2024 was one of the most turbulent years for the gaming industry, marked by record layoffs, funding cuts, and companies vying ever fiercely for players’ attention. We’ve broken down the key trends that shaped the year.

Sometimes the going gets really tough—and 2024 showed that firsthand. From the vantage point of early 2025, it’s clear that 2024 was the year when risks materialized. The result was record layoffs, teams disbanding, and a sharp drop in investor interest.

General Statistics

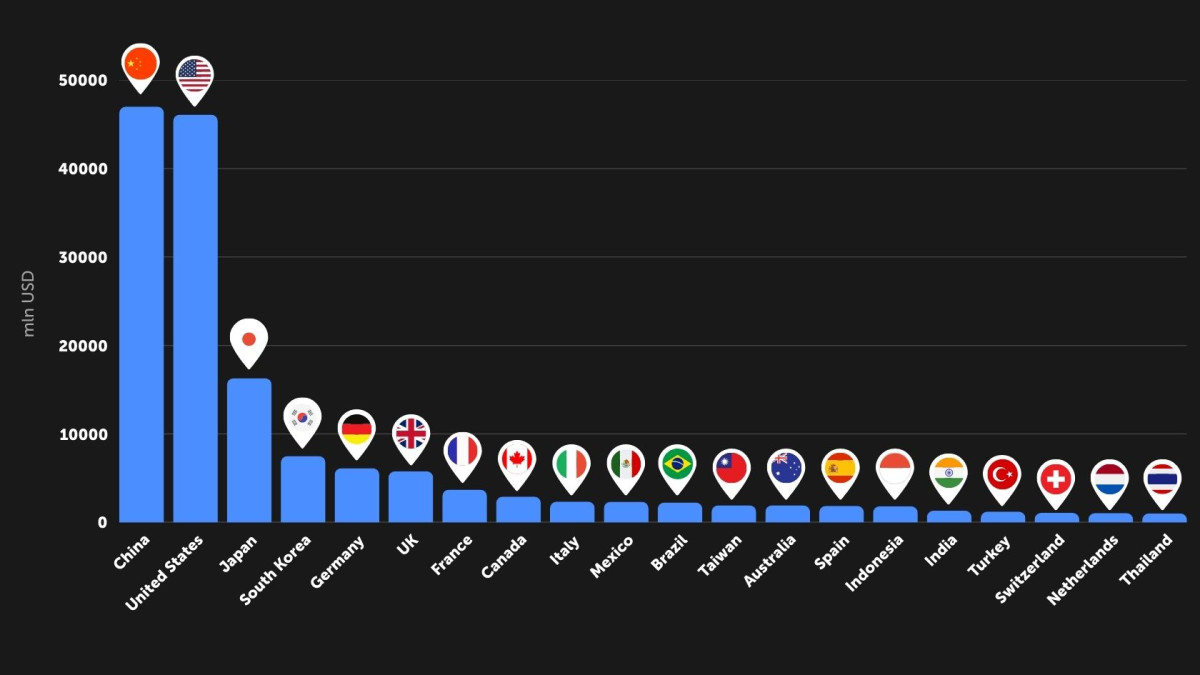

Top 20 Countries by Gaming Market Size

Source: newzoo.com

Source: newzoo.comChina reclaimed the top spot in revenue, once again overtaking the United States. While the global market grew in dollar terms, it actually declined when adjusted for inflation—even compared to 2023.

Top 20 Countries by Number of Players and Their Spending in Games

| Country | Number of gamers (millions) | Spend per Player (USD) |

| China | 702 | 67.7 |

| India | 419 | 3.03 |

| United States of America | 221 | 215 |

| Indonesia | 155 | 11.8 |

| Brazil | 115 | 19.7 |

| Mexico | 76 | 30.3 |

| Japan | 74.1 | 233 |

| Philippines | 67.7 | 12.5 |

| Vietnam | 58.5 | 12.7 |

| Iran | 53.5 | 12.5 |

| Germany | 52.1 | 123 |

| Turkey | 50 | 22.4 |

| UK | 41.9 | 145 |

| Thailand | 41 | 25.2 |

| Italy | 37.1 | 65.7 |

| South Korea | 33.9 | 226 |

| Spain | 33.2 | 57.7 |

| Colombia | 26.9 | 13 |

| Saudi Arabia | 25.8 | 38.6 |

| Canada | 23.6 | 129 |

- Developed countries (the U.S., Japan, South Korea, Switzerland) show high spending per player, starting at USD 200.

- Emerging markets (India, Indonesia, Brazil, the Philippines) report low spending per player but boast massive player bases. China is by far and away the leader in the number of gamers.

- India ranks second in terms of gamer count but has the lowest ARPU (USD 3.03). India and Indonesia are huge in volume but are currently under-monetized.

- The U.S., Japan, and Korea have fewer gamers but significantly higher revenue per user.

- Asian countries demonstrate both large player bases (China, India) and high monetization (Japan, Korea, Taiwan).

- Latin American and Southeast Asian markets are promising but require adaptation of their business models.

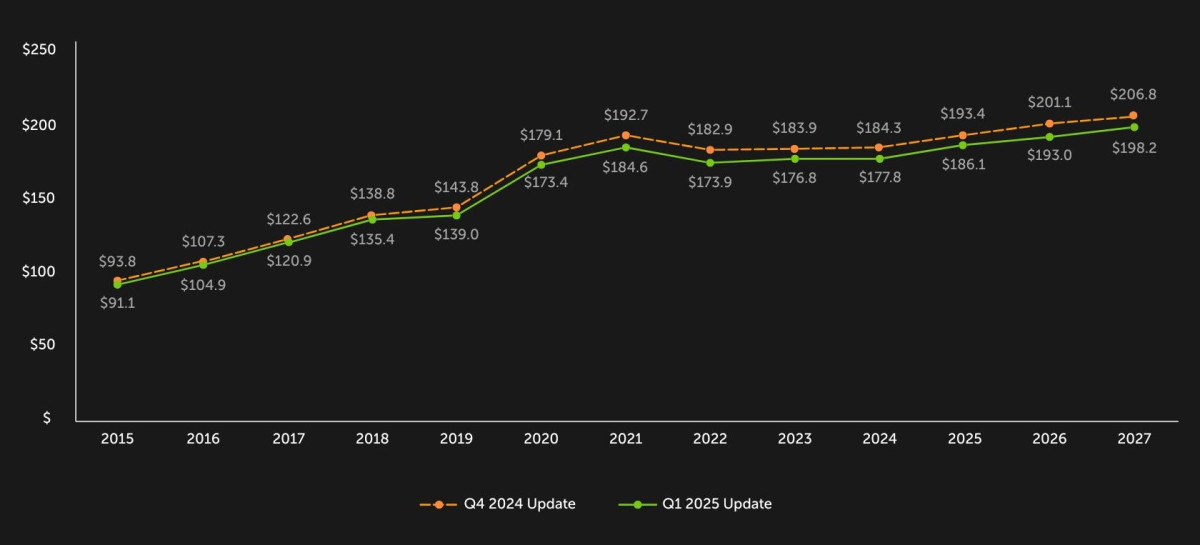

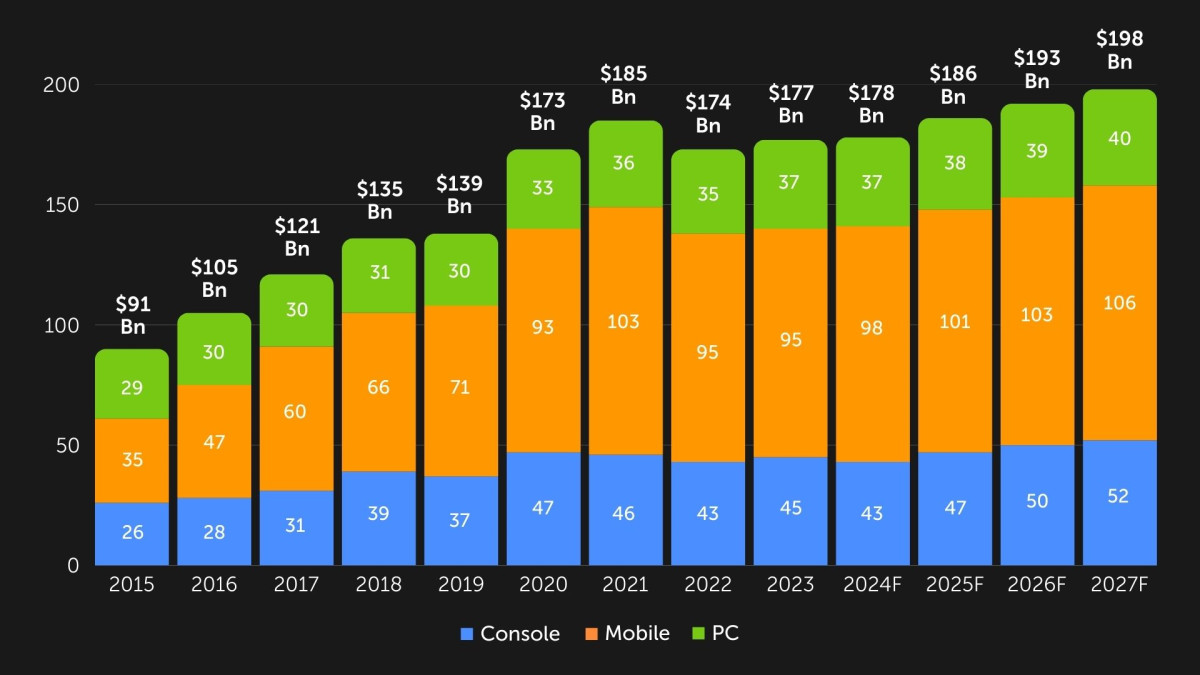

Gaming Market Size

Source: newzoo.com

Source: newzoo.comIn Q1 2025, Newzoo updated its data collection methodology and expanded the number of sources it uses. The figures now provide a more realistic picture.

- By the end of 2024, the global game market reached USD 177.9 bln.

- By 2027, the market is projected to grow to USD 198 billion, down from Newzoo’s previous estimate of USD 206.8 bln.

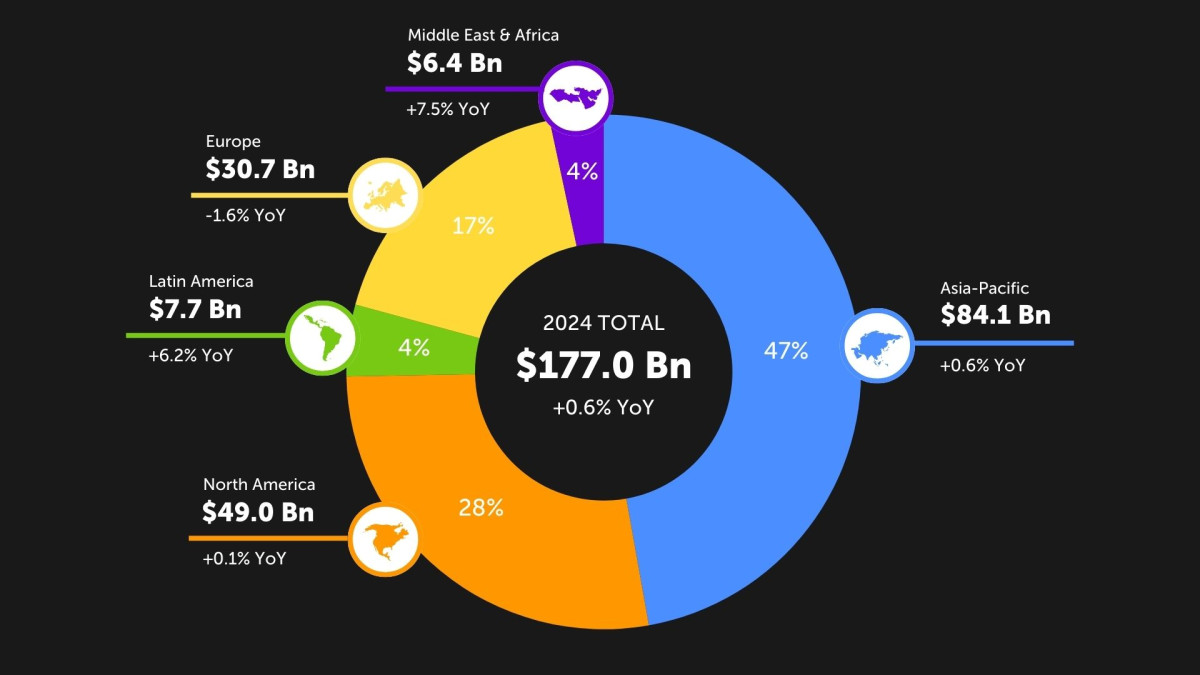

Global games revenue per region | 2024

Source: newzoo.com

Source: newzoo.com52% of all players’ spending on games in 2024 will come from the U.S. and China:

- China total: USD 47.0 bln

- U.S. total: USD 46.1 bln

By the end of 2024, the market grew by 0.6% compared to 2023. However, when adjusted for global inflation, real revenue actually declined.

Global games revenue per platform

Source: newzoo.com

Source: newzoo.comThe total market will grow with a CAGR (2024–2027) of +3.7% to reach an expected USD 198.4 billion in 2027.

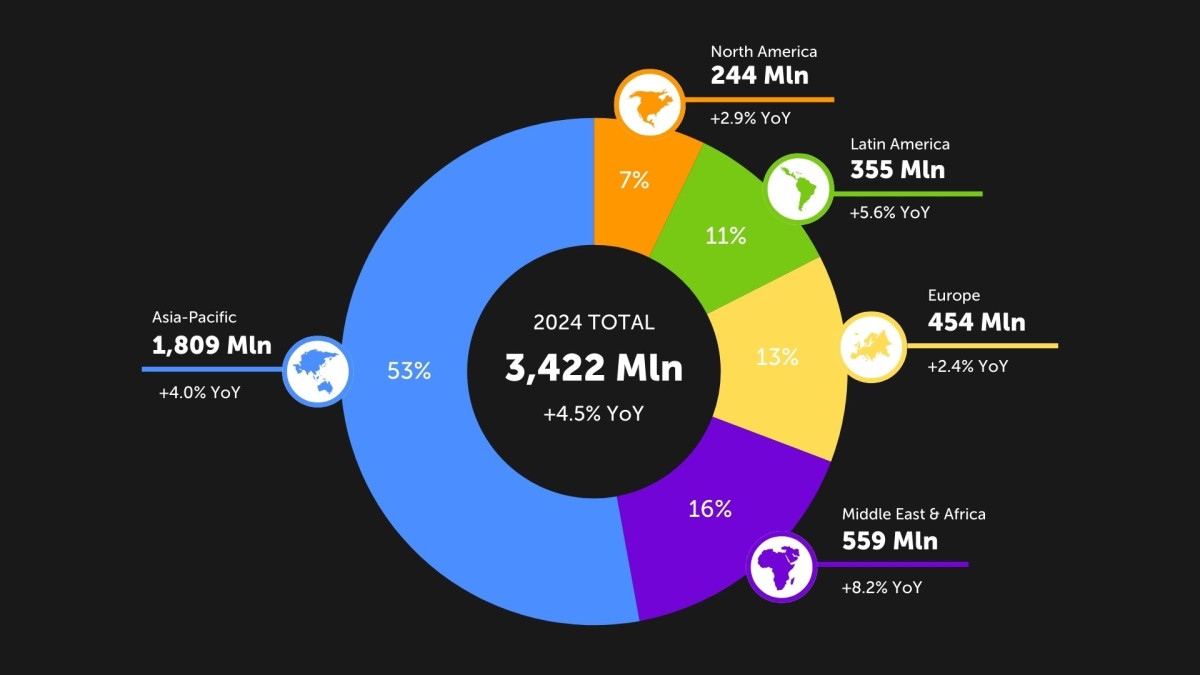

2024 Global players

Source: newzoo.com

Source: newzoo.com- The total number of players in 2024 reached 3.42 billion, showing a 4.5% increase compared to the previous year.

- The Asia-Pacific region remains the leader in player count with 53% of the total, or 1.809 billion players.

- The fastest-growing region is the Middle East and Africa, which saw an 8.2% increase and has 559 million players.

- North America and Europe represent smaller shares (7% and 13%, respectively) but remain important markets.

- Latin America shows steady growth of 5.6%, reaching 355 million players.

Key Trends

The year 2024 turned out to be not just “challenging,” but extremely difficult. Let’s talk about the trends we saw over the past year.

- Record layoffs and further cost optimization: Companies aggressively pruned back or eliminated any departments that weren’t generating revenue or strategic value.

- There was a significant reduction in available funding and an oversupply of content.

- Off-platform payments became normalized: These days, off-platform transactions are almost a required part of doing business for modern mobile (and other) game companies, as they lower transaction costs. The battle for profitability rages on.

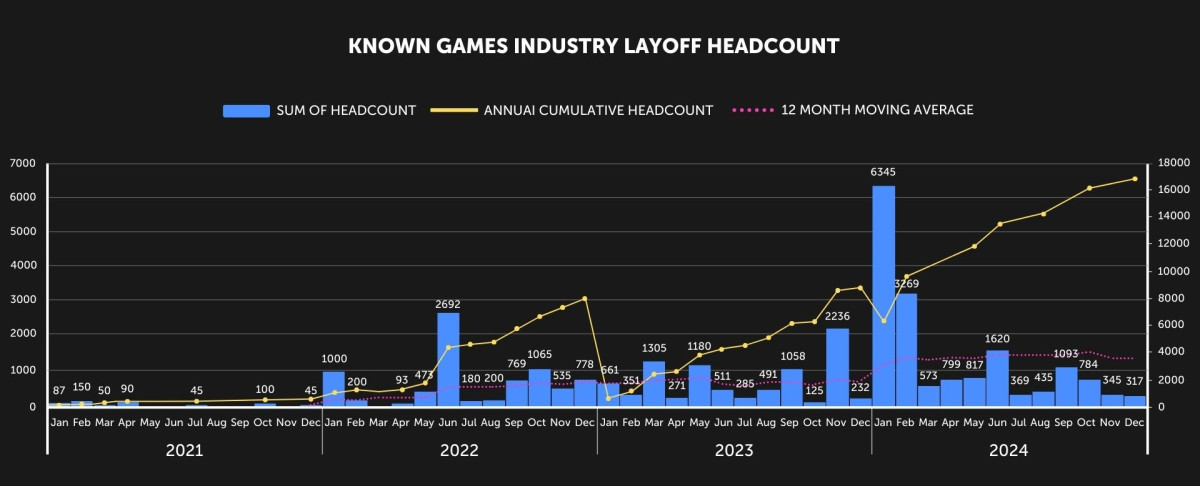

Record Layoffs and Further Cost Optimization

Source: wnhub.io

Source: wnhub.io2024 takes the cake when it comes to sheer layoffs in the gaming industry. According to expert Raj Patel, approximately 16,766 people were laid off during the year—more than in 2022 and 2023 combined. The key reasons include:

- Cost-cutting: Companies aimed to minimize costs by shutting down non-profitable or non-strategic initiatives.

- Post-pandemic correction: Many studios expanded during the pandemic, but couldn’t sustain those larger teams.

- Rising development costs: AAA game budgets increased by 6% annually from 2017 to 2022, then by 8% per year starting 2022, outpacing revenue growth.

Reduced Market Funding and Content Overload

Companies faced shrinking funding options and declining investor interest.

- Market growth slowed: Year-over-year revenue growth was just +0.2%, indicating stagnation.

- Intense competition: There’s an oversupply of content—only 19 games account for a combined 60% of user playtime.

- Dwindling subscriptions: The number of new subscribers has been dropping, most notably on platforms like PS Plus.

Off-Platform Payments

Off-platform payments have become essential for modern companies:

- Lower commissions: Third-party providers like Xsolla and Coda Payments offer commission rates of 5–10%—significantly less than the 30% typically charged by Apple and Google.

- Rise of alternative payment methods: Game companies are actively integrating alternative payment solutions to improve user convenience.

- Instant payments: Real-time payment options have increased player engagement and reduced payout delays.

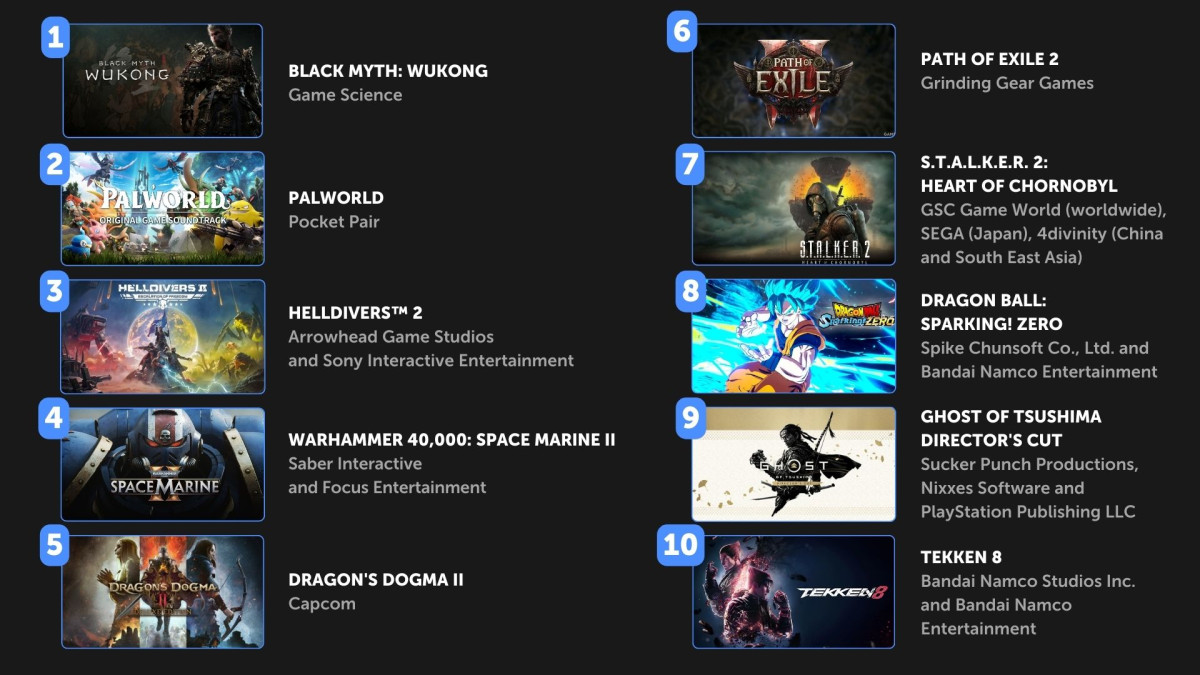

Top Games

2024 saw a wave of major game releases. One of the most talked-about was Black Myth: Wukong, which clearly demonstrated the growing influence of the Chinese market. Other big titles included Palworld, Helldivers 2, Warhammer 40,000: Space Marine 2, and Monster Hunter Wilds, marking a strong year full of prominent releases.

However, the year also saw notable failures, and the biggest one was Concord. The project reportedly cost PlayStation hundreds of millions of dollars and was shut down just a week after launch, emblematic of a market oversaturated with similar games.

Top 10 Games

What does this mean for us — the people working in games?

It’s time to stop throwing around ideas and start focusing on stability, adaptability, and smart decision-making. Because it’s not the teams with the most resources that win — it’s the ones who can adapt to the new rules of the game.