Brazil’s Gaming Market Is Booming! With over 103 million gamers and revenues expected to hit USD 2.52 billion by 2025, Brazil is leading the charge in Latin America. Curious about how localization plays a huge role in making games resonate with Brazilian players? Dive into the full story!

General Information

| Official name | Federative Republic of Brazil | |

| Capital | Brasília | |

| Population | 212,908,890 | |

| Total area | 8,515,767 km² | |

| Average age | 34.8 | |

| GDP | USD 2.19 trillion | |

| GDP per capita | USD 22.1 thousand | |

| Official language | Portuguese |

The fifth largest country in the world by area and seventh largest by population (with more than 218 million residents), Brazil is the largest country in South America and Latin America by both territory and population. The only Portuguese-speaking country in the entire Americas, it is also the largest Lusophone country on the planet.

Brazil has the ninth largest economy in the world in terms of nominal GDP and the seventh largest in terms of GDP based on purchasing power parity. Economic reforms have brought the country international recognition. Brazil is a member of international organizations such as the UN, G20, WTO, and Mercosur, and is also a BRICS country.

The monetary unit is the Brazilian real.

The Gaming Market

Game Studios in Brazil

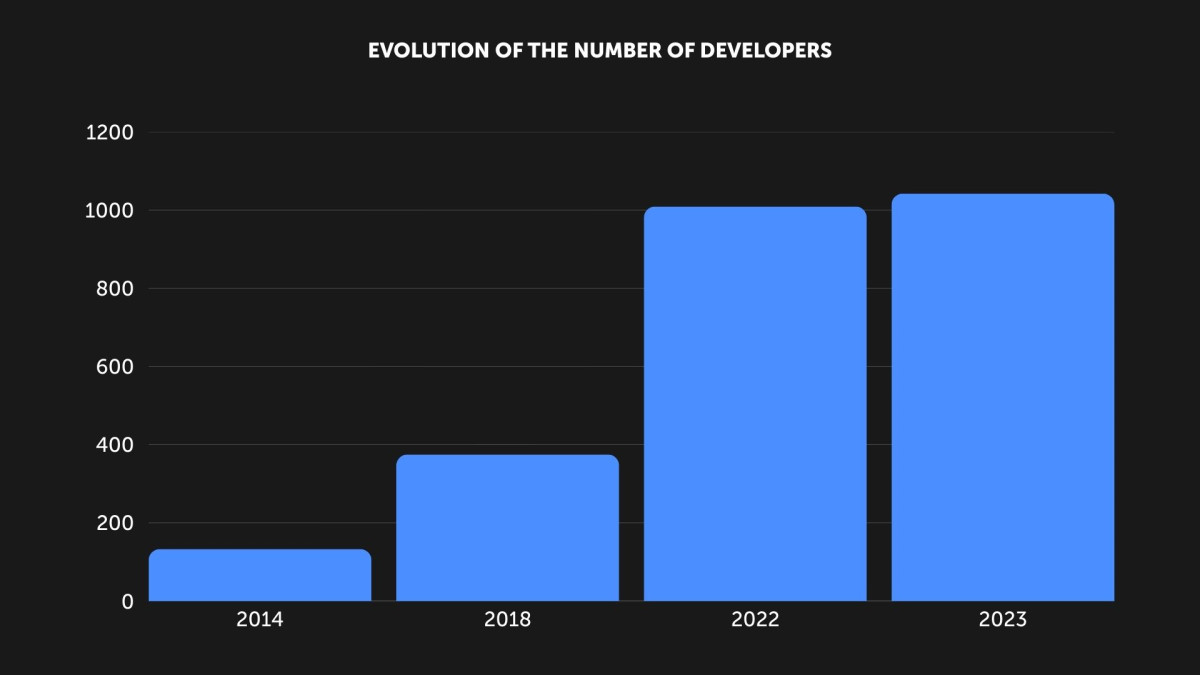

Brazil’s game industry is mostly made up of small studios, with a total of 1,042 development companies in the country. In comparison, in 2014 there were only 133 studios in the country, and by 2018 that number had grown to 375.

Between 2020 and 2022, 2,600 games were released in Brazil (with 1,009 games released in 2022 alone, a 12% increase from 2021).

Source: www.gamesindustry.biz

Source: www.gamesindustry.bizAs of 2023, the gaming industry in Brazil employed 13,225 professionals, up 6.3% from 12,441 in 2022.

The industry in Brazil is dominated by men, who make up 74.2% of employees in the studios surveyed. From 2022 to 2023, the number of women decreased from 29.8% to 24.3%. The number of non-binary employees remained unchanged at 1.5%.

93% of the Brazilian studios surveyed work on their own IP.

Game Studios Location

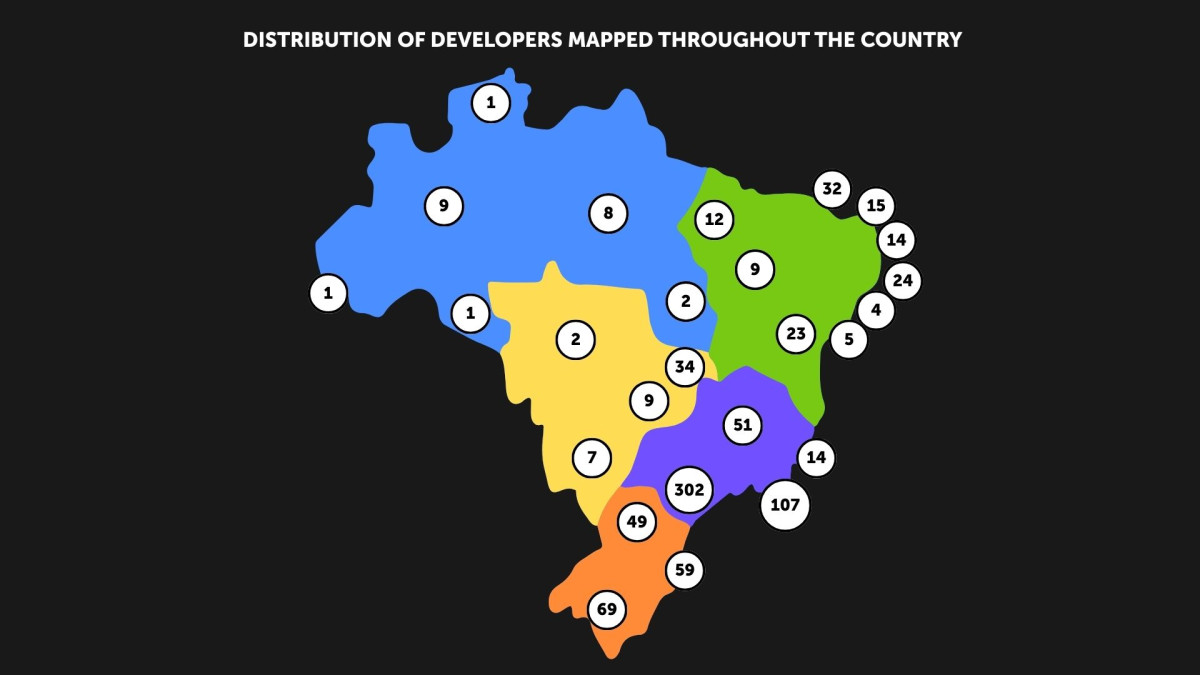

Looking at where studios are located throughout Brazil, the largest number are in the largest cities, such as São Paulo (302), Rio de Janeiro (107), and Rio Grande do Sul (69).

Source: www.gamesindustry.biz

Source: www.gamesindustry.biz70% of Brazilian studios work remotely, 16% choose a hybrid system, and only 14% work in offices.

Looking at the technologies adopted by Brazilian studios, 80% use Unity to develop their games and 25% use the Unreal engine (indicating that some studios may be using both).

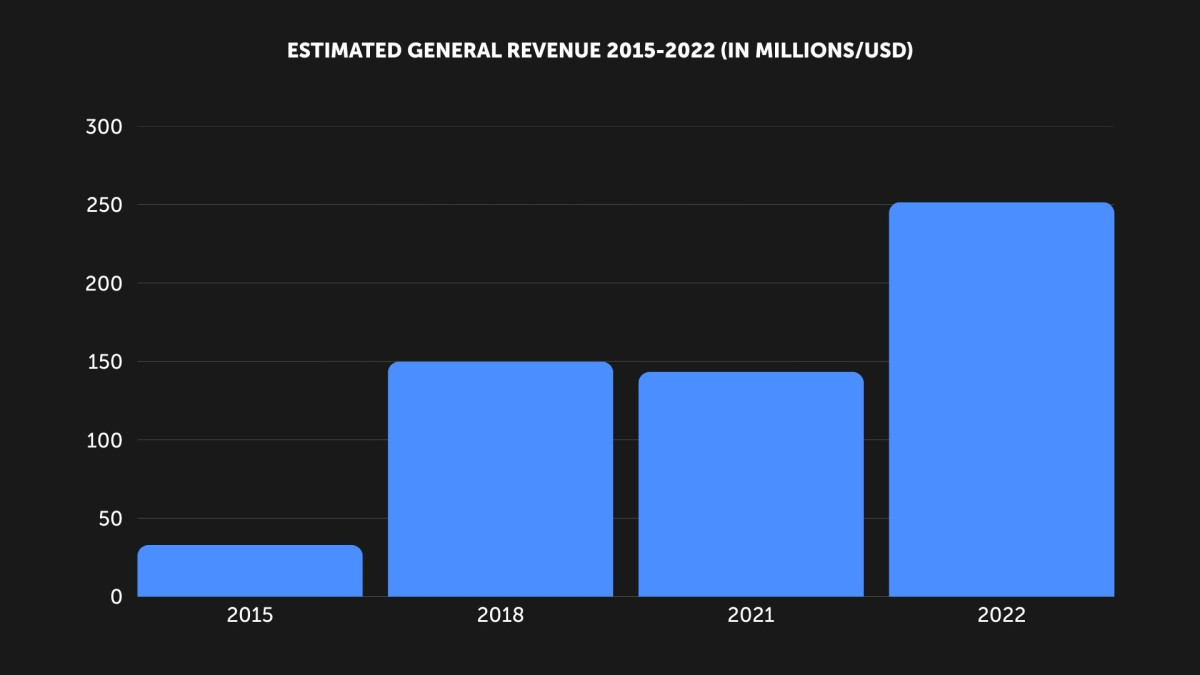

A Game Brasil’s research shows that the game development industry in Brazil has reached USD 251.6 million in revenue in 2023.

Source: www.gamesindustry.biz

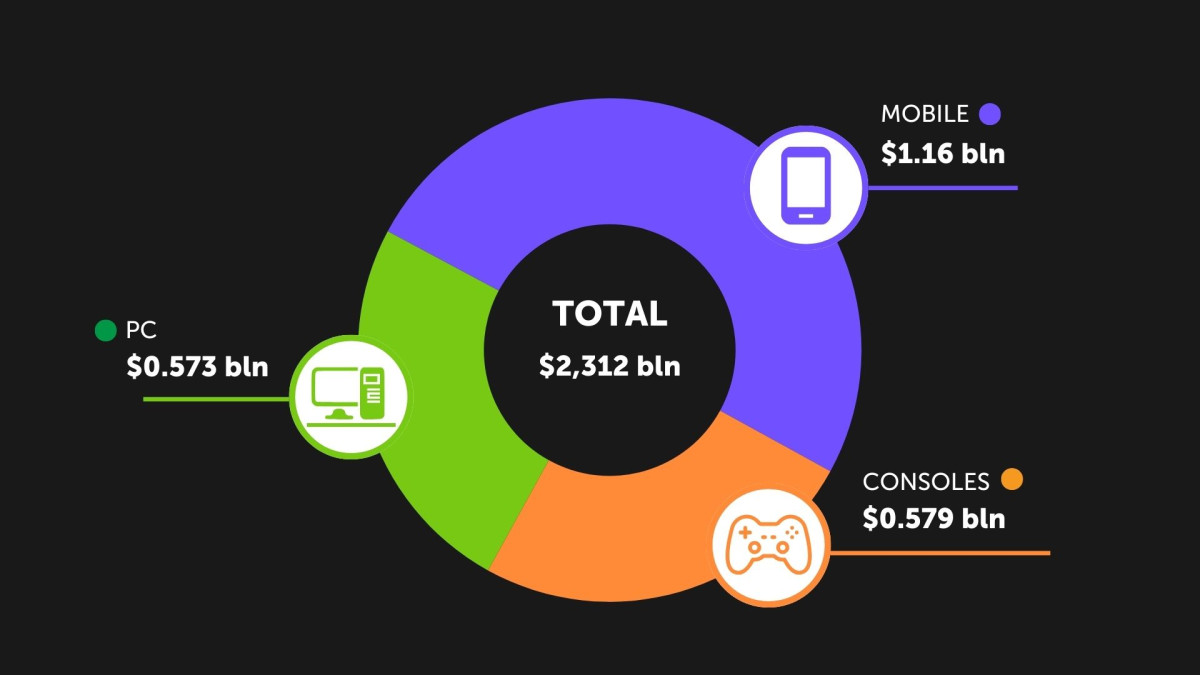

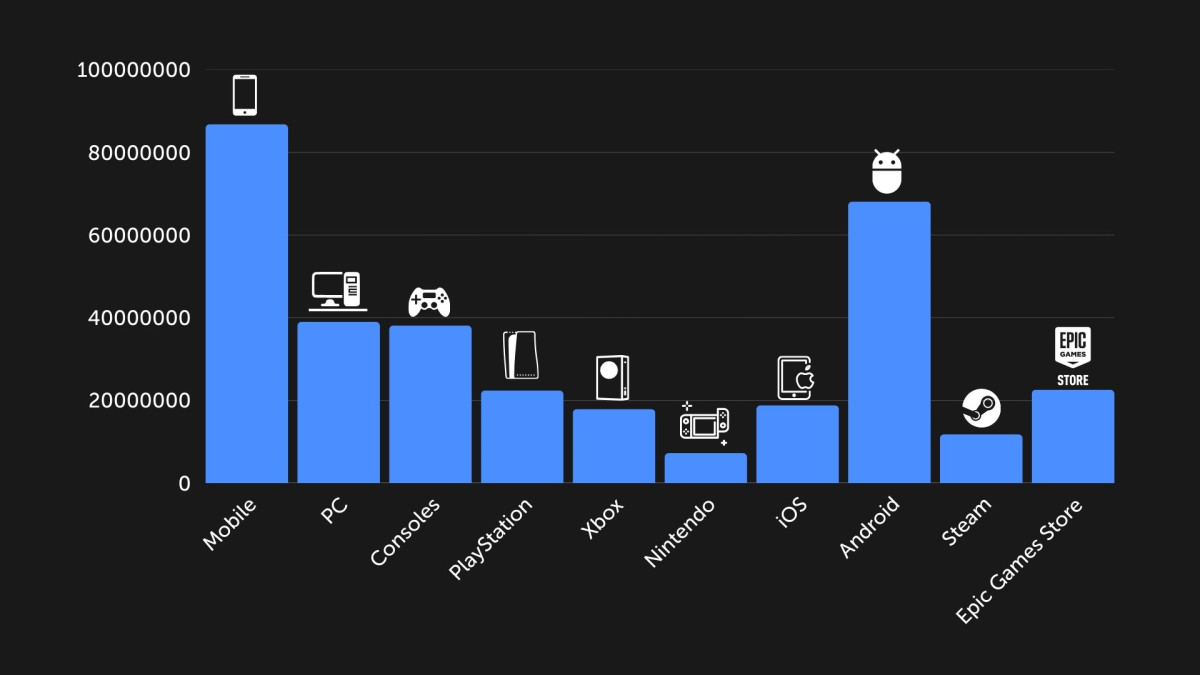

Source: www.gamesindustry.bizAccording to the survey, mobile devices account for 51.7% of the Brazilian market, followed by consoles (20.5%) and PCs (19.4%). Consoles have only recently overtaken PCs between 2022 and 2023, while mobile devices also grew by 3.4%.

However, when looking at Brazilian-made games, they are very different from what players actually buy in the country. Only 24% of games developed in Brazil are for mobile devices, slightly behind PC games (24.9%). They are followed by games for web browsers (23%) and consoles (11%).

Digital sales in Brazil grew from 54% of total game sales in 2021 to 62% in 2023.

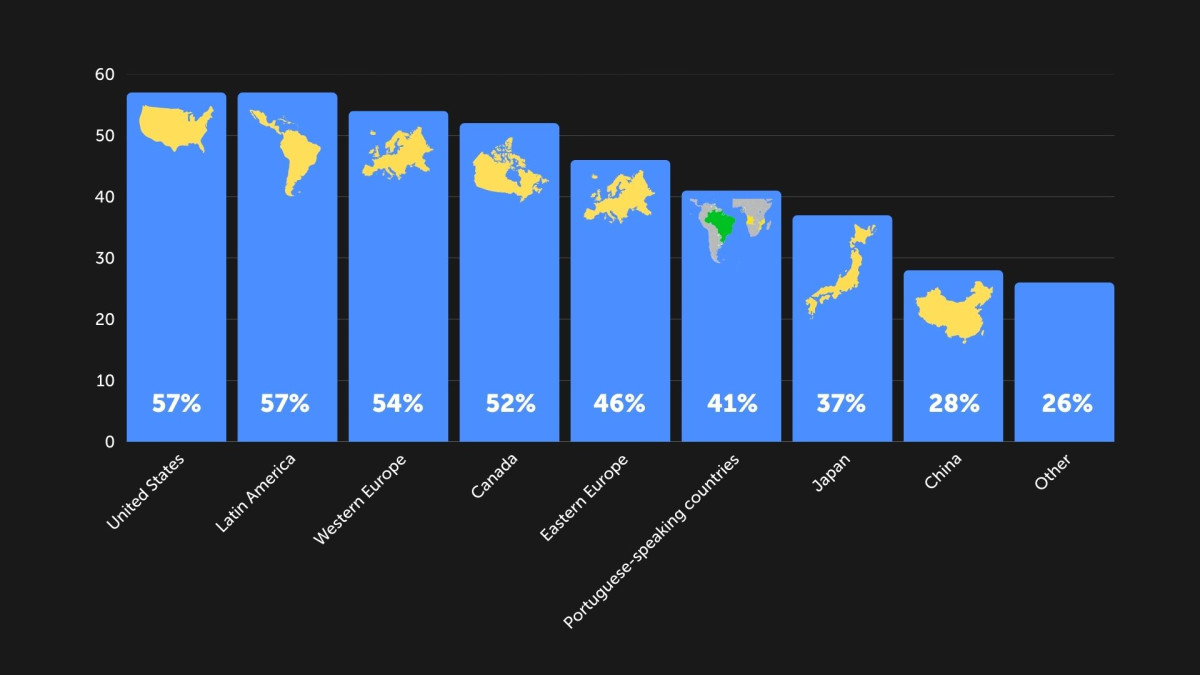

The rest of Latin America and the United States are Brazil’s largest commercial partners in games. Also, the number of partnerships with Western Europe is gradually increasing: 54% of Brazilian game studios did business with this region in 2024, up from 49% in 2023.

About half of the studios doing international business derived more than 70% of their revenues from overseas.

Brazil’s Main International Markets

Source: brazilgames.org

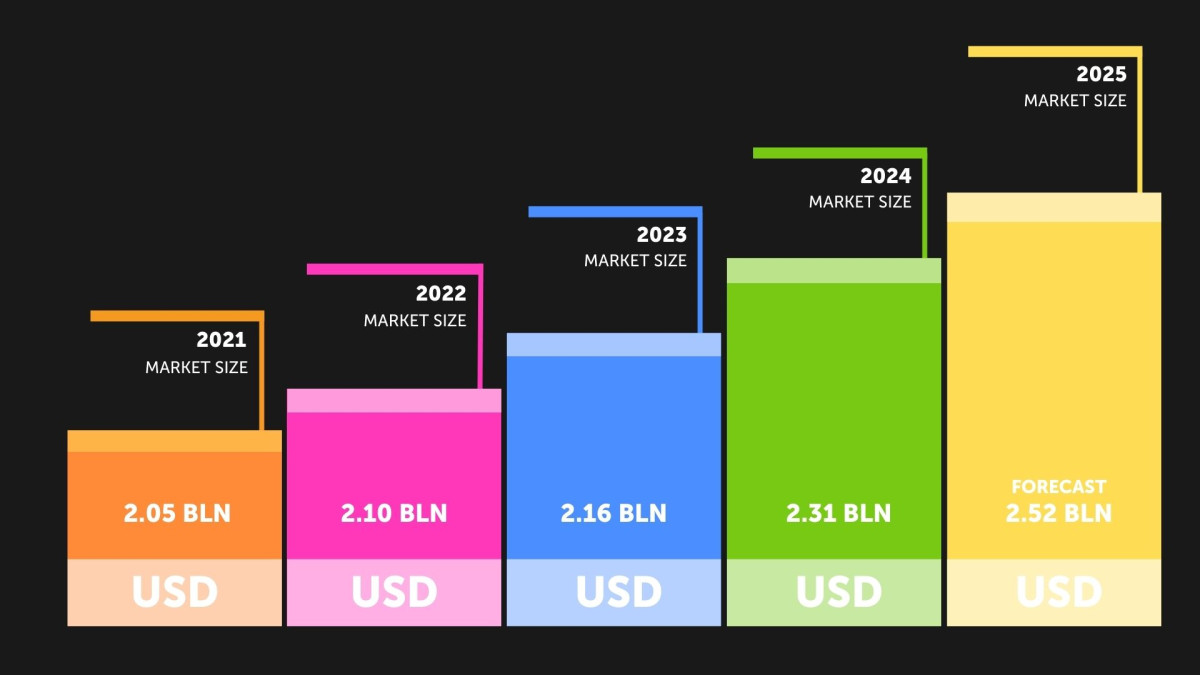

Source: brazilgames.orgStatista Forecasts for the Development of the Gaming Market in Brazil

- The number of gamers in Brazil is expected to grow to 87.4 million users by 2030.

- Gaming penetration is projected to reach 36.1% in 2025, increasing to 39.0% by 2030.

Market Development Dynamics

Source: platform.newzoo.com

Source: platform.newzoo.comGaming Market Size

Source: platform.newzoo.com

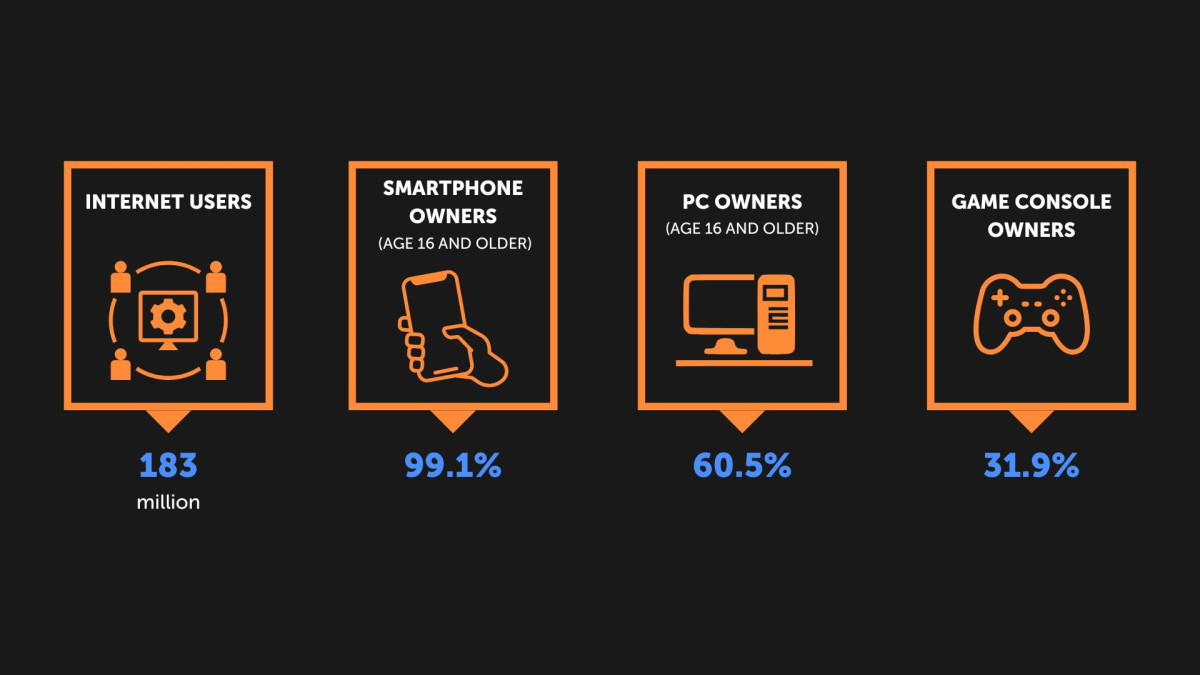

Source: platform.newzoo.comPopulation

Source: www.worldometers.info, datareportal.com

Source: www.worldometers.info, datareportal.comNumber of Gamers

Source: platform.newzoo.com

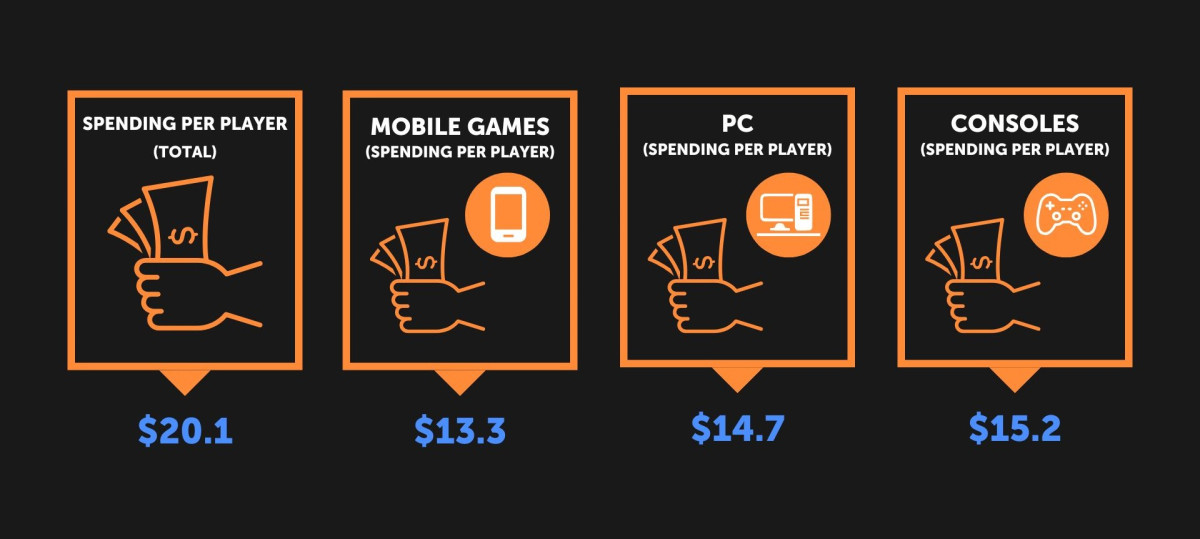

Source: platform.newzoo.comPlayer Spending

Source: platform.newzoo.com

Source: platform.newzoo.comPlayer Profile

Brazil is the largest gaming market in Latin America and has the fifth largest number of online players in the world, with 103 million players (115 million according to Newzoo).

A Game Brasil survey showed that about 82.1% of Brazilians consider video games to be one of their main forms of entertainment.

The majority of players in Brazil identify as white (42.2%), followed by mixed race (41.4%, up 4.1% year-on-year) and black (12.7%).

General Player Statistics

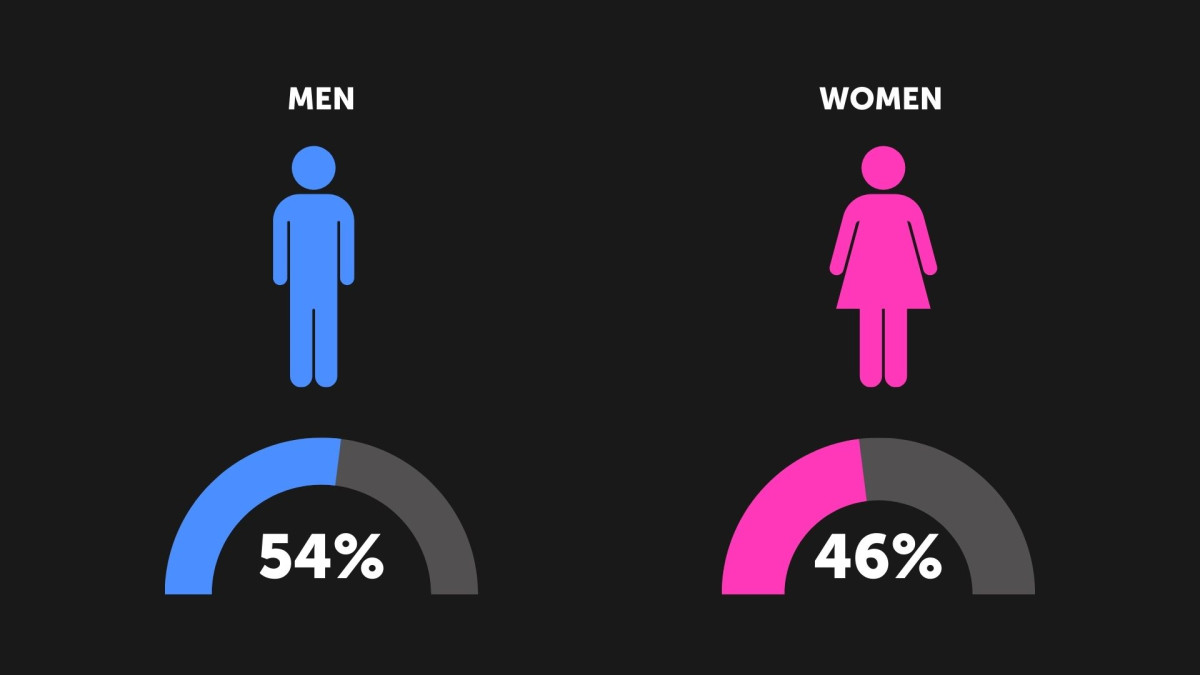

Gender Distribution

Source: www.gamesindustry.biz

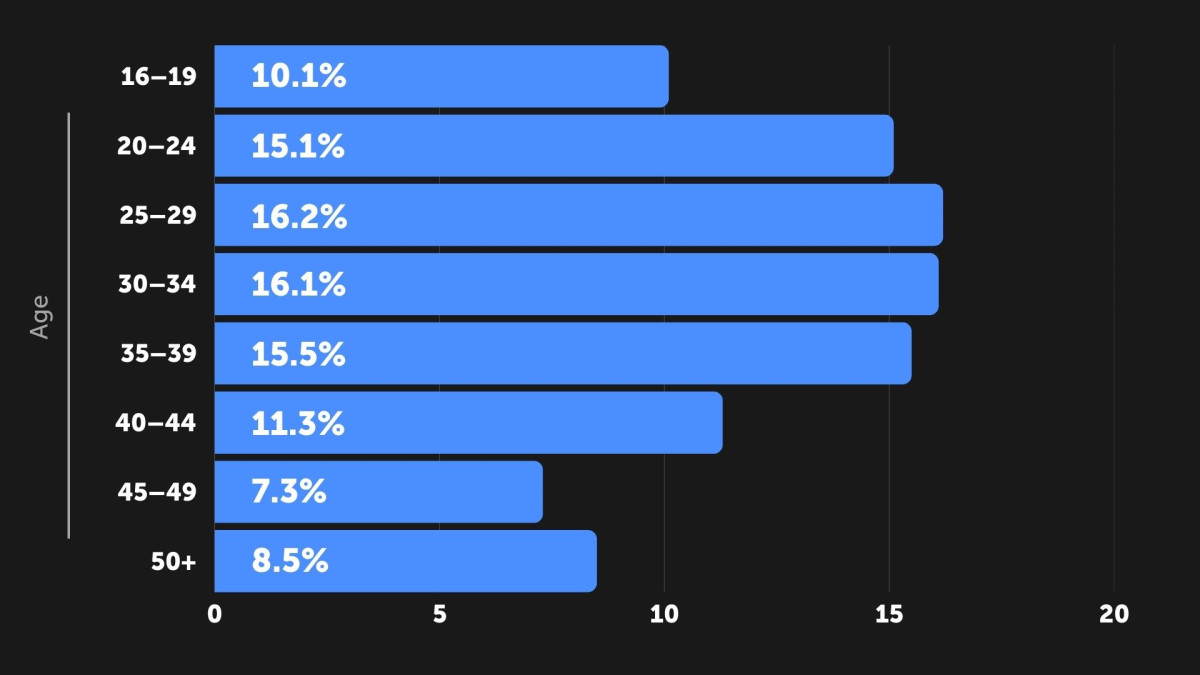

Source: www.gamesindustry.bizAge Distribution

Source: www.pagbrasil.com

Source: www.pagbrasil.comThe age of the majority of players is between 16 and 44 years old. The predominant age group is between 25 and 29 years old, which is 16.2% of players. They are followed in terms of numbers by players aged between 30 and 34 (16.1%).

The survey saw a slight increase in the over-50 age group by 2%. Currently, players over 50 years old represent 8.5% of the total Brazilian audience.

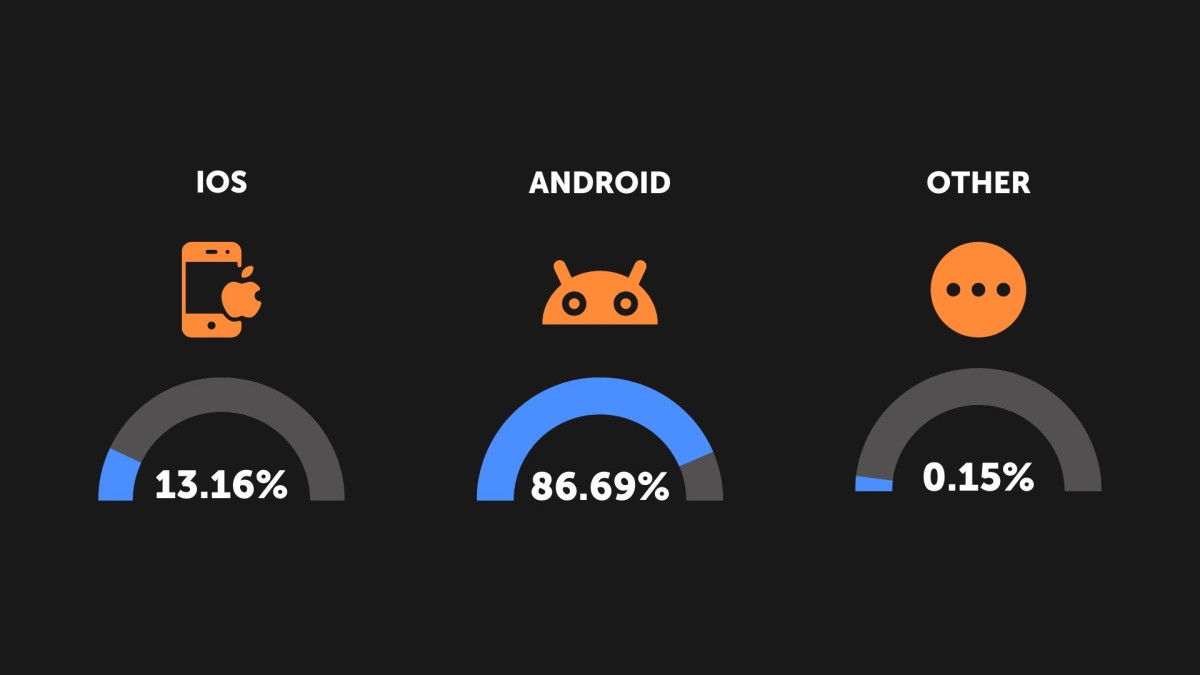

OS Distribution

Source: gs.statcounter.com

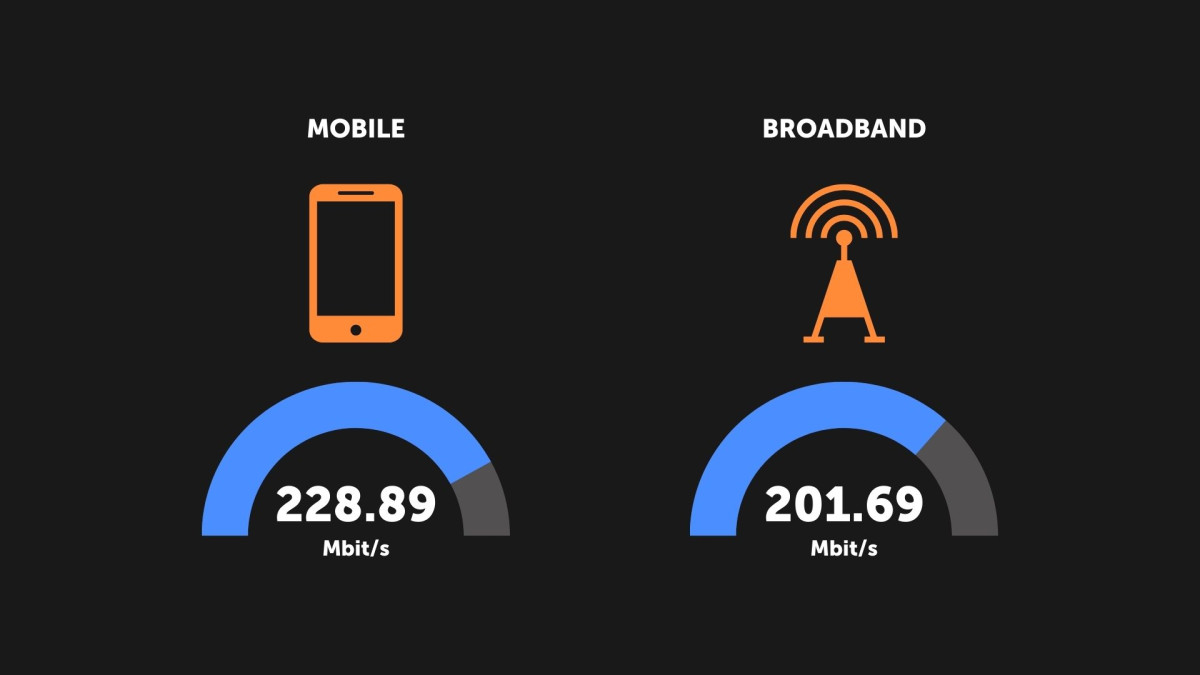

Source: gs.statcounter.comAverage Internet Speed

Source: www.speedtest.net

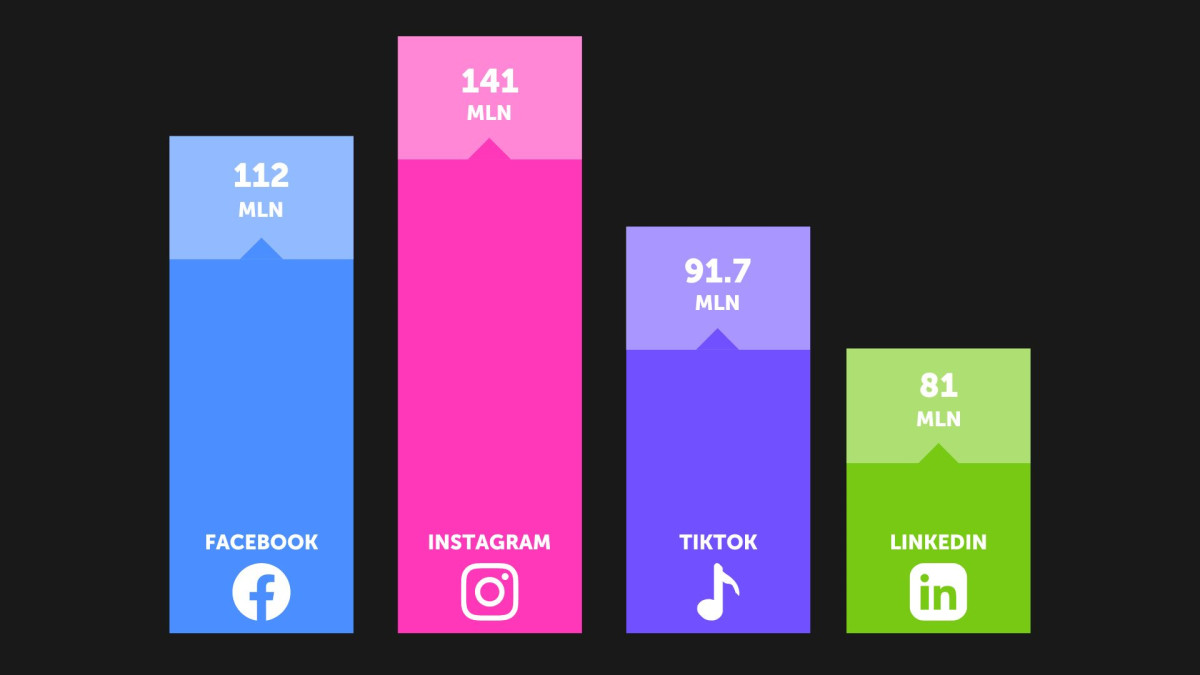

Source: www.speedtest.netPopular Social Media

Source: datareportal.com

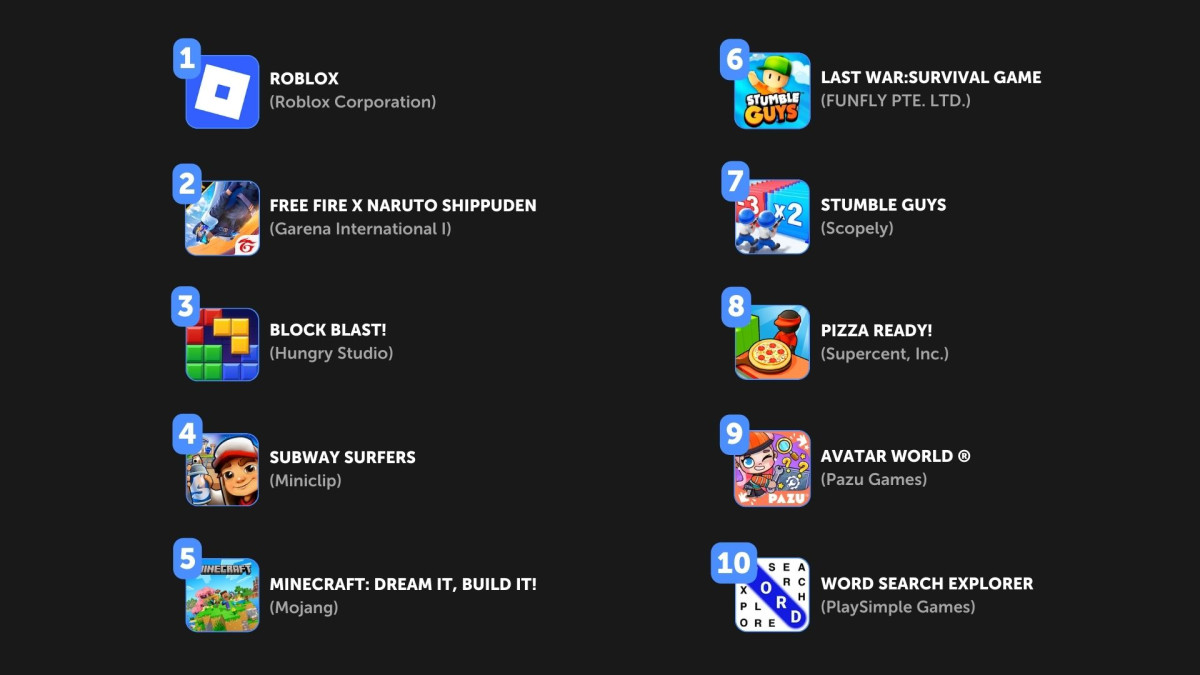

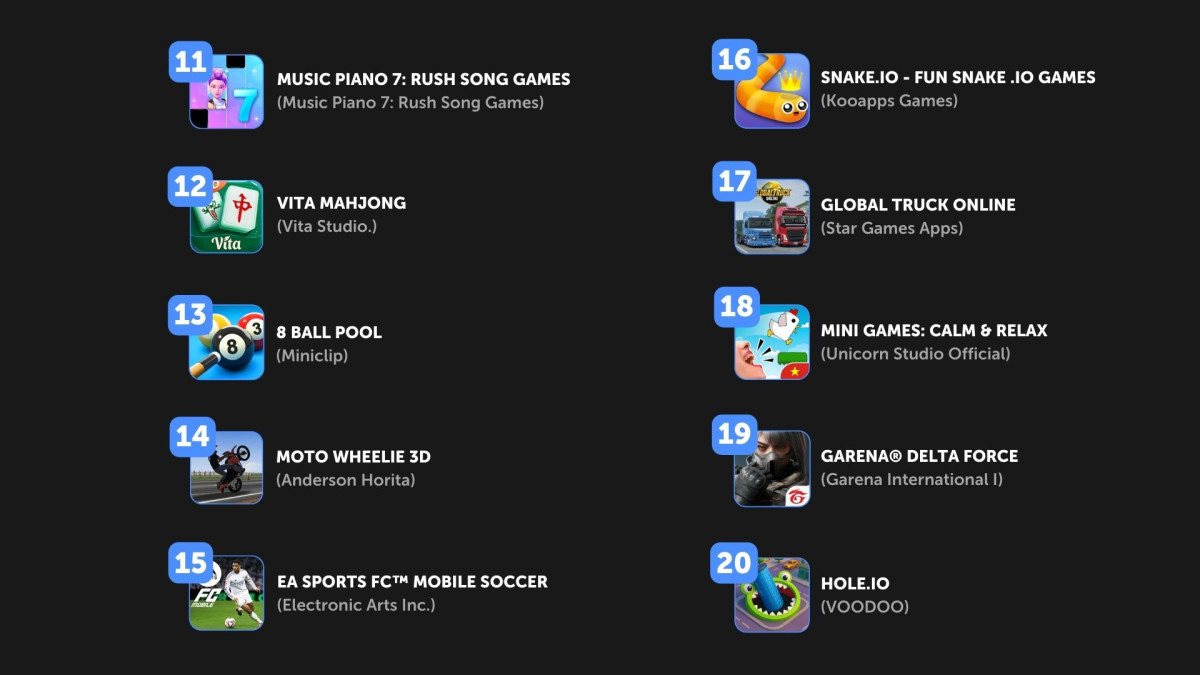

Source: datareportal.comTop Chart of Free Mobile Games in Google Play and App Store for 2025

1. Roblox (Roblox Corporation)

2. Free Fire x NARUTO SHIPPUDEN (Garena International I)

3. Block Blast! (Hungry Studio)

4. Subway Surfers (Miniclip)

5. Minecraft: Dream it, Build it! (Mojang)

6. Last War:Survival Game (FUNFLY PTE. LTD.)

7. Stumble Guys (Scopely)

8. Pizza Ready! (Supercent, Inc.)

9. Avatar World ® (Pazu Games)

10. Word Search Explorer (PlaySimple Games)

11. Music Piano 7: Rush Song Games (Music Piano 7: Rush Song Games)

12. Vita Mahjong (Vita Studio.)

13. 8 Ball Pool (Miniclip)

14. Moto Wheelie 3D (Anderson Horita)

15. EA SPORTS FC™ Mobile Soccer (Electronic Arts Inc.)

16. Snake.io – Fun Snake .io Games (Kooapps Games)

17. Global Truck Online (Star Games Apps)

18. Mini Games: Calm & Relax (Unicorn Studio Official)

19. Garena® Delta Force (Garena International I)

20. Hole.io (VOODOO)

Source: appmagic.rocks

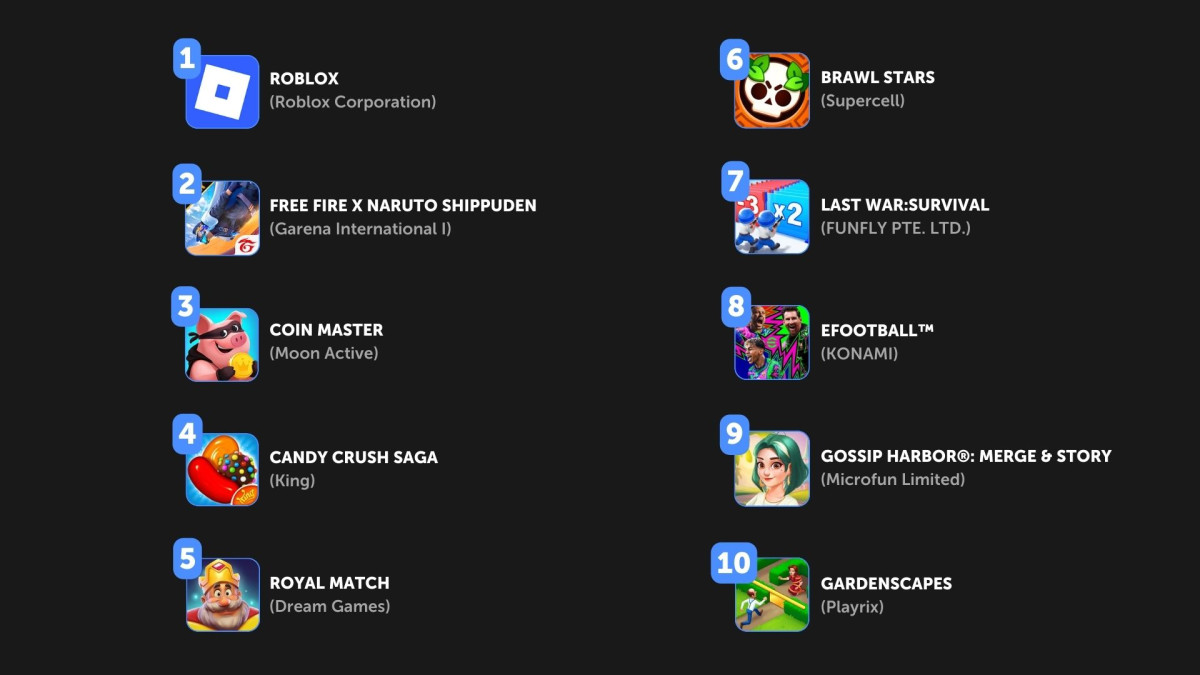

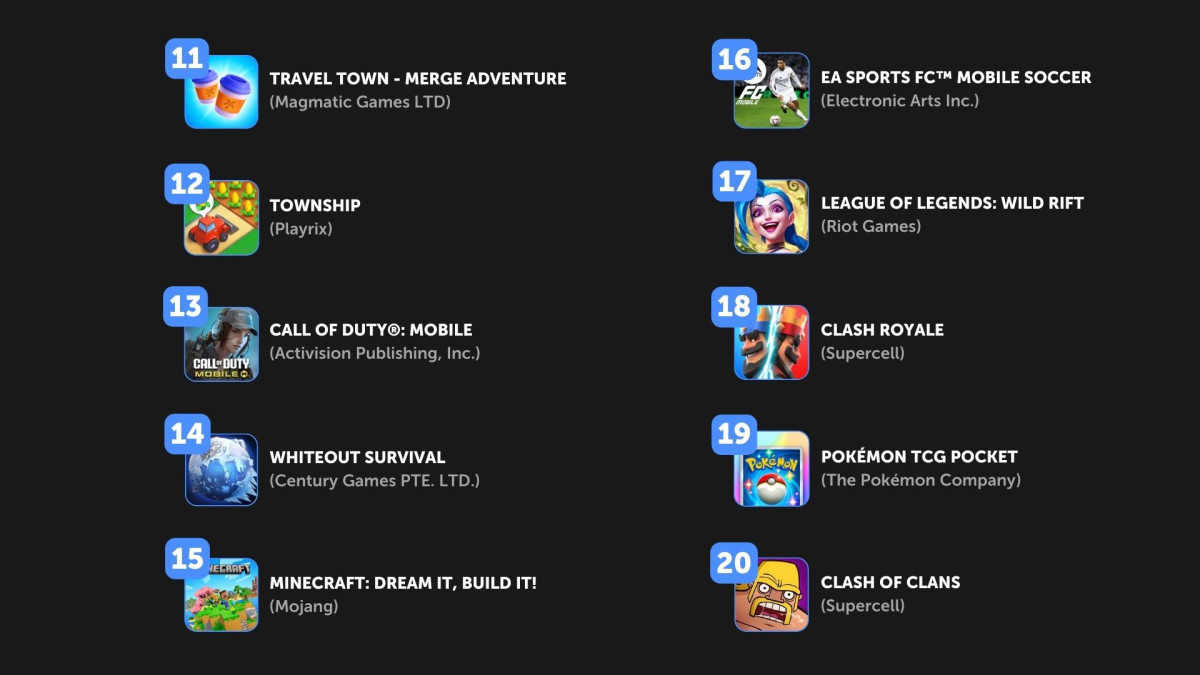

Source: appmagic.rocksTop Chart of Box Office Mobile Games in Google Play and App Store for 2025

1. Roblox (Roblox Corporation)

2. Free Fire x NARUTO SHIPPUDEN (Garena International I)

3. Coin Master (Moon Active)

4. Candy Crush Saga (King)

5. Royal Match (Dream Games)

6. Brawl Stars (Supercell)

7. Last War:Survival Game (FUNFLY PTE. LTD.)

8. eFootball™ (KONAMI)

9. Gossip Harbor®: Merge & Story (Microfun Limited)

10. Gardenscapes (Playrix)

11. Travel Town – Merge Adventure (Magmatic Games LTD)

12. Township (Playrix)

13. Call of Duty®: Mobile (Activision Publishing, Inc.)

14. Whiteout Survival (Century Games PTE. LTD.)

15. Minecraft: Dream it, Build it! (Mojang)

16. EA SPORTS FC™ Mobile Soccer (Electronic Arts Inc.)

17. League of Legends: Wild Rift (Riot Games)

18. Clash Royale (Supercell)

19. Pokémon TCG Pocket (The Pokémon Company)

20. Clash of Clans (Supercell)

Source: appmagic.rocks

Source: appmagic.rocksCatch new content first

SUBSCRIBE TO OUR LINKEDIN

![]()

Our Localization Projects

As Brazil continues to solidify its position as the leading gaming market in Latin America, localization plays a crucial role in making games not only accessible but also culturally resonant with local players. At Allcorrect, we are proud to offer top-tier localization services in Brazilian Portuguese.

Here are two standout projects we’ve worked on:

- Eriksholm: The Stolen Dream by Nordcurrent Labs and River End Games. In this captivating narrative-driven game, we carefully adapted the story to Brazilian Portuguese, ensuring that the emotional depth of the characters and the mystery were fully conveyed while respecting local cultural nuances.

- One Punch Man World by Crunchyroll Games. With a blend of fast-paced action and humor, we localized this mobile game for the Brazilian market.

Brazil continues to be the largest gaming market in Latin America with more than 103 million players. The industry reached revenues of USD 251.6 million in 2023, with forecasts suggesting that the number of players will grow to 87.4 million by 2030. Meanwhile, mobile gaming is the leading segment of the market, with a forecast for 2025 revenue growth. The Brazilian gaming industry is experiencing strong growth, with 1,042 developers and a notable increase in game releases. International cooperation with the regions of North America, Europe, and China is a key factor for this expansion.