of 8.11%, leading to a projected market value of 119.40 billion USD by 2027.

- Among the various segments, the largest one in the video game market industry is in-game advertising, with a market value of 46.61 billion USD in 2024. Notably, this figure is not included in Newzoo’s analysis.

- When comparing global markets, it should be noted that China is projected to generate the highest revenue in 2024, totaling 94.49 billion USD.

Key findings from the China Gamer Behavior & Market Insights Report (Niko Partners)

New trends in PC and mobile gaming:

- PC gaming has seen the highest player expenditures on games this year, with 62% of PC gamers reporting spending more than last year and 19% claiming they spent at least 30% more than last year.

- 79.5% of PC gamers who play premium games use Steam. It remains the largest distribution platform in the country.

- The mini-games segment has become a major growth driver in mobile gaming, with about 650 million active players. According to a survey, two-thirds of mobile gamers play mini-games daily or several times a week.

Growth of short video content and platforms:

- At least 5% of respondents learn about new video games from short videos.

- Over 4 in 10 gamers (43.9%) watch live video game / esports streams, and 68.6% use Douyin.

Local market specifics

- Releasing a game in China requires you to obtain a license (ISBN). This is mandatory for mobile, PC, and console games with in-game monetization. Games with advertising-based monetization also require a license, though this one follows a simplified scheme.

- Some of the Steam revenue in China is unaccounted for the region, as many users employ “gaming VPNs” to make purchases via other regions.

- China has a large “gray market” for consoles, primarily due to restrictions on the local PS Store, Nintendo eShop, and Xbox Games Store. Many users choose to purchase systems from Singapore, Japan, and other regions unburdened by these restrictions.

- It is widely believed that the Chinese market is “hardcore.” Available data shows this to be true, as top-grossing games tend to have complex metas.

- China also leads the world in developing 4X strategy games.

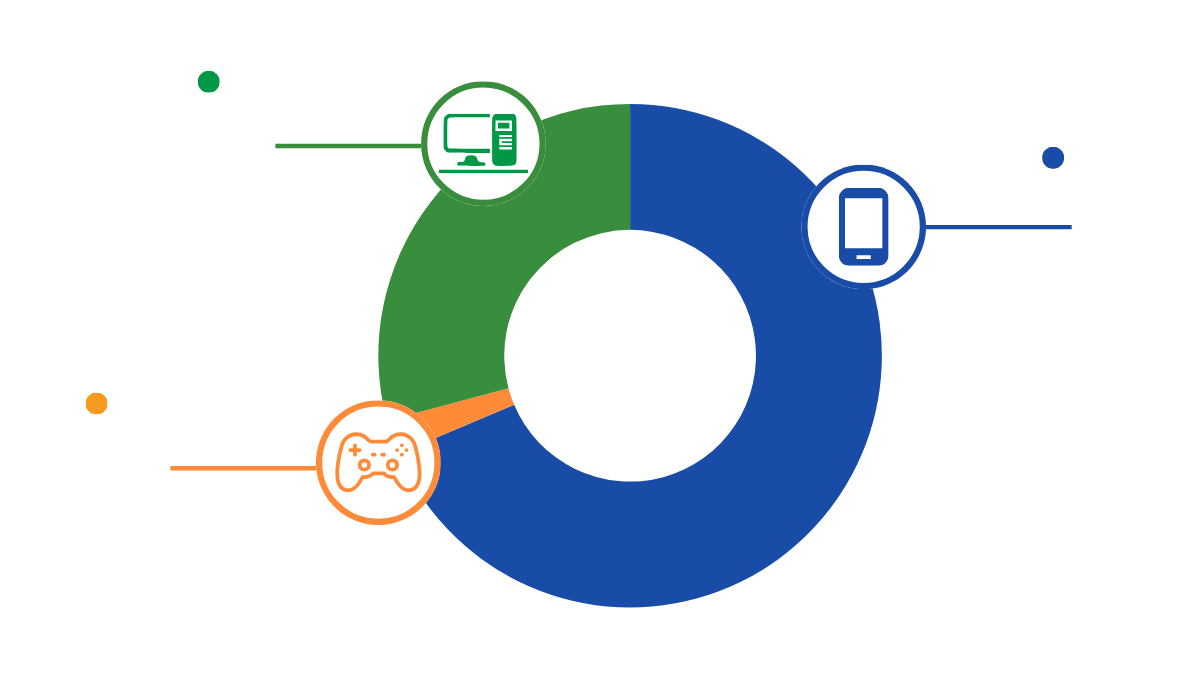

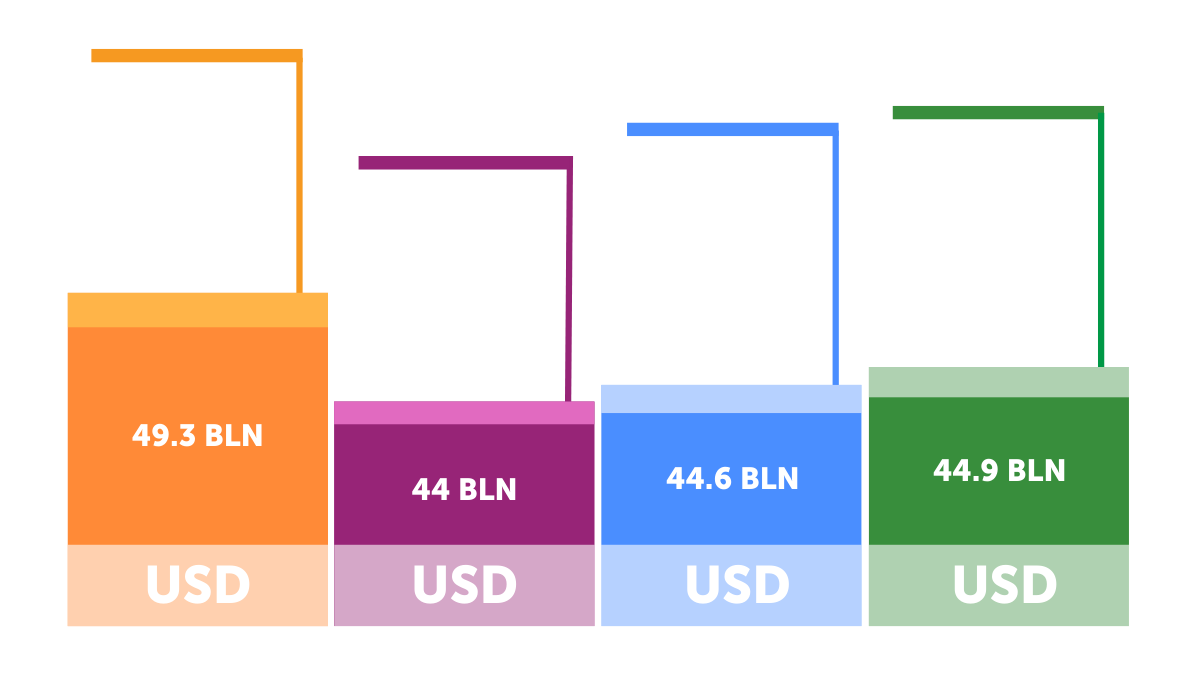

Gaming Market Size

Source: platform.newzoo.com

Source: platform.newzoo.comMarket development dynamics

Source: platform.newzoo.com

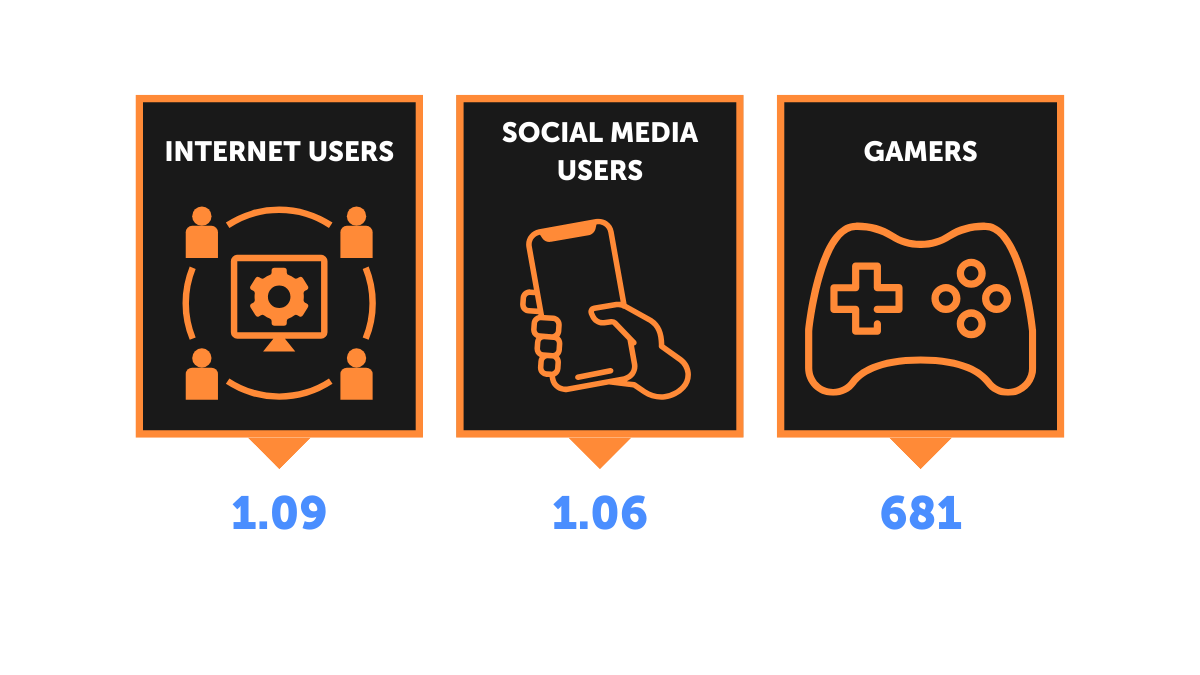

Source: platform.newzoo.comPopulation

Source: datareportal.com, platform.newzoo.com

Source: datareportal.com, platform.newzoo.comNumber of Gamers

Source:

Source:platform.newzoo.com

Player Spending

Source:

Source:platform.newzoo.com

Player profile

Highlights from the Niko Partners report:

- In China, more than 97% of people aged 18 to 24 and more than 90% of those aged 25 to 35 are gamers.

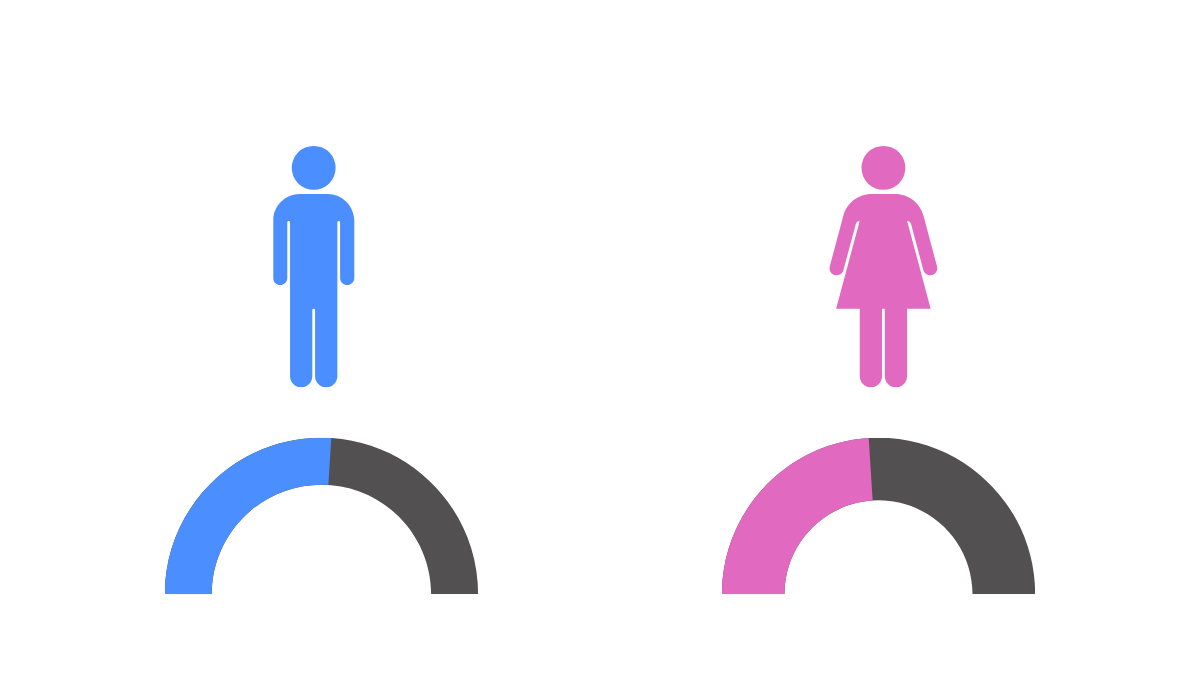

- 48% of gamers in China are women.

- Gamers in China spend more time on gaming than on any other entertainment activity.

- More than 18% of gamers spend over 30 hours a week playing games.

- Gamers spend significantly more time on online entertainment than offline. For example, 45.2% of gamers visit movie theaters, but 91.8% of them watch movies online. 68.9% go shopping, compared to 86.8% who shop online.

- 80% of gamers watch game streams.

- 70% of gamers play esports games.

State restrictions on minors playing video games

In September 2021, new rules were introduced that allowed Chinese minors to play online games for only one hour from 20:00 to 21:00 on Fridays, weekends, and public holidays. These rules have had a considerable effect on young people in China. Later that same year, the government stopped issuing new gaming licenses for eight months.

Since the rules were introduced, 77% of young people have started spending less time playing games: the total number of young gamers (aged between 6 and 17) who play games for at least an hour a month has fallen from a high of 122 million in 2020 to 83 million in 2022. 54% of young gamers only play in the hours stipulated by the government, while the other 46% get around the restrictions by using an adult ID.

According to a survey conducted by Beijing News Think Tank in August 2024, 58.5% of 1,156 respondents with children aged 8 to 18 admitted to providing their personal IDs to their children for authentication in online games. The survey found that 57% of parents with children aged 13 to 15 sometimes provided their IDs to make it easier for their children to play, indicating that parents are often willing to compromise when their children face time restrictions in games.

Under the 2024 gaming law, China lowered daily gaming restrictions and now limits minors to one hour of gaming per day on weekdays and two hours per day on weekends.

General Player Statistics

Gender Distribution

Source:

Source:nikopartners.com

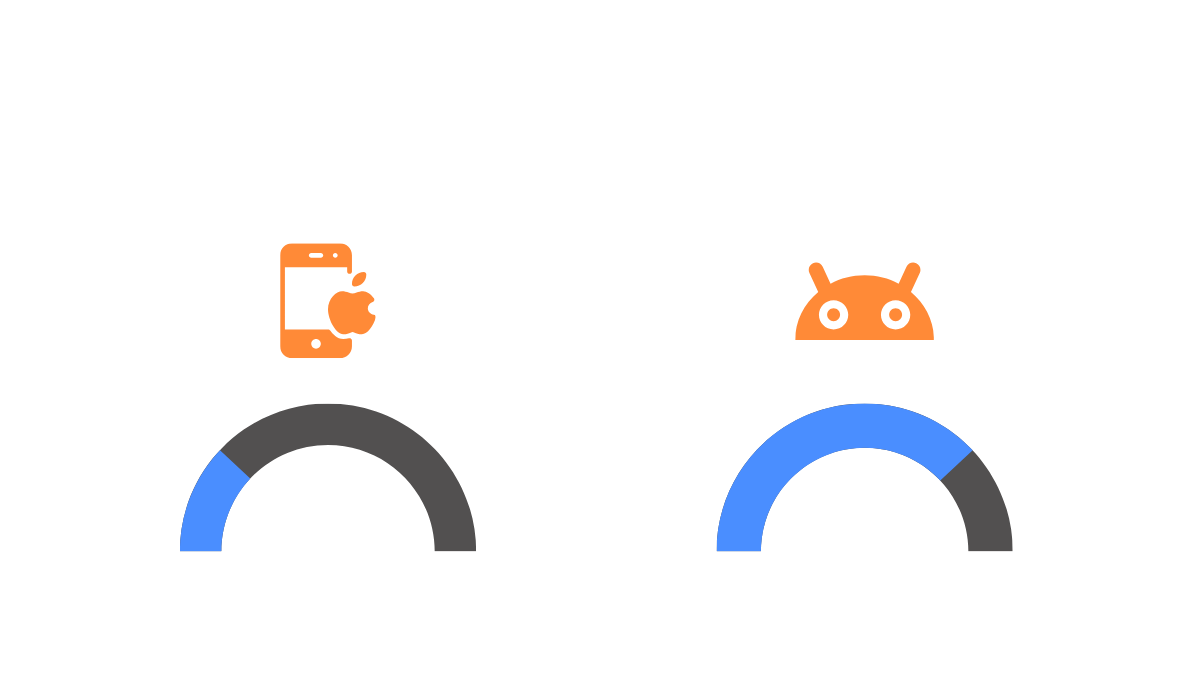

OS Distribution

Source: gs.statcounter.com

Source: gs.statcounter.comAverage annual traffic + average internet speed

Source: www.speedtest.net

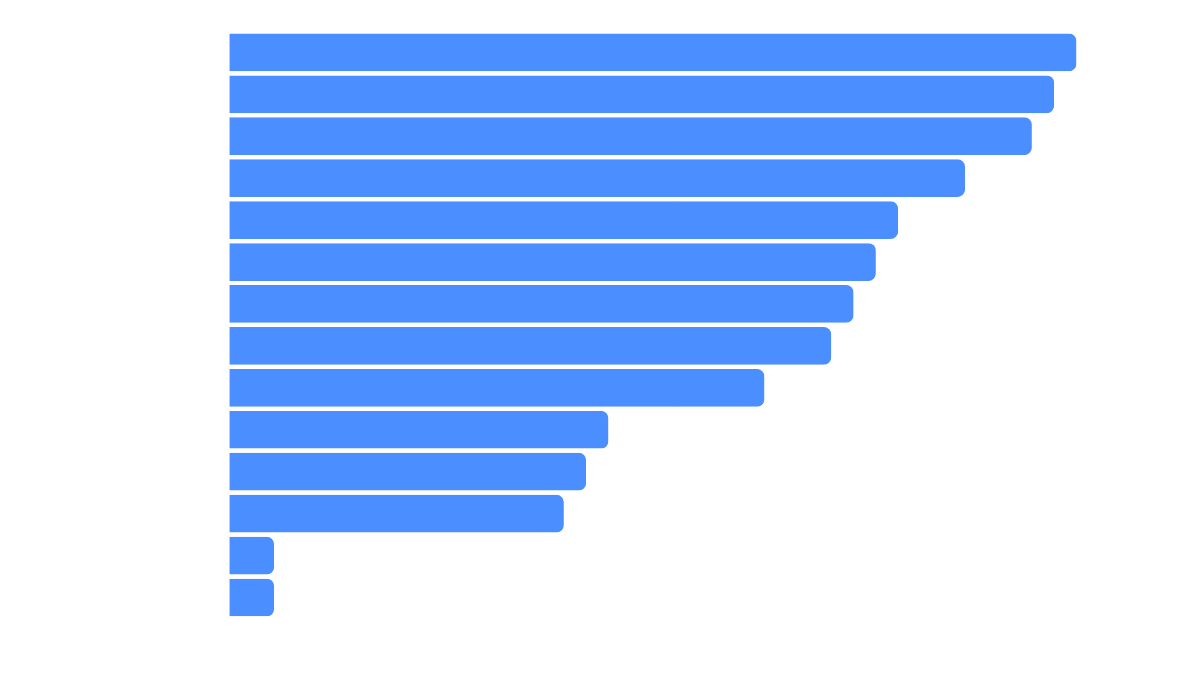

Source: www.speedtest.netPopular Game Genres in China

Source: www.statista.com

Source: www.statista.comVideo game companies in China

1. The9

2. Anbernic

3. CDC Games

4. Changyou

5. Cmune

6. Dr. Panda

7. Duoyi Network

8. Enlight Software

9. FunPlus

10. Game Science

11. Hoolai Games

12. iQue

13. Kongzhong Corporation

14. Kuro Games

15. LayaBox

16. Leyou

17. Mattel163

18. miHoYo

19. Minovate

20. Moonton

21. NetDragon Websoft

22. NetEase

23. Perfect World (company)

24. R2Games

25. Shengqu Games

26. Snail

27. Tencent

28. TiMi Studio Group

29. Typhoon Games

30. Virtuos

31. Yodo1

32. Yoozoo Games

33. Yostar Games

34. ZQGame

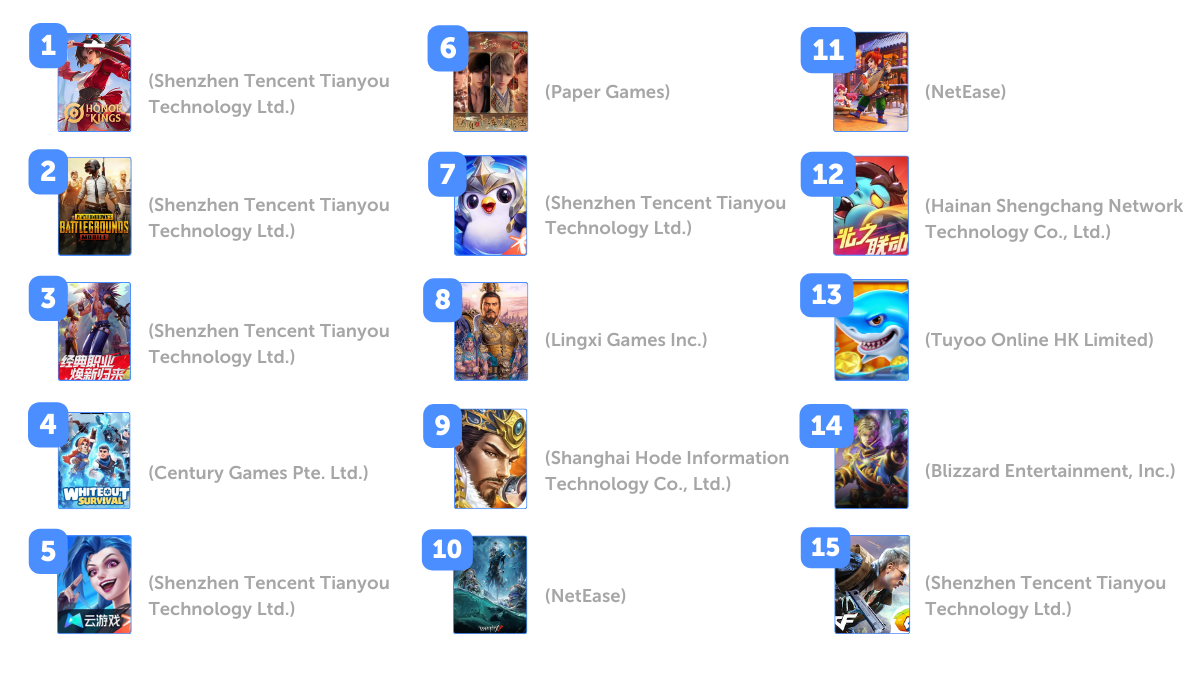

AppMagic’s Top Mobile Games, November 2024:

1. Honor of Kings (Shenzhen Tencent Tianyou Technology Ltd.)

2. PUBG Mobile (Shenzhen Tencent Tianyou Technology Ltd.)

3. 地下城与勇士:起源 (Shenzhen Tencent Tianyou Technology Ltd.)

4. Whiteout Survival (Century Games Pte. Ltd.)

5. 英雄联盟手游 (Shenzhen Tencent Tianyou Technology Ltd.)

6. Love and Deepspace (Paper Games)

7. 金铲铲之战 (Shenzhen Tencent Tianyou Technology Ltd.)

8. 三國志 真戦 (Lingxi Games Inc.)

9. 三国:谋定天下 (Shanghai Hode Information Technology Co., Ltd.)

10. Identity V (NetEase)

11. 梦幻西游 (NetEase)

12. 向僵尸开炮-尸潮来袭 (Hainan Shengchang Network Technology Co., Ltd.)

13. 捕鱼大作战-街机打鱼游戏王者 (Tuyoo Online HK Limited)

14. Hearthstone (Blizzard Entertainment, Inc.)

15. CrossFire: Legends (Shenzhen Tencent Tianyou Technology Ltd.)

16. 逆水寒 (NetEase)

17. 明日方舟 (Shanghai Hypergryph Network Technology Co., Ltd.)

18. Genshin Impact (Cognosphere Pte. Ltd.)

19. 开心消消乐® (Happy Elements Technology (Beijing) Limited)

20. QQ炫舞-炫舞节狂欢 (Shenzhen Tencent Tianyou Technology Ltd.)

21. JJ斗地主-欢乐棋牌休闲合集 (JJWorld (Beijing) Network Technology Co., Ltd.)

22. Speed Drifters (Shenzhen Tencent Tianyou Technology Ltd.)

23. 火影忍者 (Shenzhen Tencent Tianyou Technology Ltd.)

24. 途游斗地主(比赛版) (Tuyoo Online HK Limited)

25. 代號鳶-沉浸式劇情卡牌手遊 (Lingxi Games Inc.)

26. Eggy Party (NetEase)

27. 三国杀 (杭州游卡网络技术有限公司)

28. 永劫无间 (NetEase)

29. 幻唐志:逍遥外传 (Guangzhou Duoyi Network Co., Ltd.)

30. 光与夜之恋 (Shenzhen Tencent Tianyou Technology Ltd.)

Source: appmagic.rocks

Source: appmagic.rocksLocalizing for the Chinese market

According to the EF English Proficiency Index (EF EPI), China ranks 91st out of 116 countries in terms of English proficiency, which is quite low.

Here are some issues that need to be considered right from the start of the localization process:

1. There are several varieties and dialects of Chinese. The official language is Mandarin Chinese, but there are also numerous unique dialects. Another complication for Chinese game localization is that Chinese has four tones that affect how words are pronounced, so every word can have four meanings.

2. Chinese has two writing systems: Simplified and Traditional. Simplified Chinese has fewer symbols than Traditional Chinese. One issue that ironically makes Simplified Chinese more complicated is that it sometimes uses one character to represent separate words that have different meanings but are pronounced the same. Traditional Chinese is mostly used in Hong Kong and Taiwan, but its variations can be found in other regions.

3. Chinese grammar is complex, and these complexities can cause translation issues. For example, most nouns and verbs have the same form for both singular and plural, which can prove difficult to grasp for most speakers of languages that distinguish them. What’s more, verbs in Chinese don’t have tense. To figure it out, speakers have to rely on context.

4. Cultural consideration is very important in Chinese.

Many games incorporate myths or historical narratives that are part of China’s cultural heritage, and this should be reflected in localization. Furthermore, games that are deemed culturally inappropriate may be banned, making it essential to be able to identify and adapt these potentially unacceptable elements.

5. Text written in Chinese typically requires much less horizontal space than in other languages. For example, two Chinese characters can often convey the same meaning as eight English letters. This needs to be taken into account when you’re working on a game’s text fields.

6. Payment methods are another major difference. In the United States, players generally buy games using credit cards and online payment systems such as PayPal. However, these payment methods are not supported in China where players generally use Alipay, TenPay, UnionPay, or QR codes instead.

7. Adapting your game to the Chinese market also means adjusting the user interface. Chinese players tend to favor visually rich, colorful interfaces. It also pays to think about the choice of icons and design.