When we looked back at 2022, we called it a “crisis year.” The gaming industry was reacting to new challenges but generally not making serious strategic decisions, which were instead put off until 2023. Let’s look at how the industry reacted to market challenges in 2023 and what we can expect going forward.

General Statistics

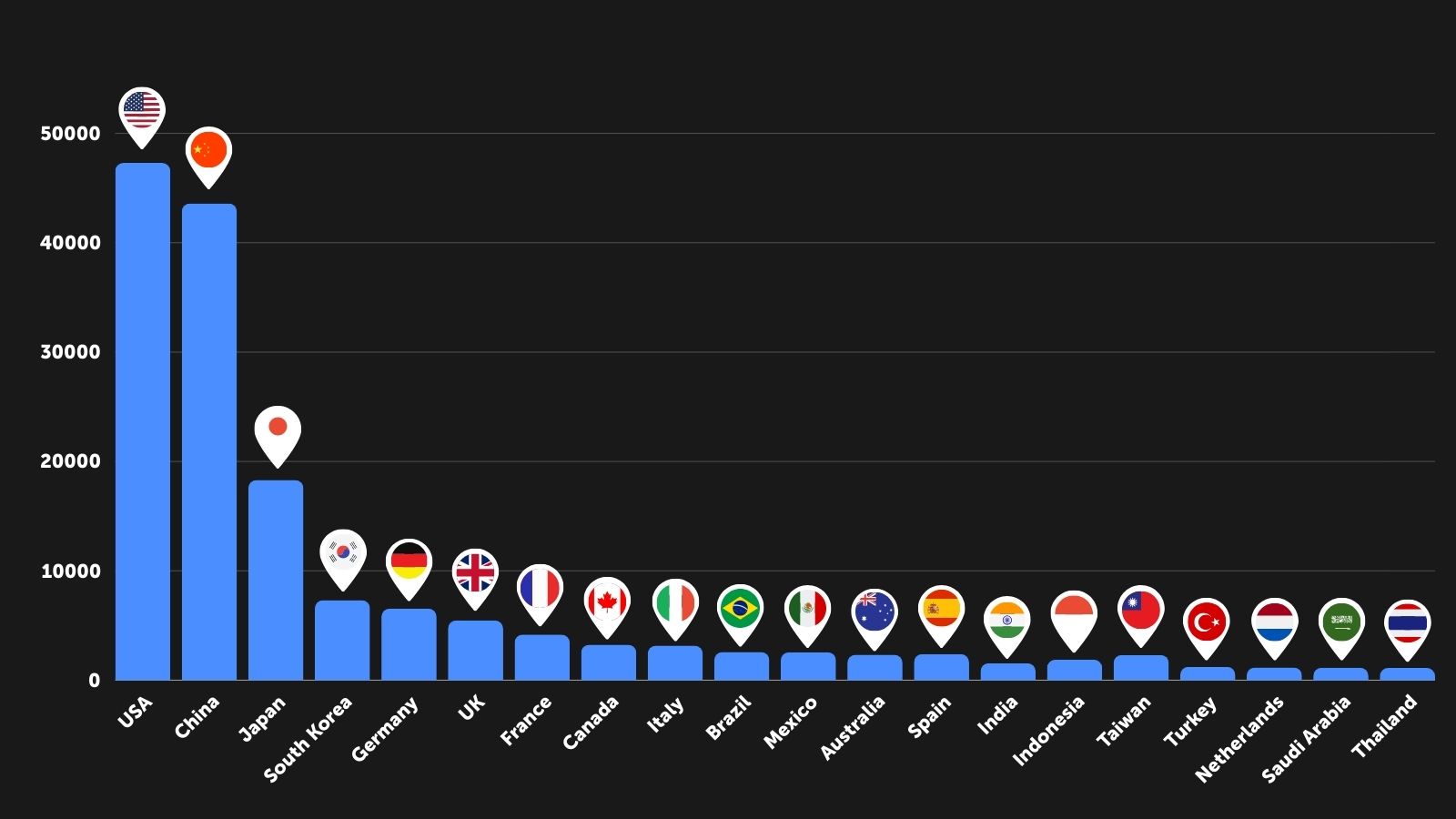

Top 20 Countries by Gaming Market Size

In 2023, the U.S. and China lead the way in market size, showing a significant lead over the rest of the world. China’s market was largely made up of mobile games, while the console market dominated in the U.S., with the mobile game market following up. This is similar to Europe, which is primarily a console market, while the mobile market leads most of the remaining countries.

Top 20 Countries by Number of Players and Their Spending in Games

| Country | Number of gamers (millions) | Spend per Player (USD) |

| China | 668 | 65.4 |

| India | 402 | 3.83 |

| United States of America | 214 | 221 |

| Indonesia | 148 | 12.6 |

| Brazil | 108 | 23.7 |

| Japan | 73.6 | 249 |

| Mexico | 72.4 | 35.4 |

| Germany | 52.1 | 126 |

| Turkey | 50 | 24.2 |

| UK | 40.3 | 136 |

| France | 39.8 | 105 |

| Thailand | 38.9 | 28.8 |

| Italy | 36.9 | 85.7 |

| South Korea | 33.6 | 218 |

| Spain | 33.3 | 71.6 |

| Saudi Arabia | 24.8 | 45.6 |

| Canada | 22.8 | 143 |

| Taiwan | 17.9 | 129 |

| Australia | 14.8 | 157 |

| Netherlands | 10.1 | 116 |

China and India are the global leaders in terms of the number of players, followed by the United States and Brazil.

Gamers in the U.S., Japan, and Korea spend the most in games, with significant spending also seen in Europe, Australia, and Taiwan. In China and Brazil, the average player does not spend more than 100 USD, and India has the lowest spending per player, at around 4 USD.

Important Trends for 2023

Several industry trends came to prominence in 2023, including studio cost optimization, many AAA releases, a trend towards market growth, and challenges to monopoly platforms.

Let’s look at those in detail.

Cost Optimization

Profit margins in the gaming business have been in decline for several years as development costs have risen, competition has increased, and the effect of marketing has diminished.

Consequently, in 2023, lots of studios and publishers worked hard to drive down their costs by reducing staff numbers, reducing development costs, and improving revenue collection margins.

Mass Layoffs

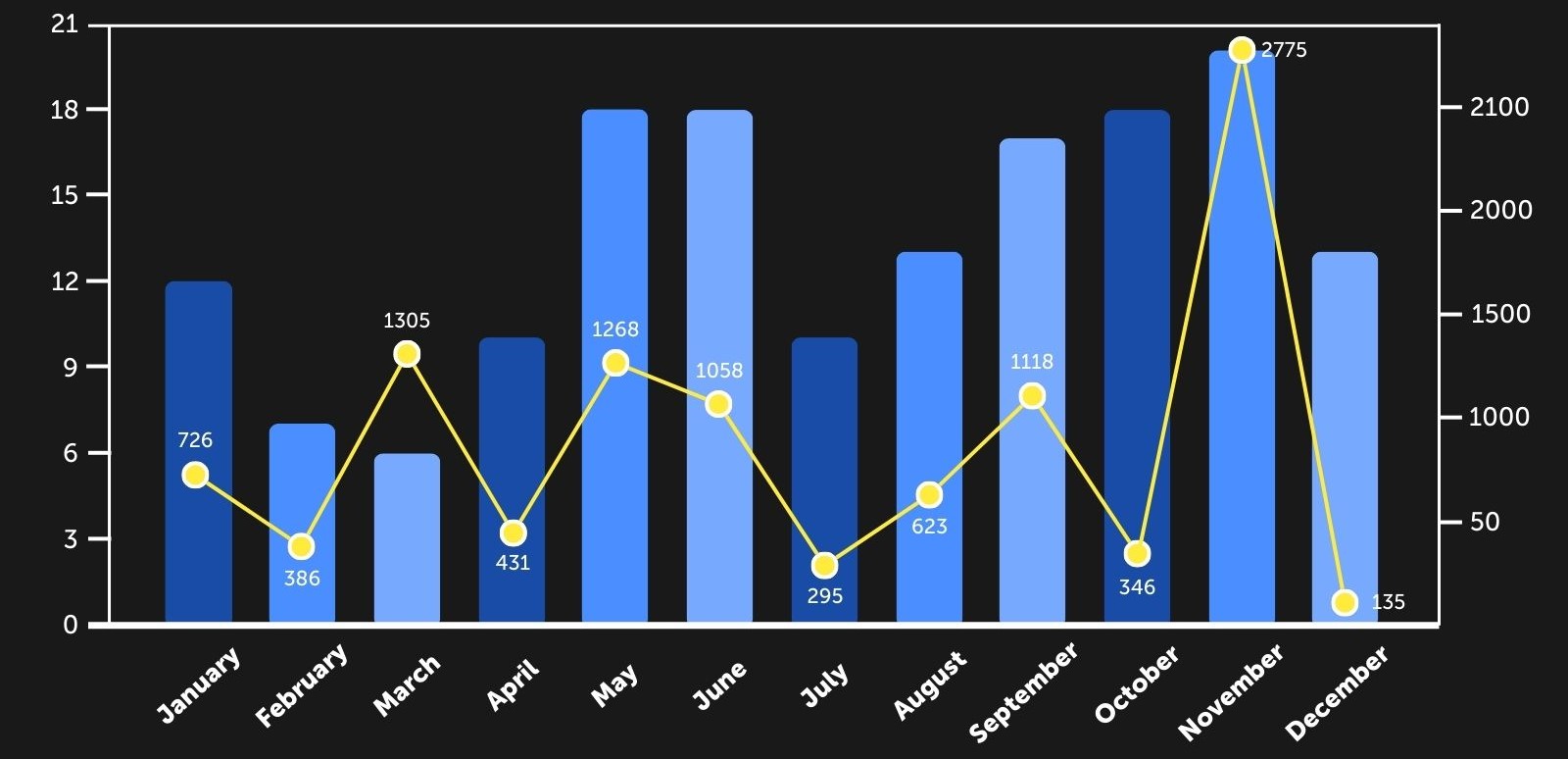

Global Layoff Rounds Against Headcount (2023)

Source : https://publish.obsidian.md/vg-layoffs/Archive/2024

Source : https://publish.obsidian.md/vg-layoffs/Archive/2024Layoffs in 2023 were on an enormous scale, and many companies affected by them had been actively expanding their staff during the pandemic years, amidst strong industry growth. We would like to believe that lessons will be learned from those layoffs and that recruitment in the future will be treated more responsibly.

Integration of AI

Plenty of studios and publishers have shown an eager attitude to the implementation of AI in their processes. So far, companies are still learning how to use the tools, and AI has subsequently not yet had a dramatic effect. There are some local successes, but global application and larger changes are still years away.

Revenue Collection

More and more developers are trying to collect revenue outside the mobile store platforms,

which can significantly reduce the commissions for taking payments. Of course, the mobile platforms don’t like it, but there is little they can do to stop the trend.

AAA Releases

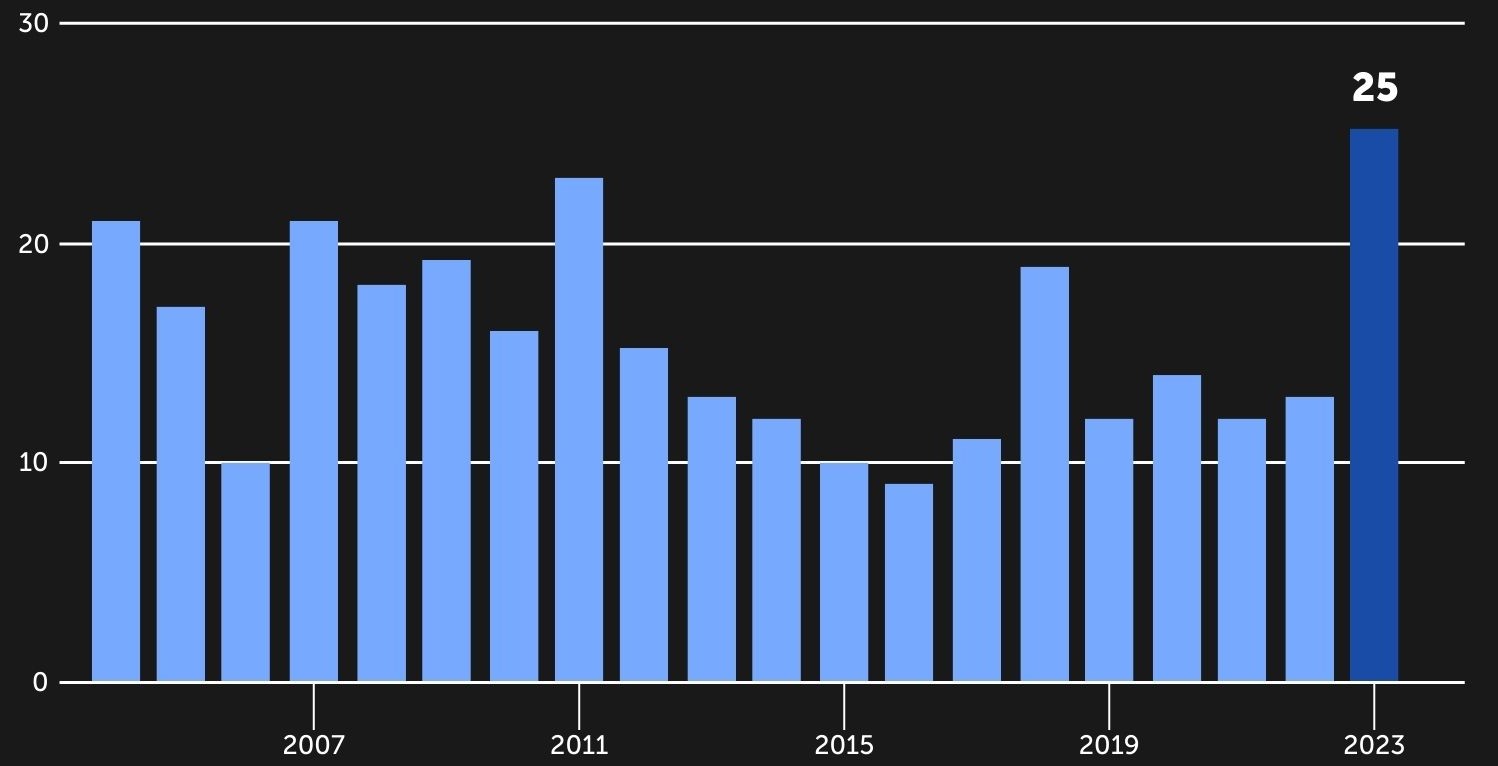

2023 was the best year for gamers in decades, as many AAA projects that had been delayed due to the pandemic and the events of 2022 finally saw their release. Subsequently, there was enormous competition for player attention and dollars in the AAA space.

Video Games Scoring 90 or More on Metacritic

Source : https://www.axios.com/newsletters/axios-gaming-e27ba10c-cf66-40ac-95ec-4f36fb320650.html

Source : https://www.axios.com/newsletters/axios-gaming-e27ba10c-cf66-40ac-95ec-4f36fb320650.htmlDozens of major projects hit the market in 2023, including top-tier titles such as:

– Hogwarts Legacy;

– Alan Wake II;

– Final Fantasy XVI;

– Baldur’s Gate III;

– Diablo IV;

– Monopoly GO!

This has led to market growth (more on that later) and much stiffer competition within that market.

There were a few examples of projects with big budgets that failed to find their audience, such as Immortals of Aveum. Simply put, with so many titles out there, many AAA projects were left without the attention they could otherwise have received.

It goes without saying that it will be impossible to maintain the same hit release rate in 2024.

Market Growth

The return to a growing market has happened largely due to the PC and console markets.

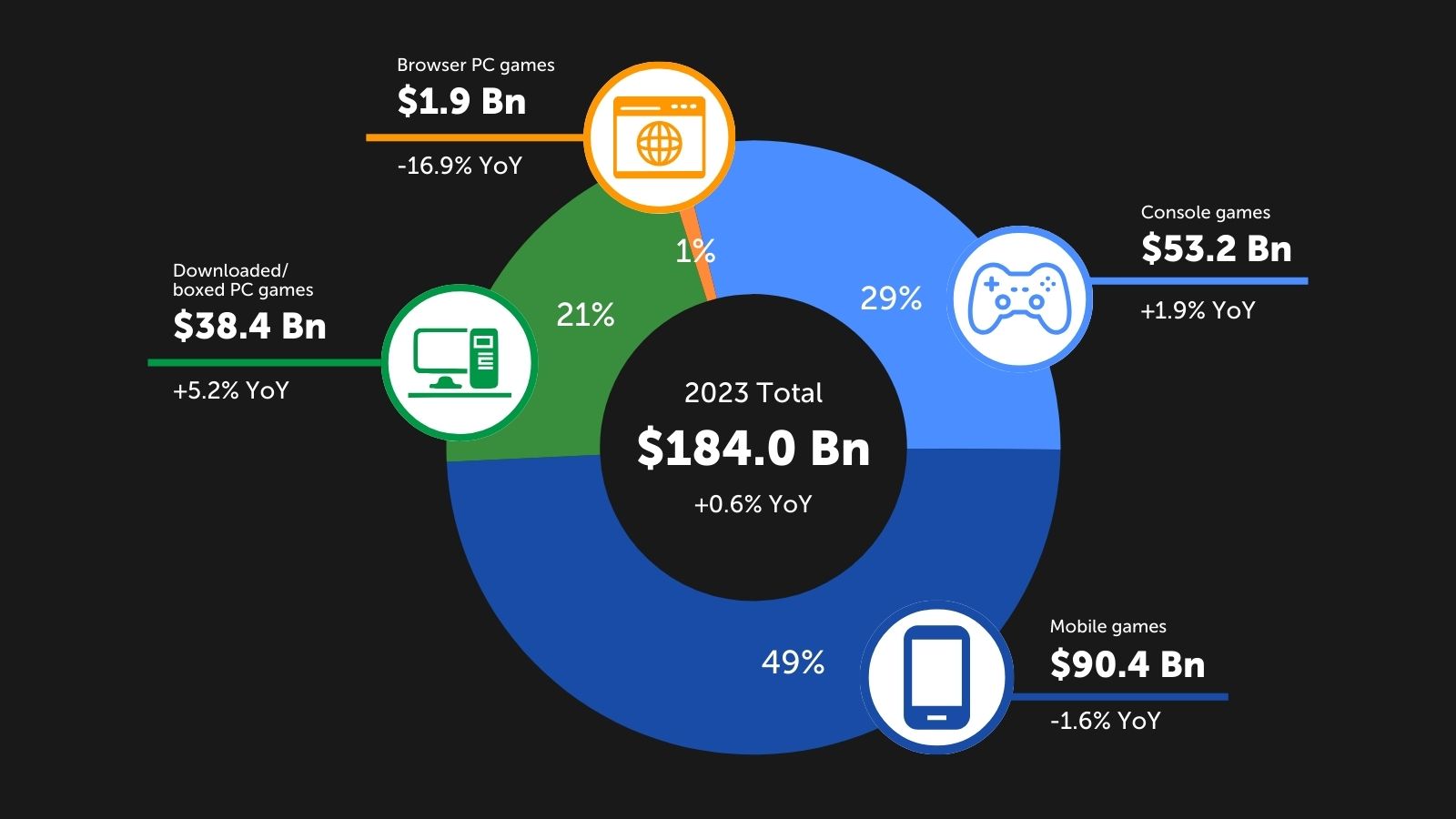

2023 Global Games Market

Per segment

Source : https://newzoo.com/

Source : https://newzoo.com/Newzoo reported that:

- The market would reach 184 billion USD in 2023 after 182.9 billion USD in 2022.

- The console (+1.7% year-on-year) and PC (+3.9% year-on-year) markets would be the main drivers of growth.

- The mobile gaming market is in negative growth territory, though it is trending into positive growth territory in the future.

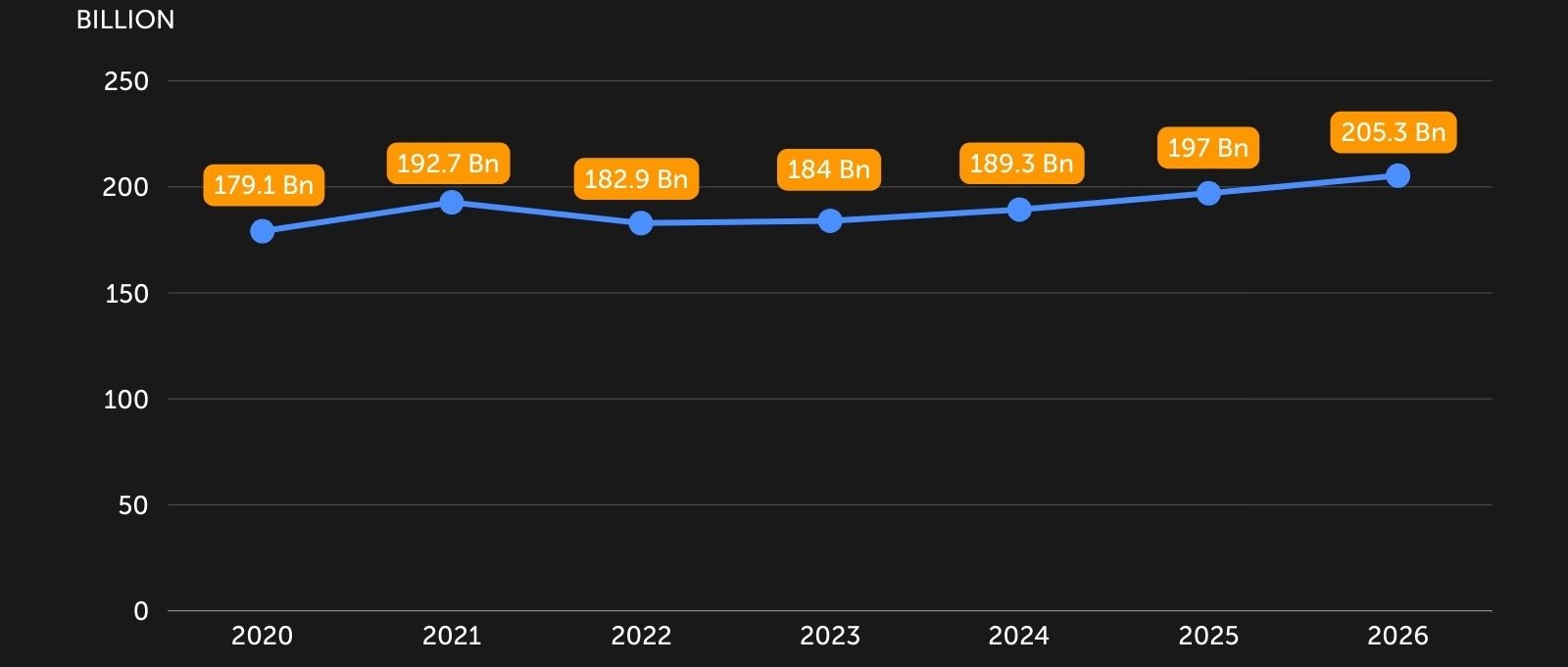

It is important to note that the growth dynamics of the market are slowing down, as it enters a saturation stage. If there are no serious revolutions, there is the possibility of reaching a plateau by 2030, representing the maximum market capacity.

Games Market Revenues

Living in a growing market is good—a rising tide lifts all boats—but the reality is that games, which for a long time were the cheapest entertainment format, have gained a serious competitor in the form of short videos. Services such as TikTok, Instagram Reels, and YouTube Shorts are all successfully taking time and attention away from potential users.

Monopoly Platforms under Pressure

Monopoly platforms came under pressure in 2023 from both authorities and other market participants.

For many years, game studios have been saying that a 30% commission is too high. Epic Games has long fought this injustice, noting that developers give back to platforms almost as much as they spend on development (read more about Epic’s stance on commissions). Subsequently, Epic Games sided with European authorities on the Digital Markets Act, which forces tech companies to allow for competition on their platforms. Apple complied, but did it in such a way that it makes no economic sense for developers to switch to third-party stores. Obviously, Apple will remain stubborn and continue to look for opportunities to take the commission that it sees as fair.

The situation is actively evolving, and it’s quite possible that, in 3–5 years, we will see a different market, more loyal to developers.

If you are interested in more detailed information on other countries or need advice on entering new gaming markets, you can always get in touch with us. Our experts will be happy to answer any questions you may have.