Nigeria’s gaming market is leveling up fast. Nigeria is now one of Africa’s fastest-growing gaming markets. Local studios are creating culturally rich content, while esports and mobile gaming are booming. By 2025, revenue is expected to hit USD 2.59 billion—and this is just the beginning. Curious what’s driving this momentum? Dive into the full story!

General Information

| Official name | Federal Republic of Nigeria | |

| Capital | Abuja | |

| Population | 237,527,782 | |

| Total area | 923,769 km² | |

| Average age | 18.1 | |

| GDP | USD 362.81 billion | |

| GDP per capita | USD 2,416.36 | |

| Official language | English, Hausa, Yoruba, Igbo |

Nigeria covers an area of 923,769 km², making it the 14th largest country in Africa and the 31st largest in the world. It has the largest population of any African country. According to 2020 data, the population was 210 million, making it the sixth largest in the world.

The official language is English. There are over 500 languages spoken in the country, and a significant part of the population speaks two or more languages.

Nigeria is characterized by its high level of ethnic and cultural diversity. Approximately equal parts of the population are Muslim and Christian, and the country ranks first in Africa in terms of the Muslim population.

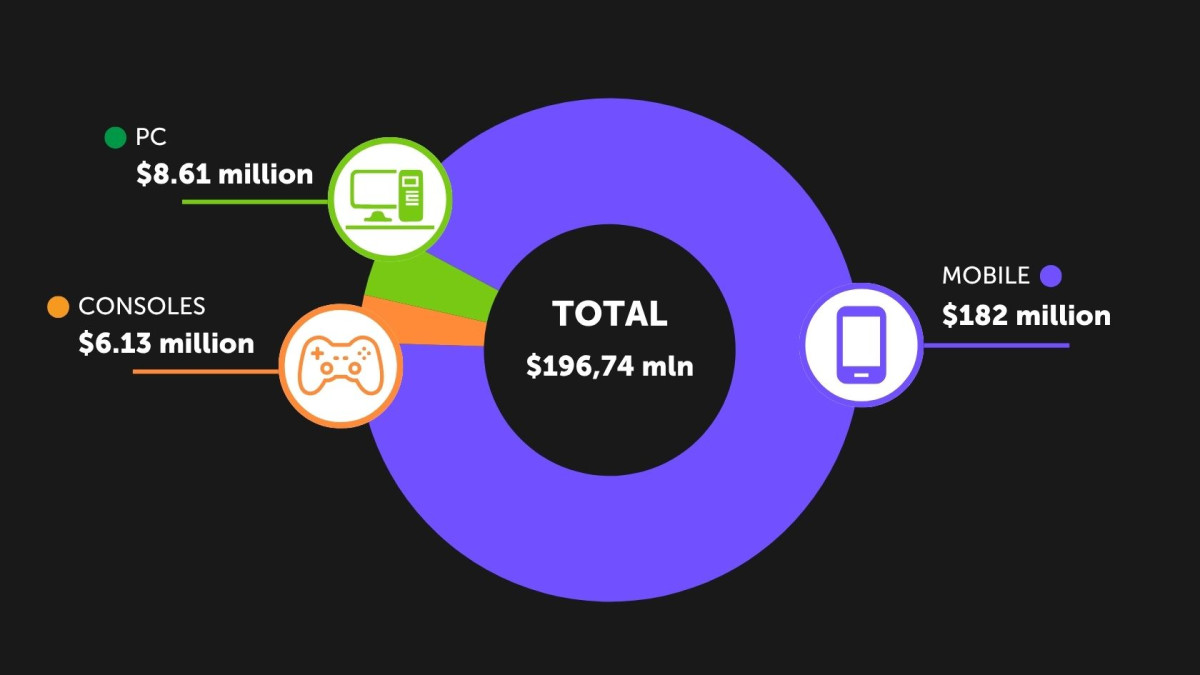

The Gaming Market

Nigeria Mobile Games Revenue (2019-2024)

Source: africagamesreport.com

Source: africagamesreport.comNigeria is one of Africa’s fastest-growing gaming markets, with revenue reaching USD 249 million in 2021, driven mainly by mobile games. Urban growth and smartphone penetration are helping to fuel the growth of casual and social games. Despite numerous challenges, like inconsistent internet speeds, the market is showing resilience as developers experiment with local content to attract Nigeria’s active audience. As infrastructure improves, Nigeria is poised to become a key player in Africa’s gaming industry, offering opportunities for both developers and investors.

According to forecasts by the Nigerian newspaper This Day, the video game market in Nigeria will reach USD 1.3 billion by 2028, demonstrating an average annual growth of 12.7% from 2024 to 2028. The main driver of this growth is mobile gaming, which will account for more than USD 1 billion by 2028.

Esports is also a growing segment in the country, with an expected annual growth rate of 25.2%, which will turn this market into a USD 20 million industry, per This Day.

In Nigeria, successful local studios like Maliyo Games and Kucheza Gaming are emerging, creating culturally significant content and striving to compete on a global level.

The Wild Kingdoms, Itan Orisha is a Nigerian mobile game released by Kucheza in 2022. It’s based in Yoruba culture and tells the story of King Alantako, who is warned about impending chaos by a mysterious voice in a dream. The game is an excellent example of how Nigerian developers playfully integrate local myths and culture. Maliyo Games, a studio founded by Hugo Obi in Lagos, has grown from 3 to 36 employees in 5 years and created an online training program to foster developers in 5 African countries. Their game Disney Iwájú: Rising Chef, developed in partnership with Disney Games, is inspired by the Iwájú series. The player controls a novice chef in Lagos, cooking traditional dishes such as jollof rice and puff-puff doughnuts, striving to become the best chef.

There is also a growing interest in console and PC games in Nigeria. PlayStation and Xbox are expanding their presence, forming a community of console gamers, while local developers are beginning to explore the PC platform.

Gaming Events in Nigeria

Lagos Games Week is one of Nigeria’s premier gaming events, celebrating the country’s growing gaming culture.

Featuring gaming tournaments, panel discussions, and presentations by local developers, it has become a central meeting place for gaming enthusiasts and developers alike.

The event focuses on community building by showcasing Nigerian games and esports, as well as connecting local talent with regional and global players in the industry.

The state of Lagos in Nigeria has set ambitious goals to capture 30% of the African gaming market, backed by investments in infrastructure and events such as the Africa Gaming Expo.

Forecasts by Research and Markets:

- Key monetization model: free-to-play with in-game purchases. In addition, the gaming industry brings millions of dollars in revenue annually across all video game platforms: mobile, PC, Xbox, and PlayStation. As a result, Nigeria is expected to make a significant contribution to the gaming market across the entire African continent.

- It is also predicted that the video game market in Nigeria will show significant growth during the forecast period due to increased internet usage via mobile devices.

- Major international players are investing heavily in the region, leading to growth in the mobile segment of the industry.

- For example, in May 2024, the Nigerian federal government announced plans to reinstate telecommunications taxes and introduce additional fiscal measures to secure a USD 750 million loan from the World Bank. This decision came almost 10 months after the abolition of a 5% excise tax on telecommunications services and import duties on certain categories of vehicles.

- The trend toward growth in Nigeria’s gaming market is also supported by the increasing penetration of mobile communications. According to Hootsuite, mobile penetration reached 51% in 2024, driven by expanded marketing by operators and technological advances in payment platforms.

- The gaming industry in Nigeria remains fragmented, with many small players. However, with changing user behavior and increasing spending, the industry is expected to consolidate in the coming years.

- According to the OECD, between 2024 and 2029, Nigeria is expected to see steady growth in mobile broadband connections, with 8.9 connections per 100 residents, representing an increase of 19.16%. After 8 years of continuous growth, mobile broadband penetration will reach 55.3 connections per 100 people by 2029, setting a new record. The vast majority of connections are GSM mobile connections. The increase in the number of active internet subscriptions will contribute to overall market growth during the forecast period.

Forecasts by Statista:

- Video game market revenue in Nigeria is projected to reach USD 2.59 billion by 2025.

- This revenue is expected to demonstrate a compound annual growth rate (CAGR) of 8.61% between 2025 and 2029, resulting in a projected market size of USD 3.60 billion by 2029.

- In a global comparison, the United States will generate the highest revenue, expected to reach USD 141.84 billion in 2025.

- The Nigerian video game market is expected to reach 140.9 million users by 2029.

- The penetration rate among users in Nigeria will be at 49.8% in 2025, with an expected growth to 54.8% by 2029.

- The average revenue per user (ARPU) in Nigeria is expected to reach USD 383.15.

- The video game market in Nigeria is experiencing a surge in popularity of mobile games, driven by increased internet accessibility and a young audience eager for interactive forms of entertainment.

Market Development Dynamics

Source: platform.newzoo.com

Source: platform.newzoo.comGaming Market Size

Source: platform.newzoo.com

Source: platform.newzoo.comPopulation

Source: datareportal.com, platform.newzoo.com

Source: datareportal.com, platform.newzoo.comNumber of Gamers

Source: platform.newzoo.com

Source: platform.newzoo.comPlayer Spending

Source: platform.newzoo.com

Source: platform.newzoo.comPlayer Profile

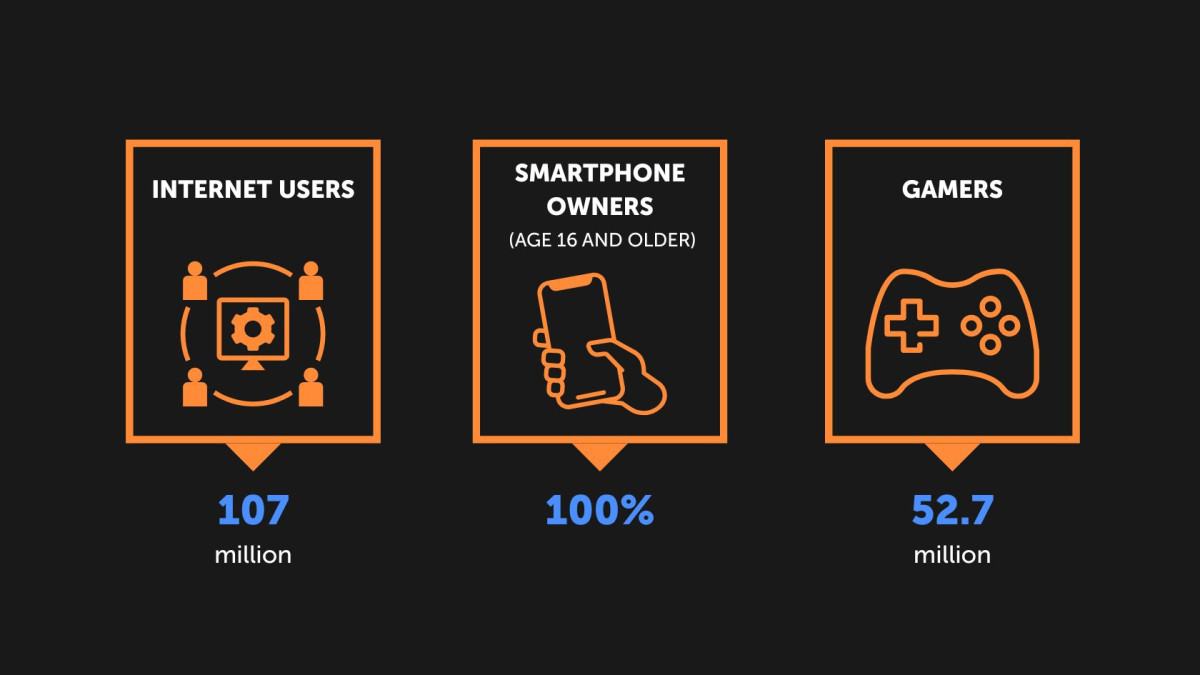

The increasing number of young middle-class people in Nigeria is driving the rapid growth of mobile gaming, which is also boosted by increased internet access and more connected devices. There are an estimated 150 million active mobile subscribers in the country. 40% of mobile phone owners have internet access, and by the end of 2025, the number of smartphone owners is expected to reach 143 million.

Young Nigerians under the age of 30 have changed the demographic profile of esports compared to the overall gaming market. The typical player is male, age 18 to 34.

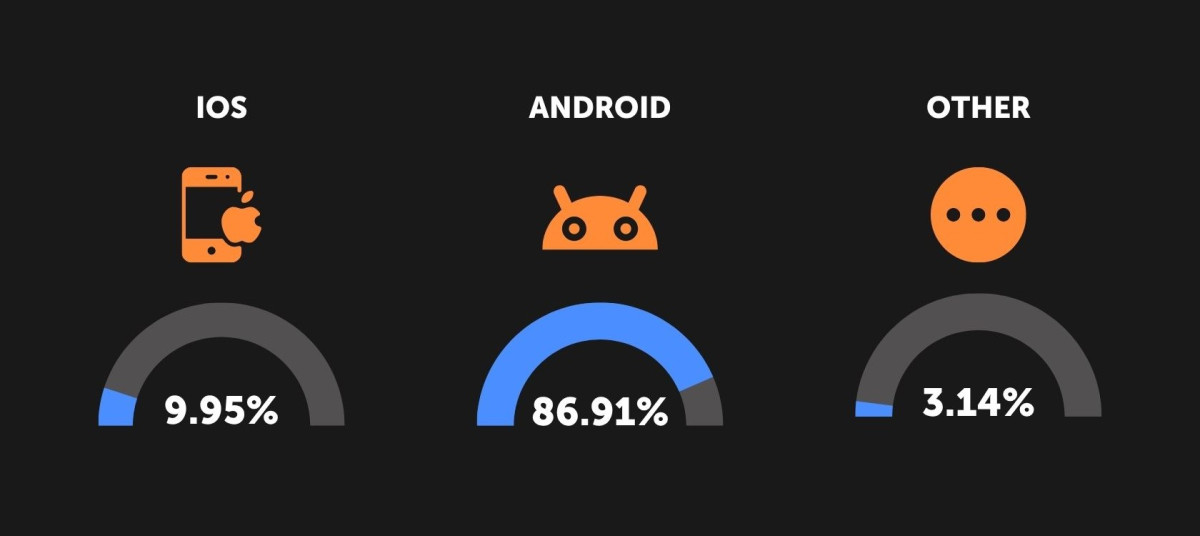

Mobile sports betting is big business in Nigeria: 87% of players use mobile devices to access the internet and bet on sporting events.

General Player Statistics

Gender Distribution

Source: novatiaconsulting.com

Source: novatiaconsulting.comOS Distribution

Source: gs.statcounter.com

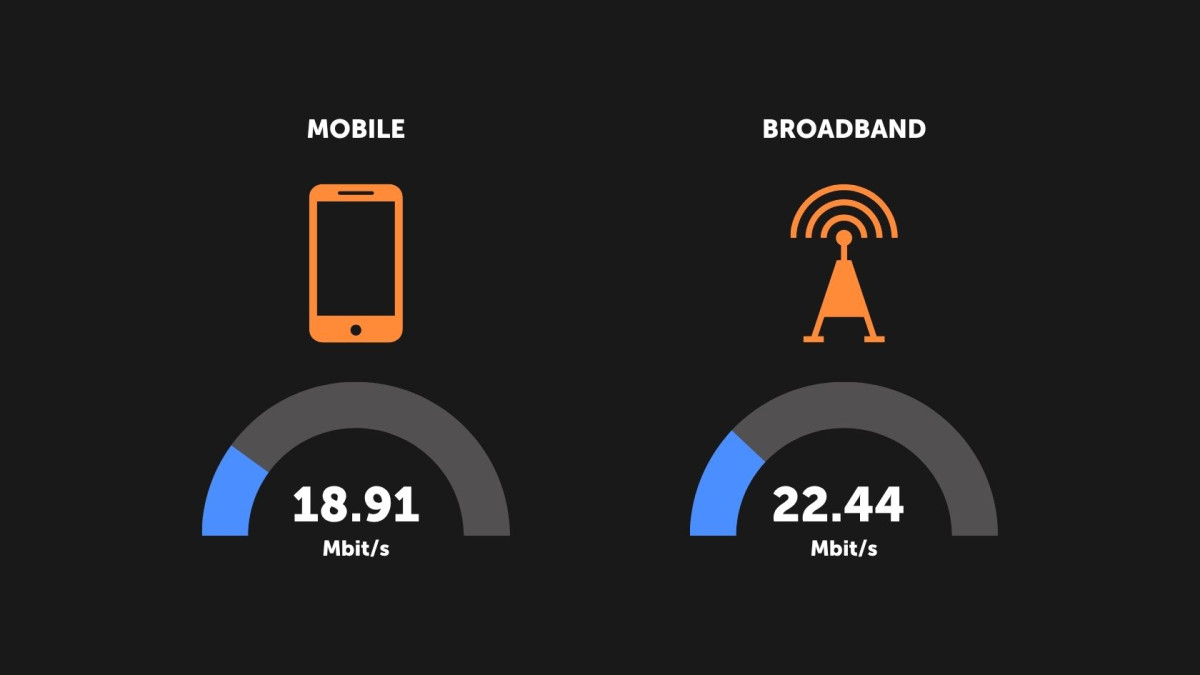

Source: gs.statcounter.com Average annual traffic + average internet speed

Source: datareportal.com

Source: datareportal.com Popular Social Media

Source: datareportal.com

Source: datareportal.com Game Studios in Nigeria

- Betsaleel Studio

- Deluxe Creation Studios

- Dimension11

- Maliyo Games

- Orange VFX Studios

- Quiva Games

- AnyhowAnyhow Games

- Gbrossoft

- Goondu Interactive

- Immersia VR Studios

- Kucheza

- Mirince Studio

- Pirate Games

- Raven Illusion Studio

- Revival Game Studios

- Side Effect Studio

- Studiologix

- Wolfia Studio

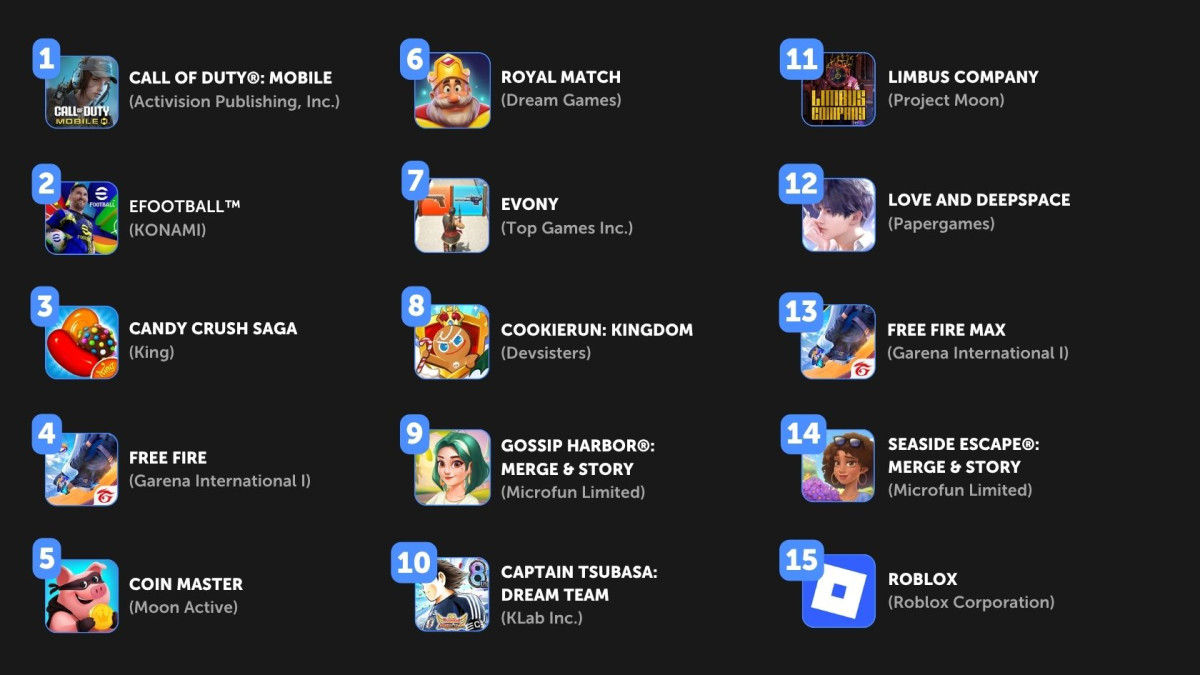

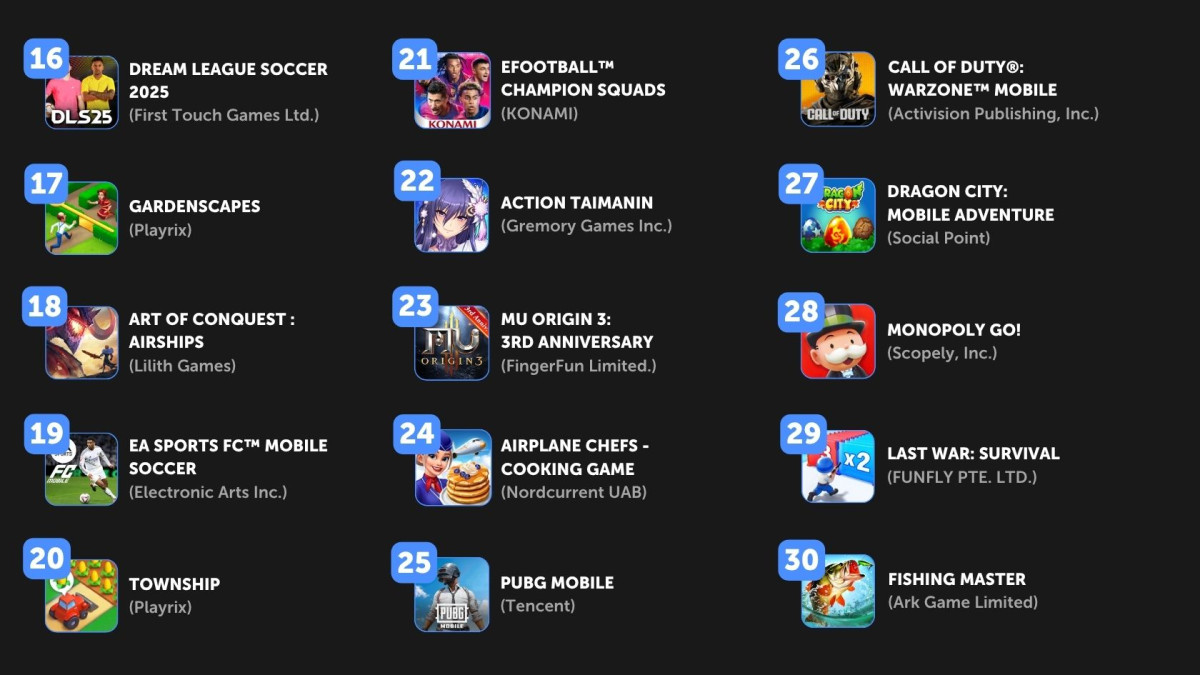

Top Mobile Games by Revenue in 2025

Source: appmagic.rocks

Source: appmagic.rocks