General Information

Russia, or the Russian Federation, is a country in Eastern Europe and Northern Asia. Russia is the largest country in the world by area, with a territory of 17,098,246 square kilometers within internationally recognized borders.

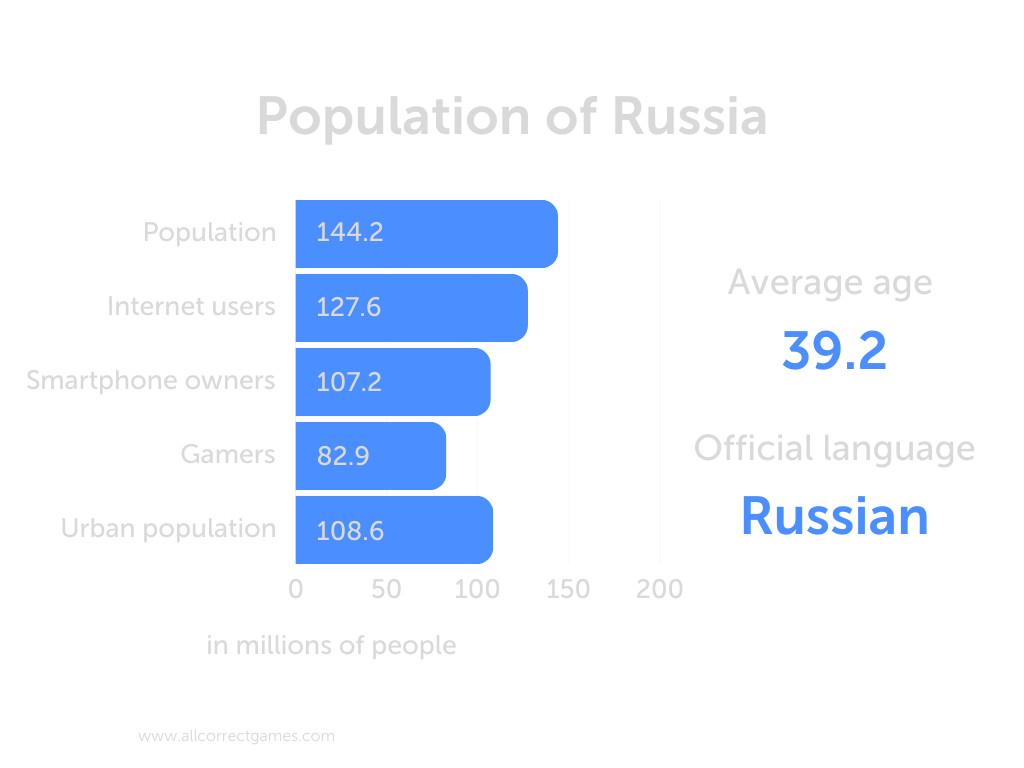

The capital is Moscow. The official language throughout the country is Russian, with several regions in Russia having their own official languages. The currency is the Russian ruble.

Russia is a multi-ethnic country with a significant degree of ethnic and cultural diversity. According to the 2010 population census of Russia, which includes territories with unrecognized status, such as Crimea and Sevastopol, the country is home to people from over 190 nationalities. Russians make up over 80% of the population, and over 99.4% of Russians speak Russian. The majority of the population (about 75%) identifies as Orthodox Christian, making Russia home to the largest Orthodox Christian population in the world.

Russia is a federal presidential republic. Vladimir Putin has held the position of president of Russia since December 31, 1999, except for the period between 2008 and 2012, when Dmitry Medvedev was president.

Russia is a nuclear state and one of the leading spacefaring nations in the world. It is a permanent member of the United Nations Security Council with veto power and one of the modern great powers. Russia is also a member of several international organizations, including the UN, G20, Eurasian Economic Union (EAEU), Commonwealth of Independent States (CIS), Collective Security Treaty Organization (CSTO), World Trade Organization (WTO), Organization for Security and Cooperation in Europe (OSCE), Shanghai Cooperation Organization (SCO), Asia-Pacific Economic Cooperation (APEC), BRICS, International Olympic Committee (IOC), and others.

After the dissolution of the Soviet Union at the end of 1991, Russia was recognized by the international community as the successor state to the USSR.

The nominal GDP for the year 2021 was approximately 1.8 trillion US dollars, making Russia the 11th largest economy in the world (6th in terms of purchasing power parity).

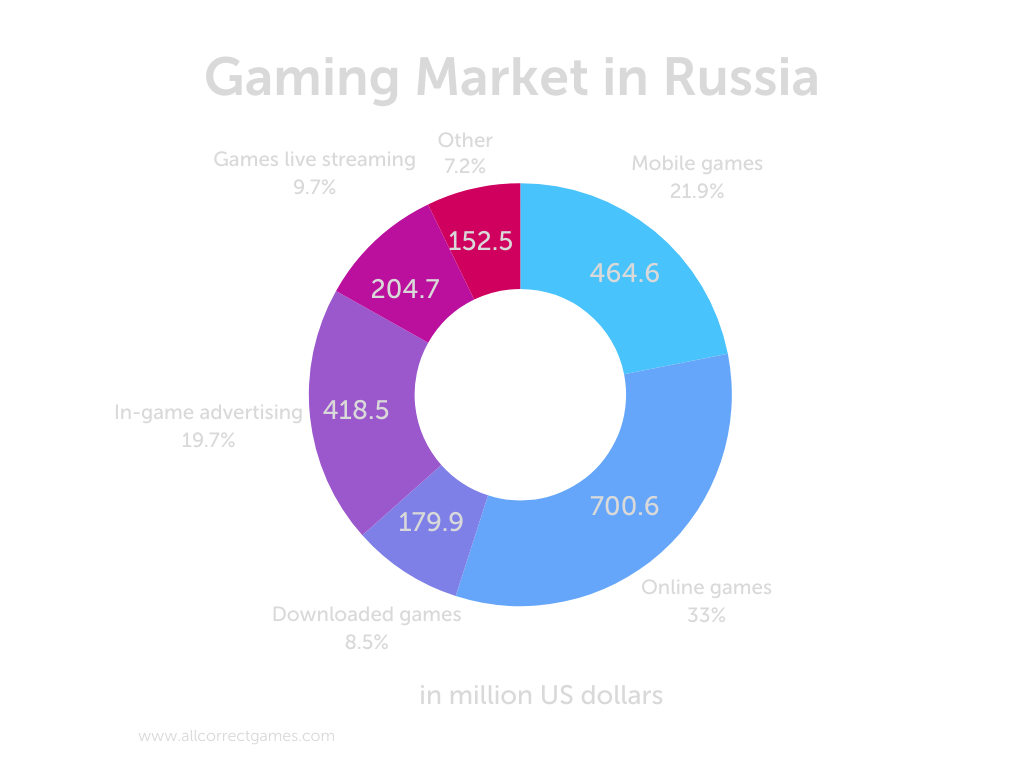

Gaming Market

In recent years, the state of the gaming market in Russia has been significantly impacted by the military conflict with Ukraine. According to data from the Russian Association for Electronic Communications (RAEC), the Russian online gaming market saw an 80% decline in 2022 compared to the previous year. The main reasons for this decline were the departure of major gaming companies from the Russian market, the relocation of Russian studios, and the inability to carry out financial transactions.

Maria Saikina, an analyst at RAEC, pointed out that certain characteristics of the Russian gaming market also contributed to the decline. Prior to March 2022, up to 90% of gaming content providers in Russia were foreign companies, and Russian developers depended on foreign specialized software and international gaming platforms.

It’s important to note that a significant portion of the Russian market has gone underground. It is difficult to accurately assess the volume of parallel imports.

Despite the challenges stemming from the global situation, the gaming industry in Russia continues to develop in 2023, and some indicators show growth in the Russian gaming industry. For instance, analysts from YooKassa and the Russian Esports Federation (RESF) calculate that the total turnover of Russian gaming platforms for the period between January 2023 to July 2023 has more than doubled that of the same period in 2022. As of February 2022, approximately 90% of the Russian video game market was dominated by major foreign players, including Steam, Xbox, and others, but due to disconnections from various external systems, the Russian gaming market has received a boost in development.

However, Russian users have not completely left international platforms. They use Turkish and Kazakh accounts for purchasing games on Steam, use Turkish and Polish accounts for the PS Store, and have a long-standing preference for Argentina for Xbox purchases. Despite payment and account establishment issues, the majority of game purchases are still made through other countries. Some companies, like Qiwi, Tinkoff, and others, allow users to buy games on Steam either through their services or within their own platforms.

The departure of major international gaming studios from Russia, including Electronic Arts, Microsoft, Rockstar Games, and Activision, led to restricted access to content for Russian gamers and has resulted in many gamers actively turning to pirated versions of games. In 2022, two-thirds (69%) of Russian users played at least one pirated game, and 51% of players pirated more frequently compared to 2021.

Efforts are being made in Russia to create its own gaming platforms. VK is working on VK Play, and Lesta Games recently announced the launch of the B.A.S.E. platform. Several major companies are competing for leadership in the Android store market, including RuStore (VK), NashStore (Digital Platforms), and AppBazar (MTS). However, the results so far have been mixed.

Another factor that could lead to gaming industry growth is state support. In mid-August 2023, Russian President Vladimir Putin instructed authorities to promote Russian video games in foreign markets, including BRICS countries (Russia, Brazil, India, China, and South Africa). The government, in collaboration with the Agency for Strategic Initiatives (ASI), intends to take measures to include Russian computer games created using Russian software in the unified register of Russian programs for electronic computing machines and databases.

Many leading Russian companies, whose primary focus was the Western market, were forced to exit Russia, with many relocating to Armenia, Serbia, Georgia, Cyprus, and Uzbekistan. The peak of this migration occurred in 2022, but many companies continue to relocate in 2023. Various services are being developed to help developers in Russia enter international markets.

Player Profile

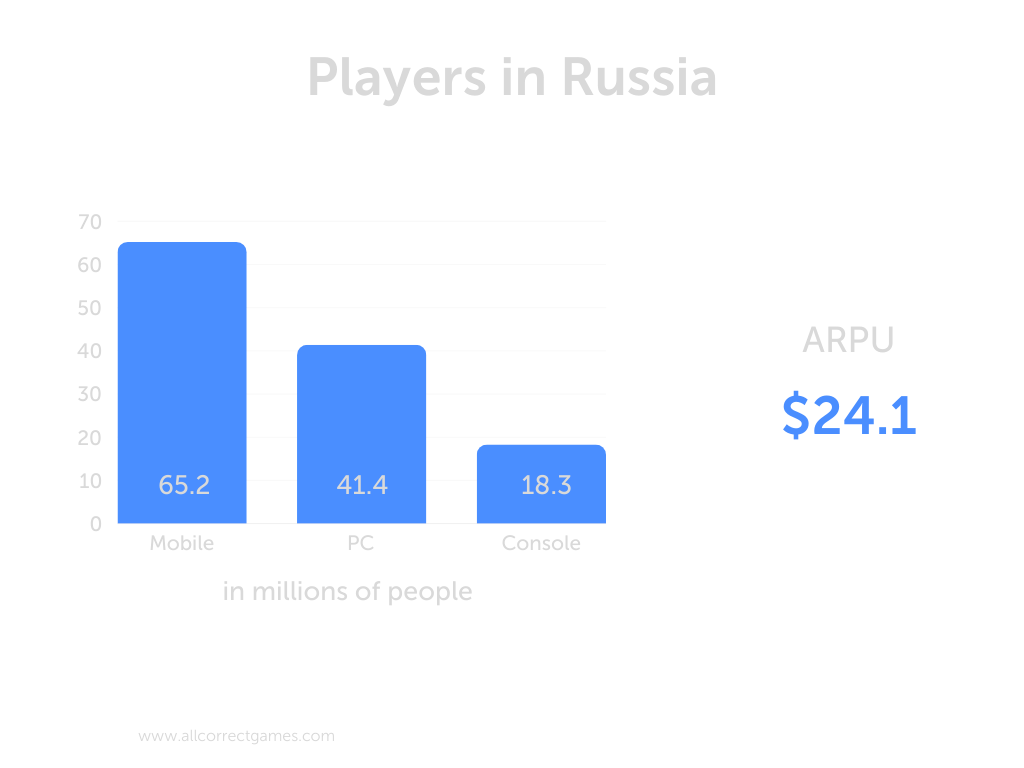

According to a joint study by media holding Rambler&Co, SberMarketing, and Chek Index, Russians played computer games 20% more often in 2023. Their research found that the majority of Russians (60%) enjoy playing games on PCs. Mobile games are preferred by 19% of respondents, PlayStation by 16%, Nintendo by 2%, and Xbox by 2%. Others (1%) use cloud gaming services. 23% of users reported that they watch streams and esports tournaments during breaks between games.

In the second quarter of 2023, demand for gaming computers also increased. Sales rose by 10%, with the average check decreasing by 3% to 74,230 rubles.

In 2023, the most beloved genre among gamers was RPGs. Strategy games came in second place, and shooters in third place.

SberMarketing analysts noted that RPGs are played 67% more on consoles than on smartphones and 36% more than on PCs.

According to a survey of 1200 Russian gamers by XYZ School, gamers in the region spent 135 billion rubles on video games since the beginning of 2023, and it is believed that the market volume could reach 167 billion rubles by the end of the year. The research estimated that approximately 107 billion rubles, or 79% of all funds, went through official channels, while the remaining 21% (28 billion rubles) went through intermediary resellers. Users spent this money on offline game purchases (discs) and online purchases (e.g., through Turkish Steam accounts), as well as on platforms like KupiKod, where activation keys for various games and in-game goods are sold.

The Russian Association of Video Game Distributors and Importers (an association of suppliers and sellers, accounting for about 60% of the market) reported in mid-October 2023 that sales of legal video games on discs continue to decline in Russia.

However, only recently, the M.Video-Eldorado group informed Kommersant that console sales in Russia had more than doubled in 2023. In 2022, the entire market volume was 8 billion rubles, while the volume in 2023 stands at 18 billion rubles. However, it’s worth considering inflation and currency fluctuations.

According to the research, each player spent an average of 5,400 rubles on games between January and August. Considering that there are approximately 25 million gamers in Russia today (XYZ School’s estimate), the total expenses amounted to around 135 billion rubles.

Gaming Companies That Left Russia or Imposed Sanctions:

1. Activision Blizzard

2. Amazon Games

3. Bethesda Softworks

4. Behaviour Interactive

5. Bungie

6. Capcom

7. CD PROJEKT RED

8. Electronic Arts

9. Epic Games

10. ESL

11. GSC Game World

12. Humble Bundle

13. Koei Tecmo

14. Microsoft

15. Nintendo

16. Nvidia

17. Plarium

18. Rockstar Games

19. Sad Cat Studios

20. Sony

21. Supercell

22. Square Enix

23. Take-Two Interactive

24. Ubisoft

25. Rovio

26. CI Games

27. Niantic

28. Bloober Team

29. Thing Trunk

30. Koch Media

Top Gaming Apps (AppMagic, 2023):

1. Royal Match

2. PUBG MOBILE

3. Gardenscapes

4. Roblox

5. Homescapes

6. Tanks Blitz PVP битвы

7. Genshin Impact

8. Hero Wars: Alliance

9. Fishdom

10. Standoff 2

11. Rise of Kingdoms

12. Rush Royale: Tower Defense TD

13. Mobile Legends: Bang Bang

14. Call of Duty®: Mobile

15. Viking Rise

16. Toca Life World: Build a Story

17. Lords Mobile: Kingdom Wars

18. Township

19. The Ants: Underground Kingdom

20. Age of Origins:Tower Defense

Culturalization for Russia