Southeast Asia’s gaming market is booming! With a forecasted revenue of USD 6.39 billion in 2025, this region is a powerhouse for mobile, PC, and console games. From Indonesia’s skyrocketing downloads to Thailand’s esports dominance, SEA offers incredible opportunities for developers. How do you see SEA shaping the future of gaming? Let’s talk about it!

Overview

Southeast Asia (SEA) is a region encompassing the continental and island territories between China, India, and Australia. It includes the Indochinese Peninsula and the Malay Archipelago, part of the Asia-Pacific region.

The following 11 countries are included in Southeast Asia: on the continental side are Cambodia, Laos, Myanmar, Thailand, Malaysia, and Vietnam; and on the island side are Brunei, East Timor, Indonesia, Singapore, and the Philippines.

The gaming industry in the part of Southeast Asia that includes Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam is continuing to grow, showing increased playtime, growing interest in cyber sports, and rising player engagement with new technologies, including Web3.

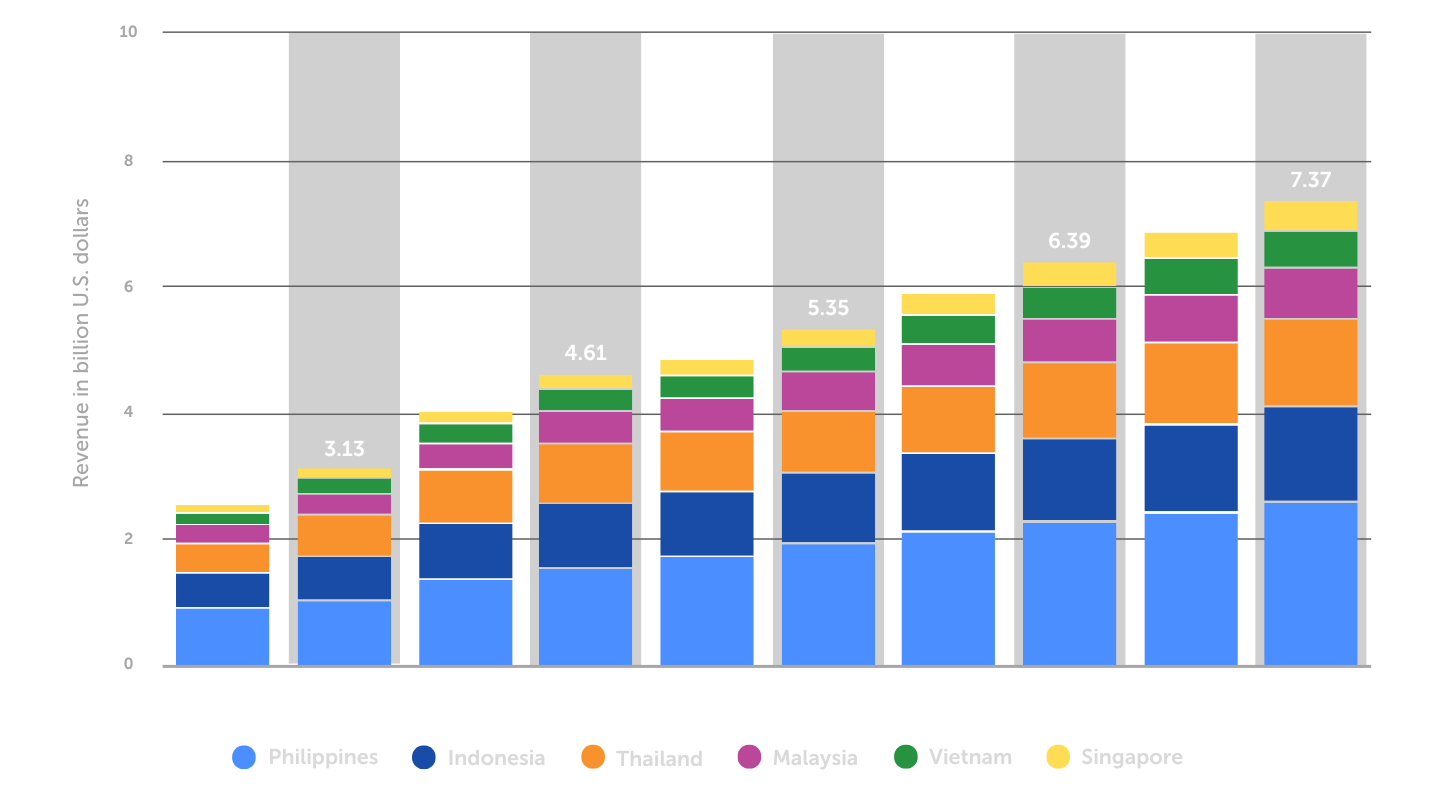

According to Statista, the gaming market in Southeast Asia is growing steadily. In 2024, revenue from this market amounted to USD 5.89 billion. Revenue is projected to grow across all regions in 2025 to USD 6.39 billion and is projected to reach USD 7.37 billion by 2027. Of the selected regions, the Philippines is projected to lead the ranking in terms of revenue in the video games segment of the digital media market, with a revenue of USD 2.27 billion.

Video games market revenue in Southeast Asia from 2018 to 2027, by country

Source: platform.newzoo.com, datareportal.com

Source: platform.newzoo.com, datareportal.comSoutheast Asian Video Game Market Revenue in 2018–2027 by Country (in Billions USD), per Statista (S) and Newzoo (N)

| 2022 | 2023 | 2024 | 2025 prediction | 2026 prediction | 2027 prediction | |

| Total revenue | S-4.85 N-6.14 | S-5.35 N-6.17 | S-5.89 N-6.51 | S-6.39 N-6.89 | S-6.88 | S-7.37 |

| Philippines | S-1.75 N-0.817 | S-1.94 N-0.844 | S-2.12 N-0.894 | S-2.27 N-0.953 | S-2.42 | S-2.6 |

| Indonesia | S-1.02 N-1.85 | S-1.12 N-1.79 | S-1.23 N-1.9 | S-1.34 N-2.03 | S-1.43 | S-1.52 |

| Thailand | S-0.94 N-1.03 | S-1 N-1.07 | S-1.1 N-1.12 | S-1.2 N-1.18 | S-1.29 | S-1.37 |

| Malaysia | S-0.52 N-0.898 | S-0.59 N-0.904 | S-0.65 N-0.948 | S-0.7 N-1 | S-0.76 | S-0.81 |

| Vietnam | S-0.37 N-0.764 | S-0.41 N-0.776 | S-0.46 N-0.817 | S-0.5 N-0.885 | S-0.55 | S-0.59 |

| Singapore | S-0.25 N-0.531 | S-0.29 N-0.551 | S-0.33 N-0.548 | S-0.38 N-0.557 | S-0.43 | S-0.48 |

General Market Characteristics

State of SEA-6 Mobile Gaming Market in 2024 by Sensor Tower

1. Growth in Mobile Game Downloads

- Mobile game downloads in Southeast Asia grew by 3.4% to 4.2 billion in the first half of 2024.

- Indonesia is the leader in downloads, accounting for 41% of all downloads in the region.

- Mobile game downloads in Indonesia increased by 15%, making it the fastest-growing market in SEA.

2. Decrease in Revenue from In-Game Purchases (IAP)

- Total IAP revenue in the region declined by 3.0% to USD 1.16 billion, approaching first-half 2020 levels. 57% of the revenue is attributable to Google Play. At the same time, it is important to take into account that some payments may have gone “into the shadows” due to the growth of integrations of proprietary payment systems.

3. Most Popular Genres

- Simulators are the most downloaded mobile games in SEA. Downloads for these games grew by 11% to 1.2 billion (January–August 2024).

- Sports games showed a 39% increase in revenue, driven by the popularity of eFootball™ 2024 and EA SPORTS FC™ Mobile Soccer.

- RPG and strategy games remain the revenue leaders, contributing 24% and 23% of total revenue, respectively.

4. Southeast Asian Markets: Key Data

- Indonesia is the largest market in terms of downloads.

- The country accounts for more than 41% of mobile game downloads in SEA.

- Between January and August 2024, downloads in the country grew by 10%.

- Thailand is the largest market by revenue.

- Over the same period, mobile gaming revenue in Thailand grew by 10%, exceeding USD 400 million.

5. Leaders by Downloads and Revenue

- Garena Free Fire is the most downloaded game in SEA. Thanks to the Chaos, 2024 Ramadan Campaign, and Mechadrake events, downloads increased by 110% in Indonesia and by 54% in SEA as a whole. The game also ranked first in the global download rankings.

- Mobile Legends: Bang Bang comes second in downloads and first in revenue. Downloads grew by 45%, with 44% of all downloads coming from Indonesia. In Thailand and Vietnam, the game held the lead in revenue, increasing by 6%.

- Honor of Kings has successfully launched (relaunched) in Southeast Asian countries. The game was released in June 2024 and quickly reached the top on Google Play in Indonesia. It’s third place in terms of download growth rate in the region.

- Pizza Ready! saw a 6-fold increase in downloads, putting it in eighth place in SEA.

- Legend of Mushroom (Joy Net Games) brought in USD 11 million in revenue in SEA over 8 months.

Market Overview by SEA Country

| Country | Market size 2023 ($bln) Newzoo | Market size 2024 ($bln) Newzoo | Growth dynamics 2023–2024 (%) | GDP ($mln) |

| Indonesia | 1.79 | 1.9 | +6.14 | 1,371,171 |

| Philippines | 0.844 | 0.894 | +5.92 | 437,146 |

| Thailand | 1.07 | 1.12 | +4.67 | 514,968 |

| Malaysia | 0.904 | 0.948 | +4.86 | 399,705 |

| Vietnam | 0.776 | 0.817 | +5.28 | 429,716 |

| Singapore | 0.551 | 0.548 | -0.55 | 501,427 |

Source: platform.newzoo.com, data.worldbank.org

Population Overview by SEA Country

| Population | Average age | Number of internet users | Number of players (mln) | |

| Indonesia | 284,774,845 | 30.4 | 185.3 | 155 |

| Philippines | 116,384,194 | 26.1 | 86.98 | 67.7 |

| Thailand | 71,640,300 | 40.6 | 63.21 | 41 |

| Malaysia | 35,797,999 | 31 | 33.59 | 25 |

| Vietnam | 101,338,073 | 33.4 | 78.44 | 58.5 |

| Singapore | 5,854,387 | 36.2 | 5.79 | 4.62 |

Source: www.worldometers.info, datareportal.com, platform.newzoo.com

SEA Gaming Market Analysis and Future Forecasts from Mordor Intelligence:

1. Digital Infrastructure Development

- The market is undergoing a transformation as a result of significant investments in digital infrastructure. Operators in the region have invested USD 30 billion to develop 5G networks, which improves support for gaming technology. For instance, the Thai True and DTAC merger created a giant with a capitalization of USD 8.6 billion and 51 million customers.

2. Technological Breakthroughs in Gaming Industry

- Advances in cloud gamification and artificial intelligence (AI) are changing the market. Games are becoming more adaptive and personalized, and cloud-based solutions are making it possible to play even on less powerful devices. However, the overall global adoption of cloud gaming continues to be low.

3. Rise of Social Aspect in Gaming

- More than 80% of Southeast Asia’s urban online population plays online games. Developers are actively implementing social elements, especially in mobile games, which account for 69.4% of total video game revenue in the region.

4. Strategic Partnerships

- Major agreements, such as the USD 6 billion merger between Ooredoo and CK Hutchinson, are improving gaming infrastructure and accelerating the development of new gaming formats.

Key Mordor Intelligence Market Segments

Source: investgame.net

Source: investgame.netMobile gaming (72% of the market in 2024)

- Leading segment due to wide availability of smartphones and increasing internet penetration.

- Cloud gaming platforms make mobile gaming even more attractive.

- Investments in mobile eSports and in-game purchases contribute to revenue growth.

PC gaming

- Steady growth due to cloud gamification and improved gaming hardware.

- Popular among hardcore gamers because of high graphics quality and customization capabilities.

- Cybercafés and game centers remain important social hubs for gamers.

Console games

- A small but important niche focused on exclusive game titles and VR experiences.

- Attractive to high-income gamers.

Market Geography by Mordor Intelligence

Indonesia (35% of the market in 2024)

- The largest market because of the young audience and widespread use of smartphones.

- Active development of cyber sports and state support through the Baparekraf Game Prime program.

Singapore (20% growth per year from 2024 to 2029)

- Major technology center and regional base for Ubisoft, Riot Games, and Bandai Namco.

- Focus on innovation, cloud technology, and 5G.

Thailand

- Government support for gamification (DEPA).

- Cyber sports are recognized as an official sport, which has led to increased investment.

Malaysia

- High smartphone penetration rate.

- Developed ecosystem of cyber sports and local game studios.

Other countries (Vietnam, Philippines, Cambodia, and Brunei)

- Rapidly growing markets due to increasing internet penetration and growth in mobile gaming.

- Active development of local gaming communities and cyber sports.

Trends

- Content localization and adaptation to regional preferences.

- Mergers and acquisitions to increase market share.

- Development of cloud gaming and mobile esports.

Player Portraits

1. Playtime has increased.

- In 2024, there was a 53.2% year-on-year increase in time spent gaming in SEA-6 countries (the six SEA countries with the largest gaming markets). This follows a significant decline in 2023 that was associated with the end of the COVID-19 pandemic. Thailand and Vietnam show the highest growth.

2. Cyber sports are an important market segment in SEA.

- More than half of gamers in SEA-6 are involved in cyber sports, underscoring its importance to the development of the region’s gaming market. The majority of the most popular games on mobile devices and PCs in SEA-6 are oriented toward cyber sports.

3. The female audience plays an important role in game purchases.

- Female gamers are a significant demographic in Southeast Asia. The percentage of women making game-related purchases is 30%, which is higher than men at 22%.

4. Payment methods.

- Digital wallets are the main way gamers pay in SEA-6. They’re used by over 75% of gamers in the region.

5. Age affects the choice of payment methods.

- Gamers over 25 are more likely to use credit and debit cards (50% of respondents).

- Young people under 21 prefer to pay with cash.

6. Interest in Play-to-Earn and crypto games.

- Games with the Play-to-Earn model continue to capture the attention of gamers in Southeast Asia. This mechanic is one of the top 3 technologies generating the most interest among gamers in every SEA-6 country except Singapore. It’s particularly popular in Malaysia, the Philippines, and Thailand.

- Web3-based gaming also continues to grow, especially in Vietnam, Thailand, and the Philippines. Although growth in this industry has slowed, the region continues to invest in this sector.

7. Other important trends.

- Game localization: Gamers in Indonesia, Thailand, and Vietnam prefer to play games translated into their language (over 50% of respondents). In Malaysia, Singapore, and the Philippines, the figure is lower due to high levels of English proficiency.

- Importance of representation and accessibility: Players in all countries place high importance on the issues of inclusivity, accessibility, and anti-harassment, as well as the availability of well-developed female characters.

- The rise in popularity of locally developed games: Local game projects are becoming increasingly popular, both in the region and beyond. Successful games include:

– Coral Island (Indonesia)

– GigaBash (Malaysia)

– Cat Quest (Singapore)

– Home Sweet Home: Online (Thailand)

Game Localization Into Southeast Asian Languages

The languages of mainland Southeast Asia belong to four different groups: Tibeto-Burman, Kra-Dai (Thai-Kadai) Mon-Khmer, and Hmong-Mien (Miao-Yao) languages. Almost all of them are tonal, i.e., the meaning of a word is influenced by the pitch of the sounds.

| Country | Official language | EF EPI | Language proficiency |

| Singapore | English, Malay, Mandarin (Simplified Chinese), Tamil | 609 | Very high |

| Philippines | Filipino, English | 570 | High |

| Malaysia | Malay | 566 | High |

| Vietnam | Vietnamese | 498 | Low |

| Indonesia | Bahasa Indonesia | 468 | Low |

| Myanmar | Burmese | 449 | Very low |

| Cambodia | Khmer | 408 | Very low |

| Thailand | Thai | 415 | Very low |

Source: www.ef.com

It’s worth noting that Southeast Asia is a multinational region. There are over 100 different nationalities living in the area, with people speaking over 1,000 languages, including over 800 in Indonesia alone.