South-East Asia is a region that comprises 11 island-based and continental countries: Indonesia, Malaysia, Vietnam, Thailand, Myanmar, Cambodia, Laos, the Philippines, Singapore, East Timor, and Brunei. In recent years, the gaming market in South-East Asia has been one of the fastest-growing in the world, and the mobile gaming market comes in first place in terms of the growth rate. According to research, in the coming years the gaming industry here is also expected to grow by 8.5% per year on average.

Overview by country in the region

| State | Market size (USD millions) |

Growth rate from 2019 to 2020 (%) |

Compound annual growth rate (CAGR) from 2017 to 2020 (%) |

CPI (Android/ iOS) (USD) |

ARPU (USD) |

|---|---|---|---|---|---|

| Indonesia | 1,68 | 31.1 | 20.9 | 0.57/1.17 | 23.58 |

| The Philippines | 572 | 22.4 | 17.8 | 0.87/1.14 | 28.54 |

| Vietnam | 472 | 35.3 | 27 | 0.61/1.07 | 21.37 |

| Thailand | 667 | 25 | 19.8 | 0.84/1.08 | 36.84 |

| Singapore | 327 | 21 | 11.4 | 2.07/3.00 | 73.04 |

| Malaysia | 876 | 22.2 | 14.2 | 0.72/1.43 | 27.69 |

| Cambodia* | 27 | 33.2 | 31 | 0.87/1.05 | 8.71 |

| Laos* | 18 | 39 | 37 | 0.62/0.81 | 15.39 |

| Myanmar* | 79 | 52.4 | 41.3 | 0.9/0.9 | 5.98 |

| East Timor* | 0.75 | 19.7 | 26 | -/- | 6.85 |

| Brunei* | 7.5 | 13.2 | 7.7 | 0.48/0.74 | 65.73 |

The data for the countries with an asterisk is based only on information from Statista.com.

Facts about the games industry in South-East Asia

- The overall market size of the region amounted to USD 4.4 billion in 2019. Of this sum, mobile games account for more than 70% (USD 3.1 billion), thanks to the availability of mobile internet and the widespread use of smartphones (Newzoo).

- The most popular distribution model for mobile games is free-to-play.

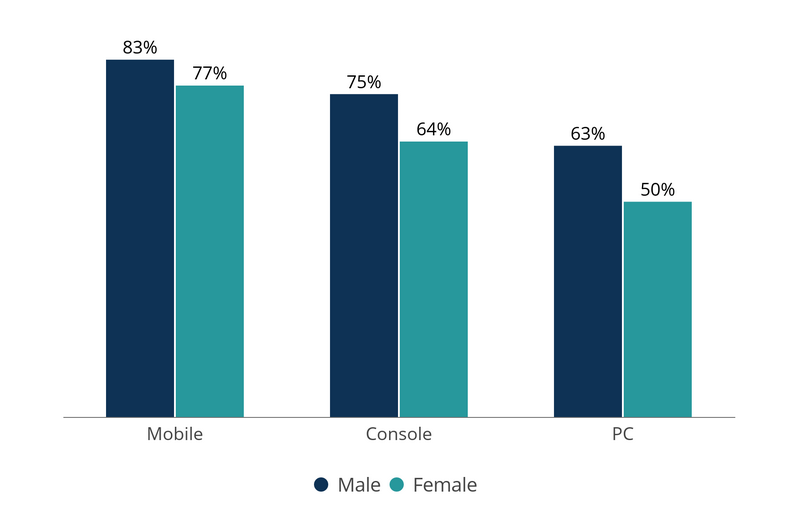

- Mobile games have attracted the largest percentage of the female urban online population (77%).

The percentages of players from the total urban population for various platforms (Newzoo)

- Strategy games are the most popular genre in the region. Approximately one third of players on each of the platforms play strategy games (mobile, 36%; console, 32%; PC, 29%).

- More than half of players spend money on games, and of those 95% have made in-game purchases in the last six months (the percentages for men and women are roughly equal).

- The audience of gaming-related video content stood at 30 million people in 2019, with PUBG Mobile leading the pack in this regard with a 40% reach.

- Sea group (Garena) and I Got Games (IGG), both from Singapore, and VNG, which is from Vietnam, are the main local publishers in the region.

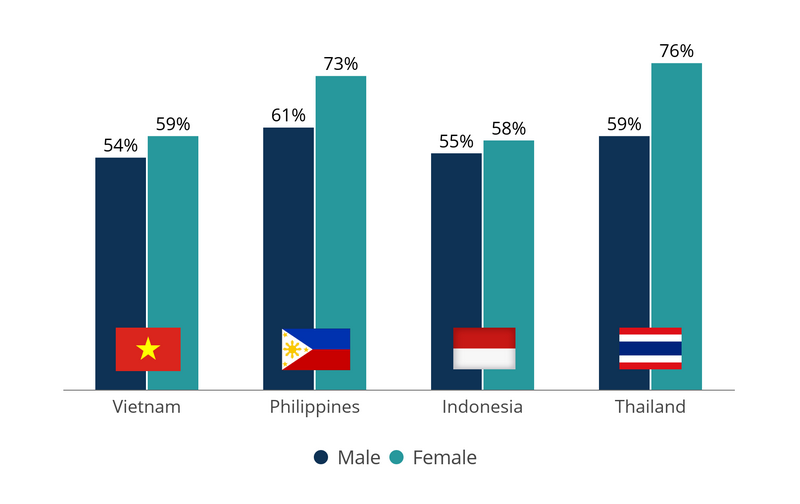

The percentages of players from the total urban population for various countries in the region (Decision Lab)

- Communication is the main driver for gaming in the region. The most successful games are based on social interaction or team-based gameplay. More than 60% of the audience prefers to play with friends.

- Historically, the smartphone market has been led by Android. However, when it comes to tablets, the situation is quite the opposite: in all countries in the region except for Indonesia, the advantage lies with Apple when it comes to tablets (in Indonesia, Samsung leads).

- In South-East Asia, a large proportion of the online population that plays mobile games does so due to the widespread availability of games with simple mechanics: casual games, puzzles, or arcade games. In the Philippines and Thailand, the figure stands at 67%, while in Vietnam and Indonesia, it is 56%.

- It is interesting that in these countries, mobile games are more widespread among women.

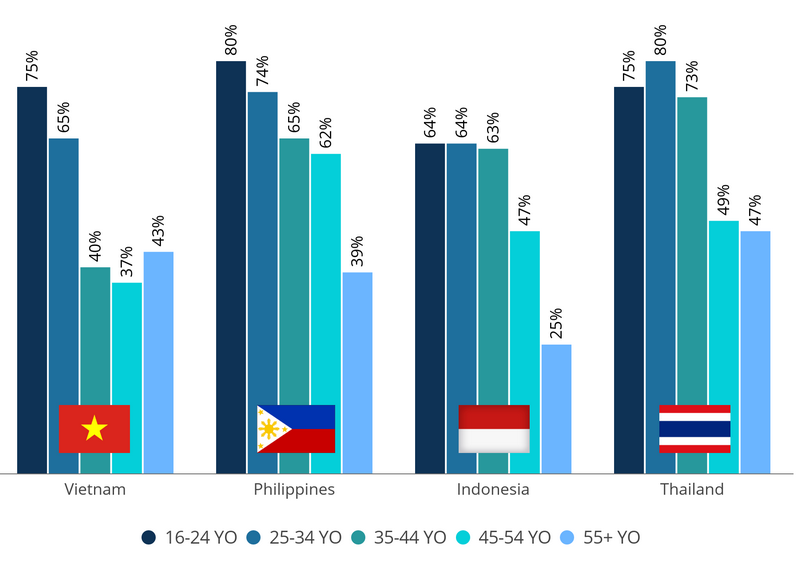

- Historically, the younger generation, between 16 and 24 years of age, have been the more active players, although in the 25–34 and 35–44 age groups, we also see a high rate of engagement.

(Source: Decision Lab)

Localization on the markets

Market Trends

- The number of mobile gamers in the region will increase to 250 million in 2021, while the total number of gamers will rise to 400 million. In the five years from 2015 to 2020, the prevalence of smartphones in South-East Asia on average rose from 33% to 70% (Statista), which provided a substantial impetus to the gaming industry.

However, the prevalence of smartphones, as with the internet, among the population is only higher than 80% in three countries: Singapore, Brunei, and Malaysia. Furthermore, the average internet speed in the region is 11.4 Mbit/s.

The COVID-19 pandemic revealed issues related to internet access in a number of regions. The problem affected school pupils and students, since many of them were unable to participate in online classes with their school or university. Due to the proliferation of the internet and smartphones, the gaming industry in the region will continue to grow at a high rate.

It is thus worth paying particular attention to mobile games. Sales of PCs in South-East Asia have been at roughly the same level for a number of years, while smartphone sales are growing year on year (Statista). - The launch and development of 5G networks, which has already begun in countries such as Singapore, Indonesia, and Malaysia, will increase the possibilities offered by the internet and should become a driver for the growth of cloud technologies.

- Free-to-play games are a driver for the development of mobile gaming in the region, and with the arrival of cloud technologies, it is expected that the growth rate will only increase (Research and Markets).

- The region is currently experiencing a boom in e-sports, which also affects e-sports-related video content. The latter is becoming very popular. Asia’s Olympic council has even added e-sports to its list of disciplines for the 2022 Asian Games.

In addition to international championships, players also take part in smaller-scale ones, such as regional competitions, and even school- and university-based ones, as well as in open leagues. Moreover, the Youth Esports Program (YEP) has been launched in the Philippines, which aims to increase the popularity of e-sports and integrate them into school sports programs.

All of this has an unquestionably positive effect on the population’s engagement in the video games industry. - Many governments in the region are offering support to the video games industry and are creating conditions to facilitate its growth. This policy is helping to attract new talent to the industry and aid its development.

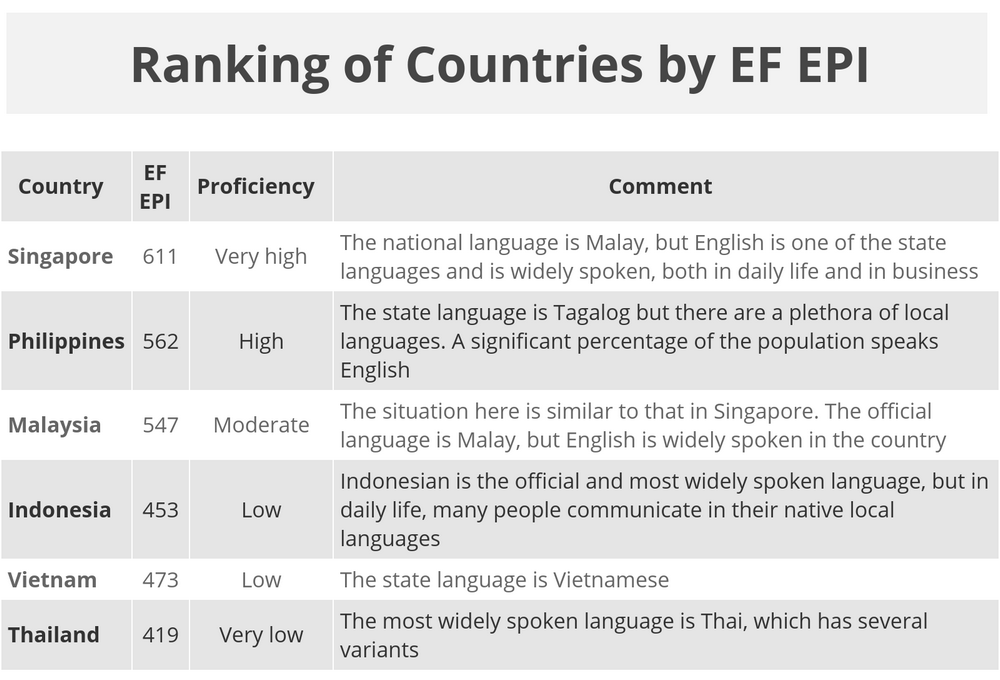

- Although English is widely and fluently spoken in some countries of South-East Asia, it is worth considering localization for each country individually, since the level of proficiency in English varies from region to region.