Latin America (Spanish/Portuguese: América Latina) is the collective name for the American countries and territories that officially use Latin-derived Romance languages, primarily Spanish, Portuguese, and French.

Until the late 19th century, the term Spanish America was also used in the United States to refer to all Spanish-speaking territories south of the United States.

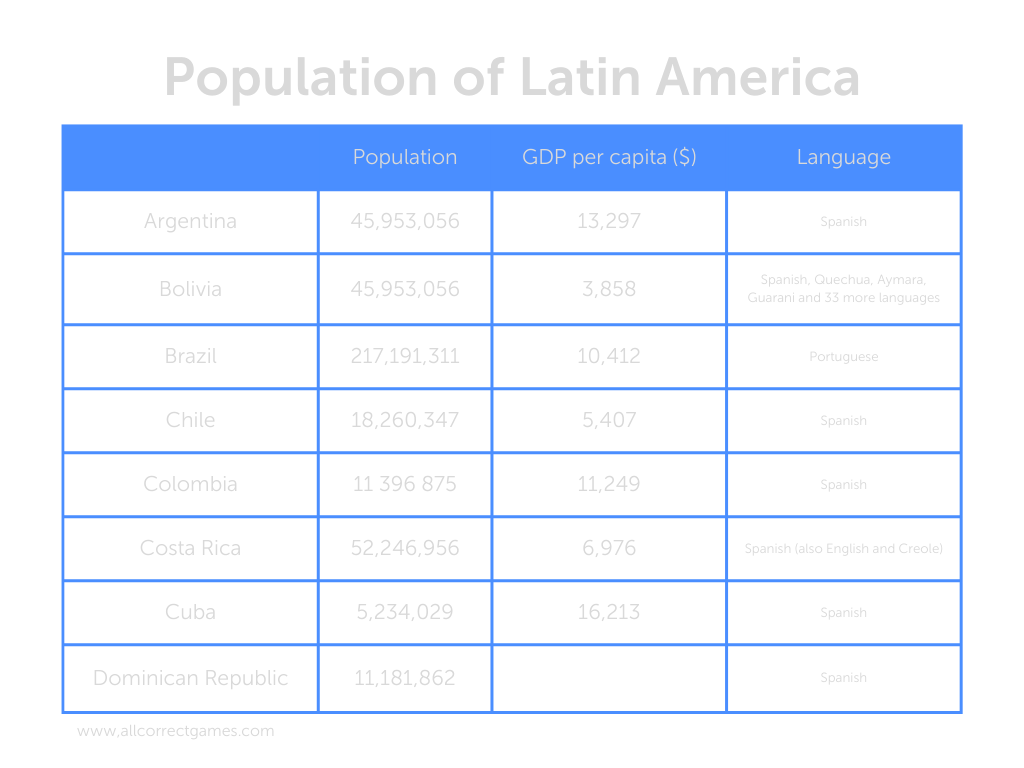

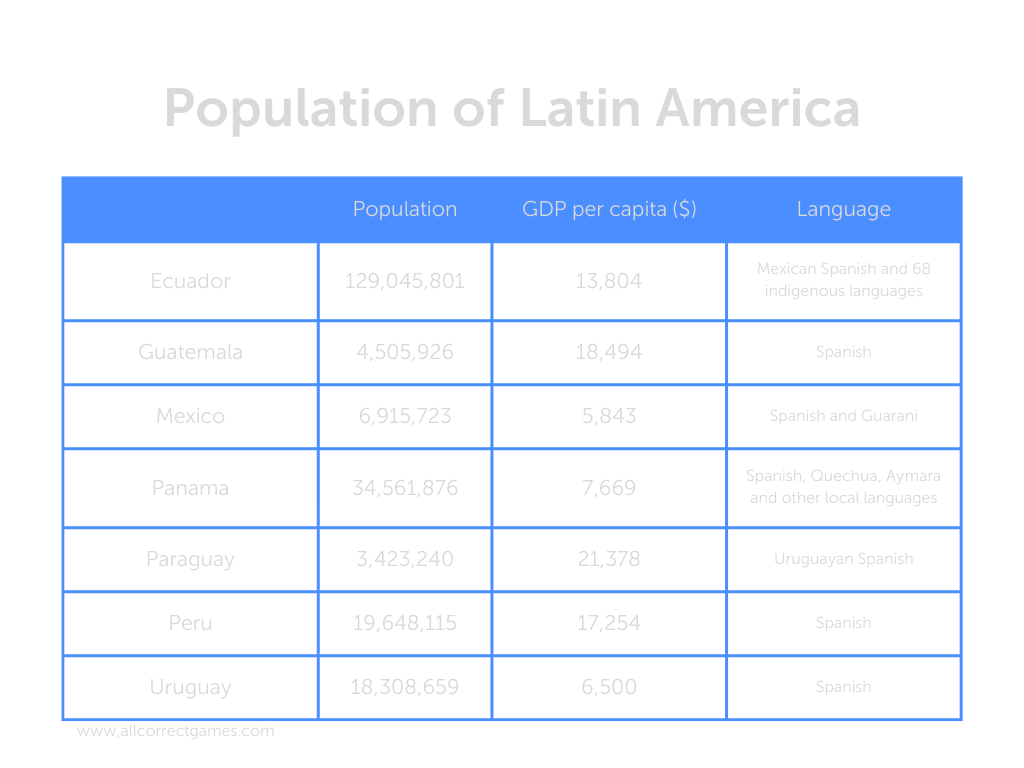

Latin America always includes the Spanish-speaking countries of mainland America from Mexico in the north to Argentina in the south, the Spanish-speaking countries of the Caribbean (Cuba, Dominican Republic, Puerto Rico), and Portuguese-speaking Brazil. French-speaking Haiti, St. Maarten and French Guiana are included in most cases. Some countries are not included in Latin America, such as Jamaica, Barbados, the Bahamas, Belize, Guyana, and Suriname, as they use Germanic languages (often English).

In total, Latin America includes 20 countries, and 6 dependent states.

As of 2021, the population of Latin America is 661 million, which accounts for 8.9% of the world’s population.

The Gaming Market in Latin America

In 2023, the Latin American market had a total revenue of 8.7 billion USD, and approximately 335 million players.

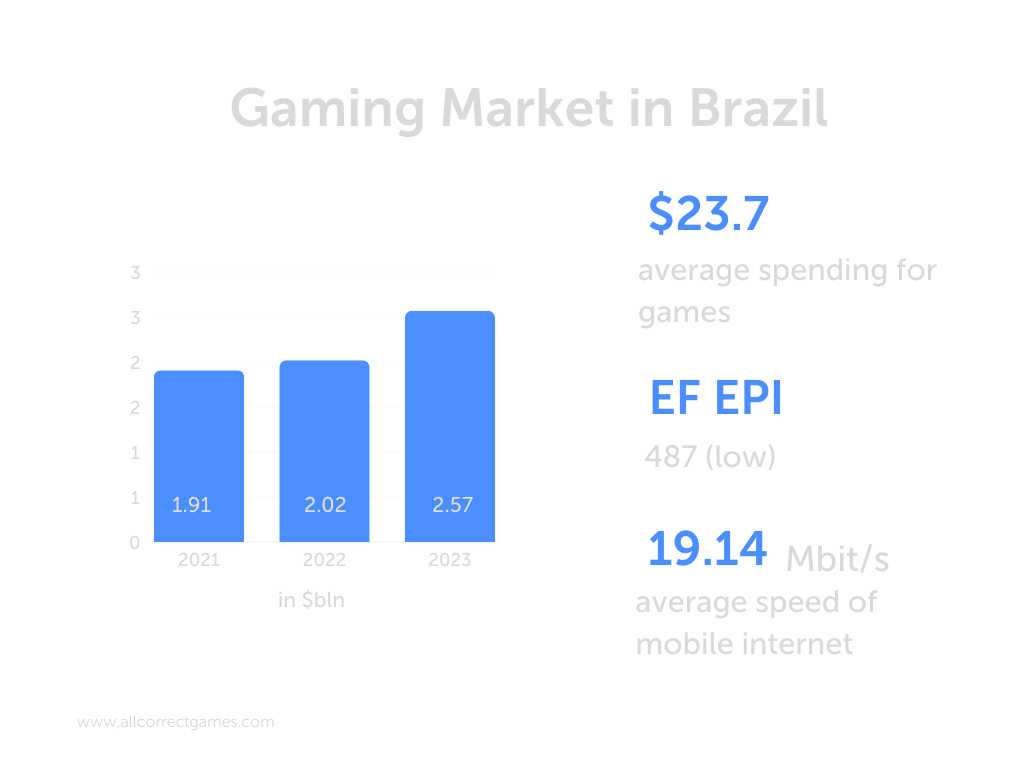

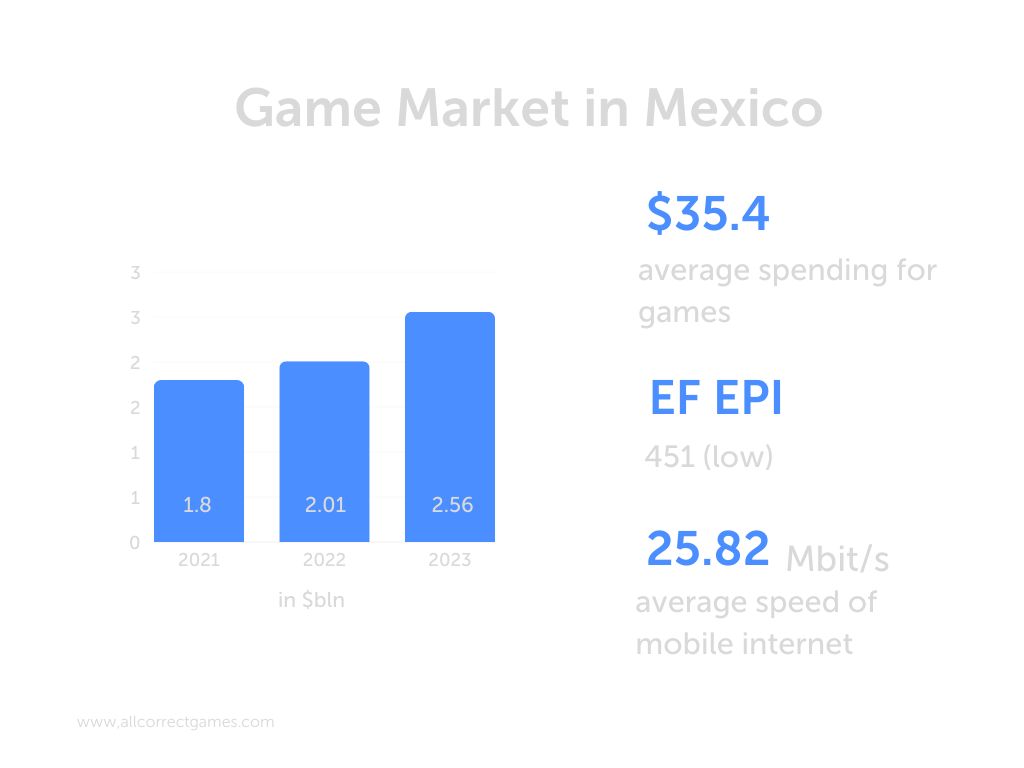

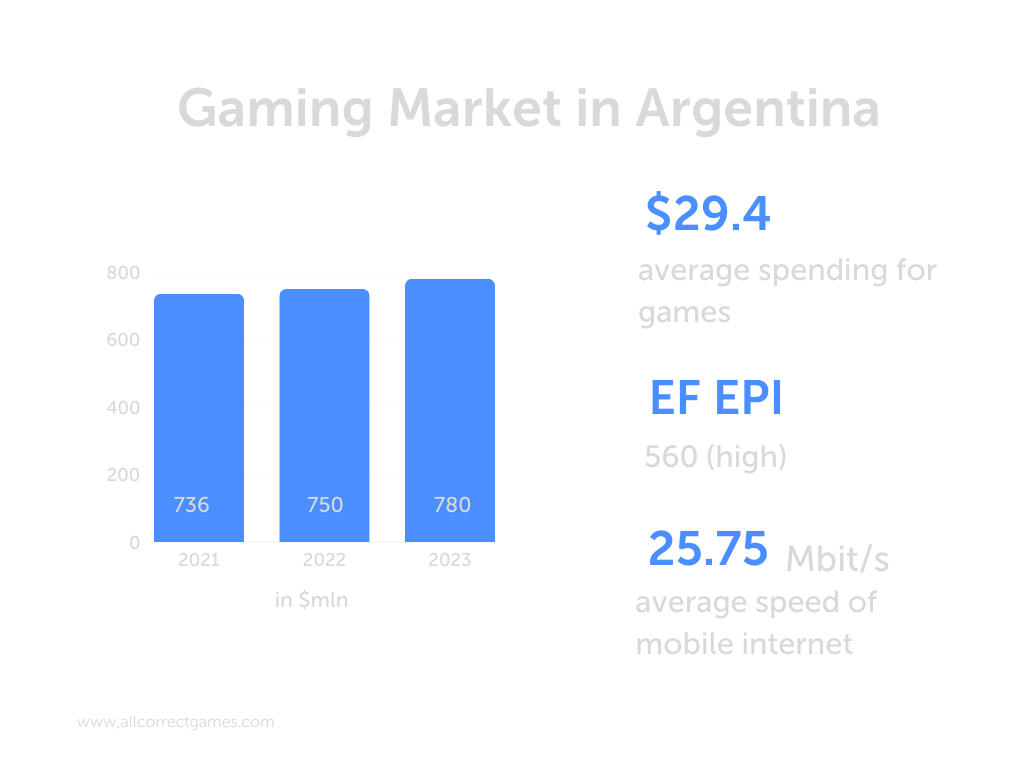

That year, Brazil’s gaming market generated 2.57 billion USD in revenue, making Brazil the country with the highest revenue among Latin American countries in 2023, followed by Mexico (2.56 billion USD), Argentina (780 million USD), Chile (347 million USD), and Colombia (396 million USD).

Faced with Covid restrictions, Latin Americans have become more likely to choose video games as their main mode of entertainment. According to recent surveys, monthly spending on games in Mexico, Brazil, and Chile increased by an average of 50% over the Covid period.

Mobile devices have given both everyday consumers and avid gamers the ability to access games anytime, anywhere. A 2020 study showed that more than two-thirds of Latin American respondents reported spending more than 40 minutes a day on mobile gaming. In another study, 69% of adults surveyed in Mexico said they play mobile video games. This figure is roughly the same in the south of the continent, with approximately 68.8% of Argentines indicating they play mobile games.

Latin American Countries by Gaming Revenue

1. Brazil (2.57 Billion USD)

As the tenth-largest gaming market in the world in terms of revenue and fifth-largest in terms of number of players, Brazil generated 2.57 billion USD in revenue in 2023. Around 43% of gamers spend money on games: primarily to unlock exclusive content, personalize characters, or advance in games.

As gaming is a habitual pastime for 70% of Brazilians, it reaches a wide variety of demographics, ethnicities, and age groups. In the past, women dominated the mobile market audience, due to the development of mobile casual games and proliferation of smartphones, but according to Pesquisa Game Brasil 2023, this has shifted, and now 53.8% of players are men. Millennials, especially those aged 25–34, make up the most active gaming audience in Brazil.

2. Mexico (2.56 Billion USD)

The gaming market in Mexico is experiencing significant growth due to several major factors: technological advancements, expanding digital infrastructure, continuous improvements in the entertainment industry, and the resulting widespread adoption of mobile gaming. Furthermore, the gaming market in Mexico continues to grow due to the increasing popularity of cybersports and online multiplayer platforms. Increasing numbers of gaming tournaments and events attract both local gamers and international audiences. According to Newzoo, Mexico’s gaming market last year ranked 11th in terms of revenue and 8th in terms of number of players.

Mexico has a high gaming penetration rate of 78.4%, more than 15 percentage points higher than Brazil, which otherwise has the largest gamer audience in the region.

As of July 2023, 51% of video gamers in Mexico were male, while the remaining 49% were female. 60% of video gamers in Mexico are between the ages of 20 and 39.

3. Argentina (780 Billion USD)

In terms of revenue, Argentina ranks 29th in the world. Argentina’s video game market experienced a “golden age” in the early 2000s, driven by the devaluation of the peso and the growing popularization of the Internet.

The market grew significantly throughout the decade until it faced the crisis of 2011, and since then, it has grown at a more moderate pace. The gaming sector in Argentina currently has more than 130 companies employing 1,600 people, and more than 100,000 students are pursuing gaming-related higher education. In 2022, a total of 53 video games were released by Argentinian studios.

There are 26.5 million gamers in Argentina, which is more than half of the total population. According to the Newzoo report, 90.24% of respondents between the ages of 35 and 44 said they play mobile games. The 45+ age group had the lowest number of mobile gamers, at 82.35%.

Top Mobile Games in Brazil, Mexico, and Argentina (February 2024)

Brazil

1. Roblox (Roblox Corporation)

2. Coin Master (Moon Active)

3. Free Fire: The Chaos (Garena International I)

4. Candy Crush Saga (King)

5. Brawl Stars (Supercell)

6. Royal Match (Dream Games)

7. EA SPORTS FC™ Mobile Soccer (Electronic Arts)

8. eFootball™ 2024 (KONAMI)

9. Gardenscapes (Playrix)

10. League of Legends: Wild Rift (Riot Games)

Mexico

1. Free Fire: The Chaos (Garena International I)

2. Roblox (Roblox Corporation)

3. Call of Duty®: Mobile (Activision Publishing)

4. Candy Crush Saga (King)

5. Royal Match (Dream Games)

6. Brawl Stars (Supercell)

7. Coin Master (Moon Active)

8. EA SPORTS FC™ Mobile Soccer (Electronic Arts)

9. Clash Royale (Supercell)

10. Clash of Clans (Supercell)

Argentina

1. Roblox (Roblox Corporation)

2. Free Fire: The Chaos (Garena International I)

3. Candy Crush Saga (King)

4. Brawl Stars (Supercell)

5. EA SPORTS FC™ Mobile Soccer (Electronic Arts)

6. Coin Master (Moon Active)

7. Royal Match (Dream Games)

8. Call of Duty®: Mobile (Activision Publishing)

9. Clash Royale (Supercell)

10. Mobile Legends: Bang Bang (Moonton)