Looking to expand into the Gaming Market in France? We might have some useful insights to share with you! Check out our quick report on French gaming trends to get a snapshot of your potential audience and make more informed decisions.

General Information

| Official name | France, officially the French Republic (Wikipedia) | |

| Capital | Paris (Wikipedia) | |

| Population | 66,594,168 (Worldometer) | |

| Total area | 547,030 km² (Wikipedia) | |

| Average age | 42.1 (Worldometer) | |

| GDP | $3,030.90 bln (Trading Economics) | |

| GDP per capita | $38,975.58 (Trading Economics) | |

| Official language | French |

Rooted in the motto “Liberty, Equality, Fraternity,” France follows the principle of governance of the people, by the people, for the people.

The religious composition of France’s population as of 2019 was as follows: Catholics—41%, non-religious—40%, Muslims—5%, other religions—5%, Lutherans—2%, Orthodox Christians—2%, other Christians—2%, Buddhists—1%, Jews—1%, no data—1%.

The Gaming Market

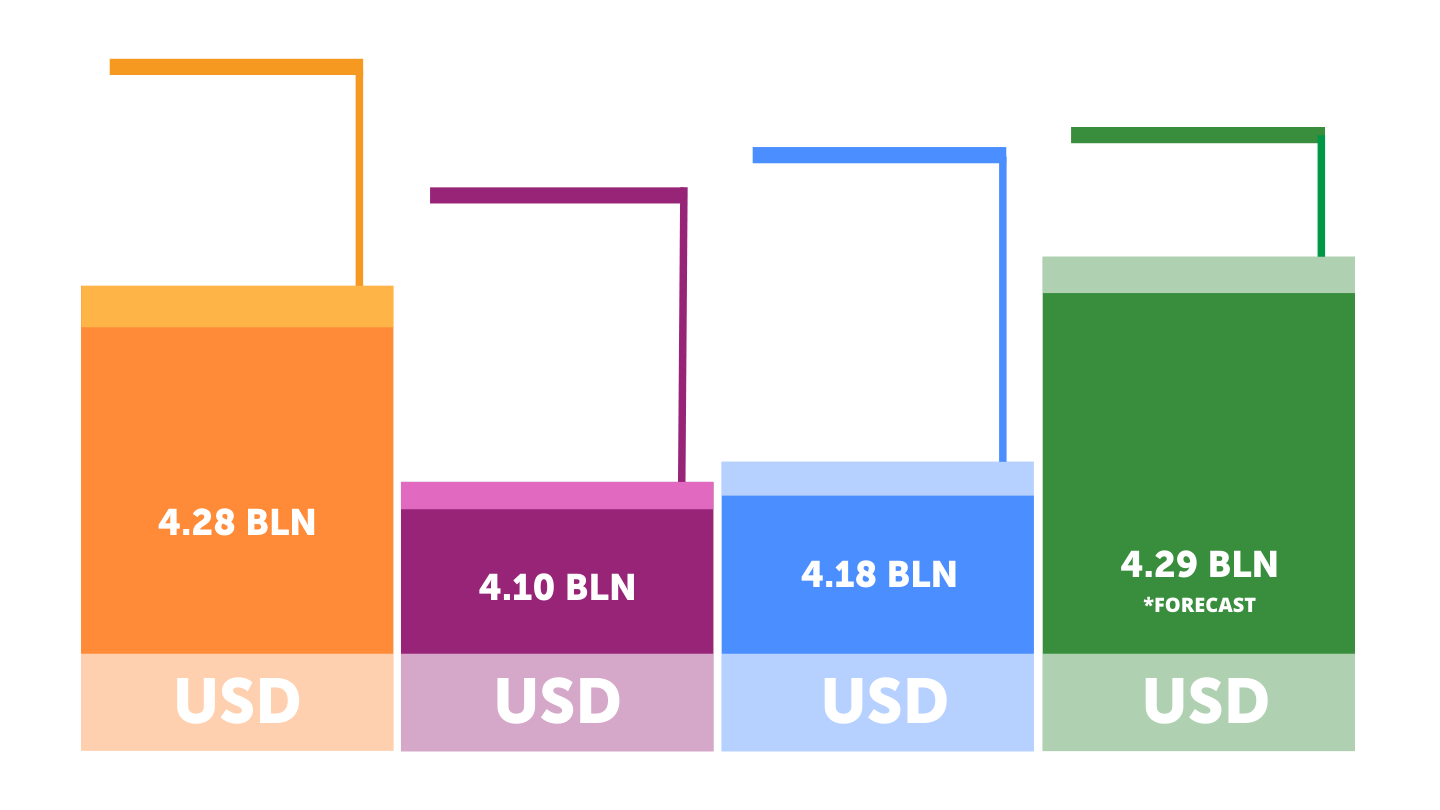

France’s gaming market is the 7th largest in the world at USD 4.18 billion in 2023, according to Newzoo.

In 2022, there were more than 1,000 gaming companies in France, 580 of which were developing games.

According to a 2023 report by Syndicat National du Jeu Vidéo (SNJV), there are 1,257 games currently in development. Of these, 39% are indie games, while 4.4% are high-budget AAA games. The range of game budgets varies: 67.2% of games operate with a budget of less than EUR 1 million, while 6.9% have budgets exceeding EUR 10 million. In terms of development time, 7% of developers spend more than four years creating their games. However, the majority—60.6%—complete their projects within one to three years.

Inclusivity in hiring is on the rise, and 24% of the current workforce are women. In terms of hiring plans, 52% of studios are looking to expand their teams, 40% are focusing on retention strategies, and 7.5% are considering layoffs. Remote work continues to gain traction, with 33% of employers working remotely full-time, and 47.5% adopting hybrid models. Financially, 27% of studios have surpassed the EUR 1 million annual revenue mark, indicating steady growth. A significant 8.3% of French studios have exceeded EUR 20 million in revenue, while the majority of 55% operate with annual revenues under EUR 300,000.

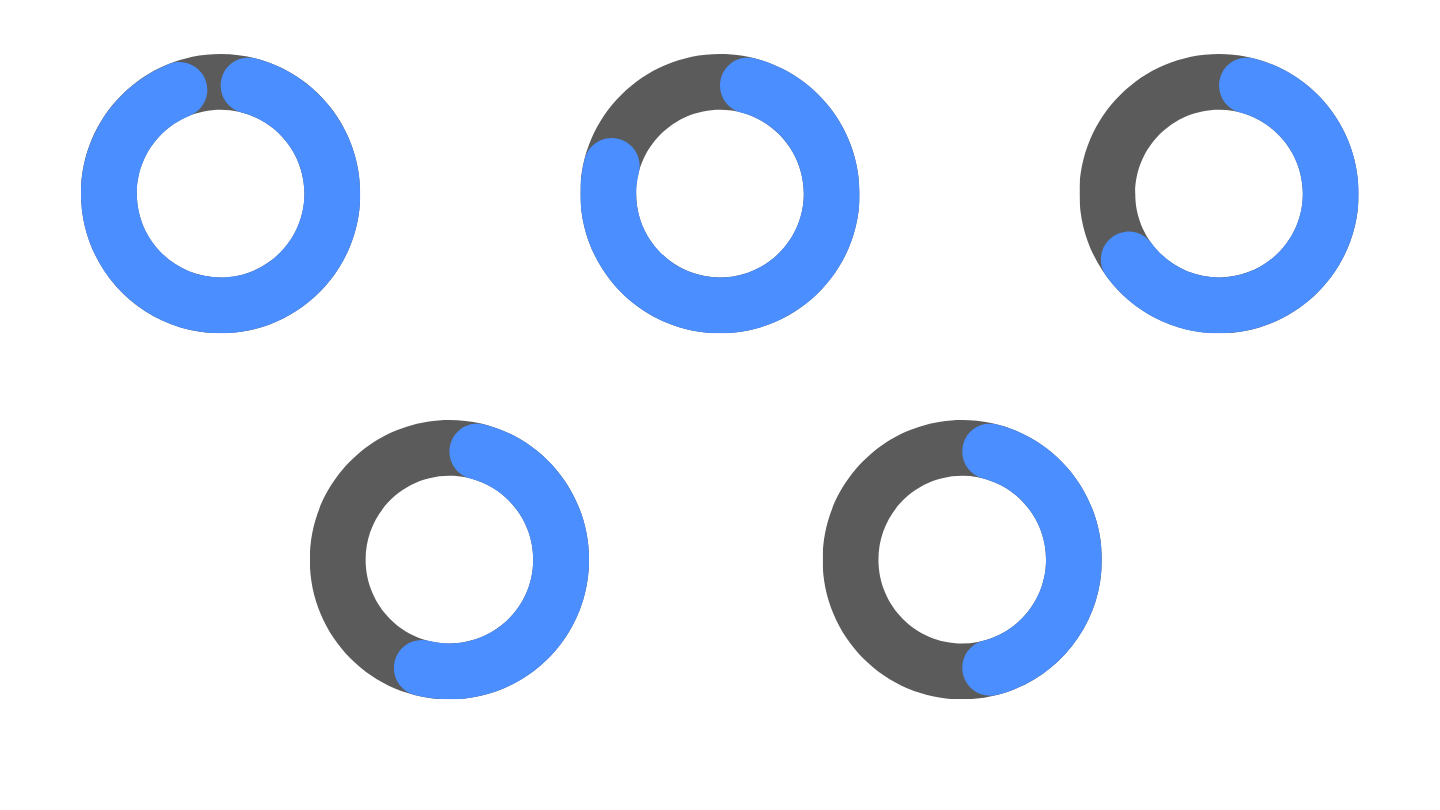

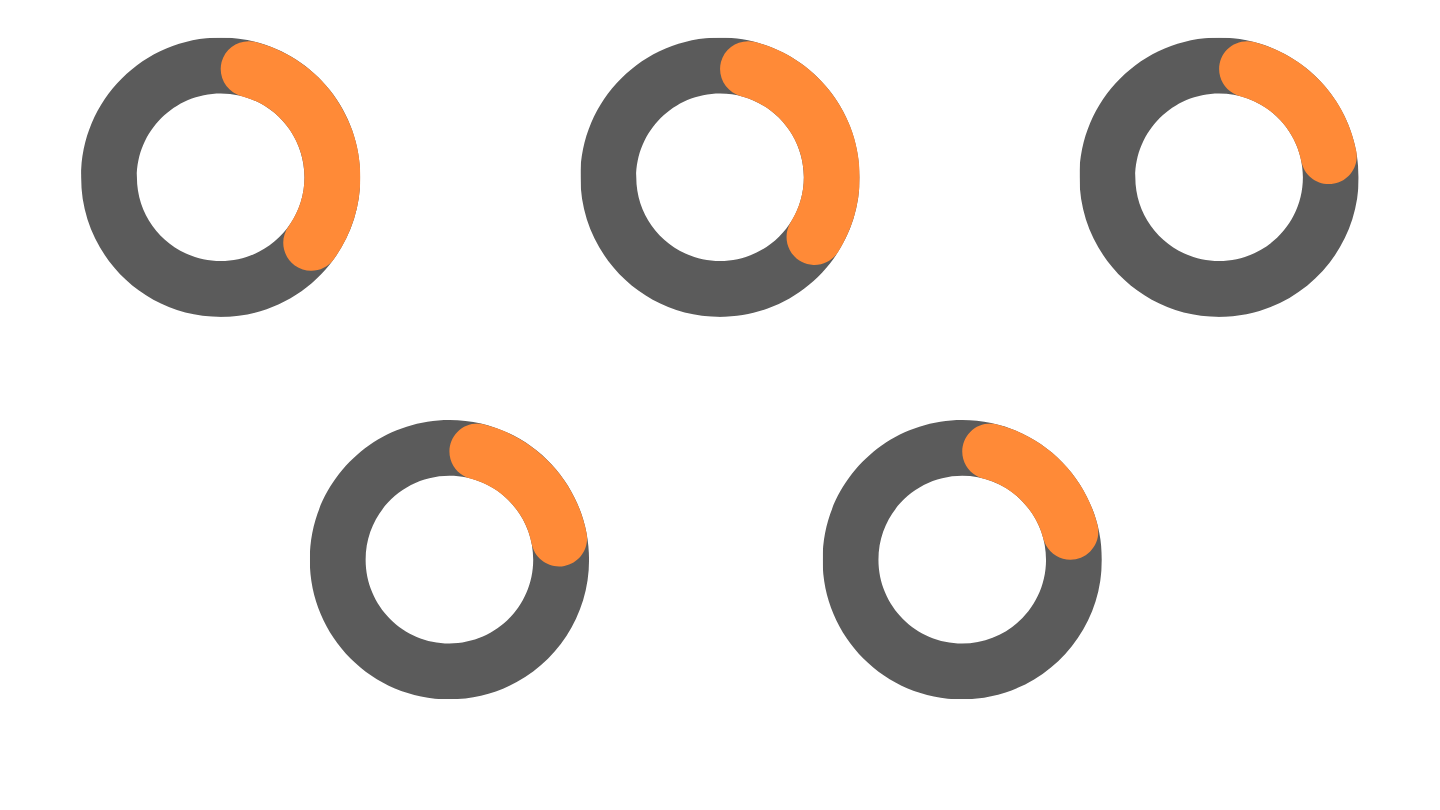

Market development dynamics

Source: platform.newzoo.com

Source: platform.newzoo.comGaming Market Size

Source: platform.newzoo.com

Source: platform.newzoo.comPopulation

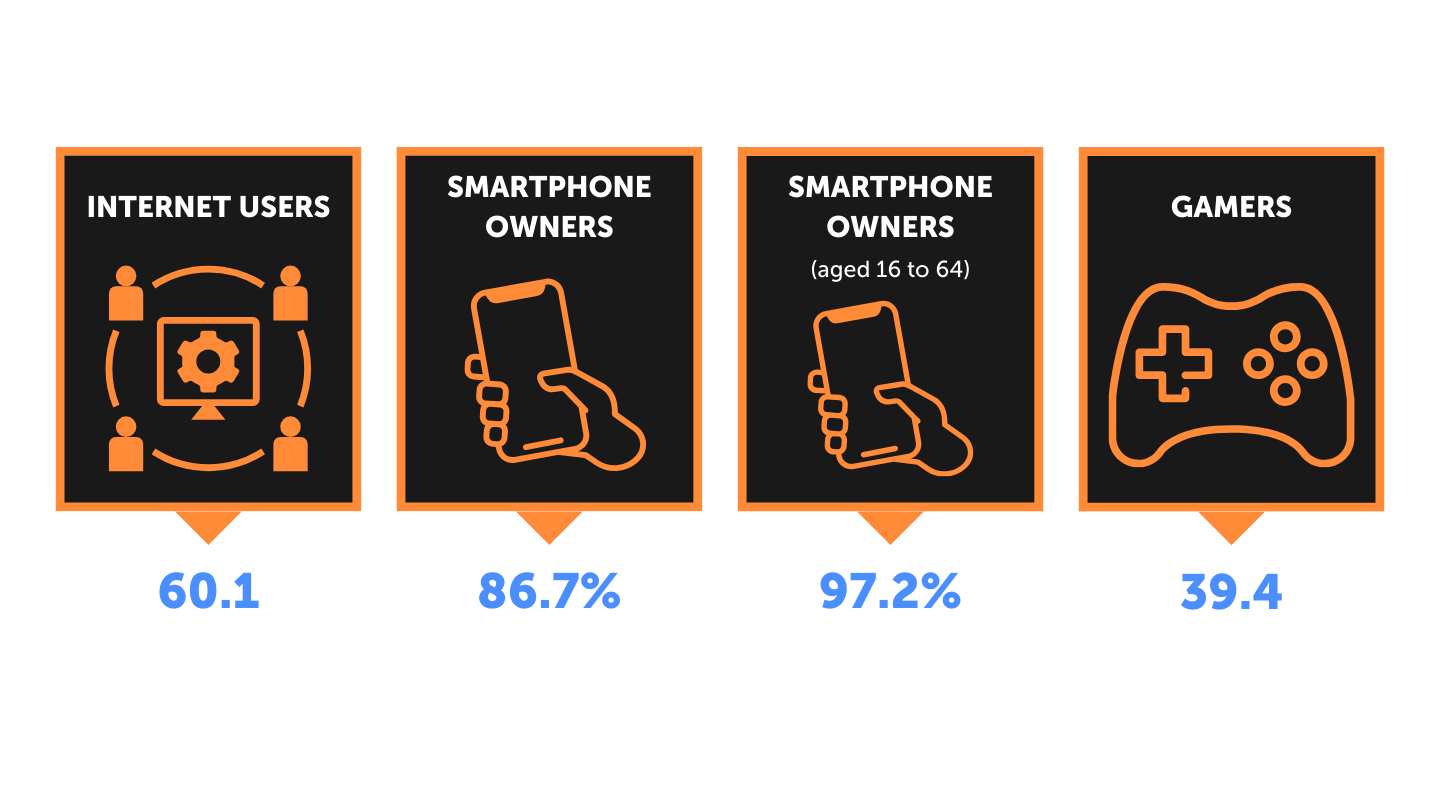

Source: platform.newzoo.com, datareportal.com

Source: platform.newzoo.com, datareportal.comNumber of Gamers

Source: platform.newzoo.com

Source: platform.newzoo.comPlayer Spending

Source: platform.newzoo.com

Source: platform.newzoo.comPlayer Profile

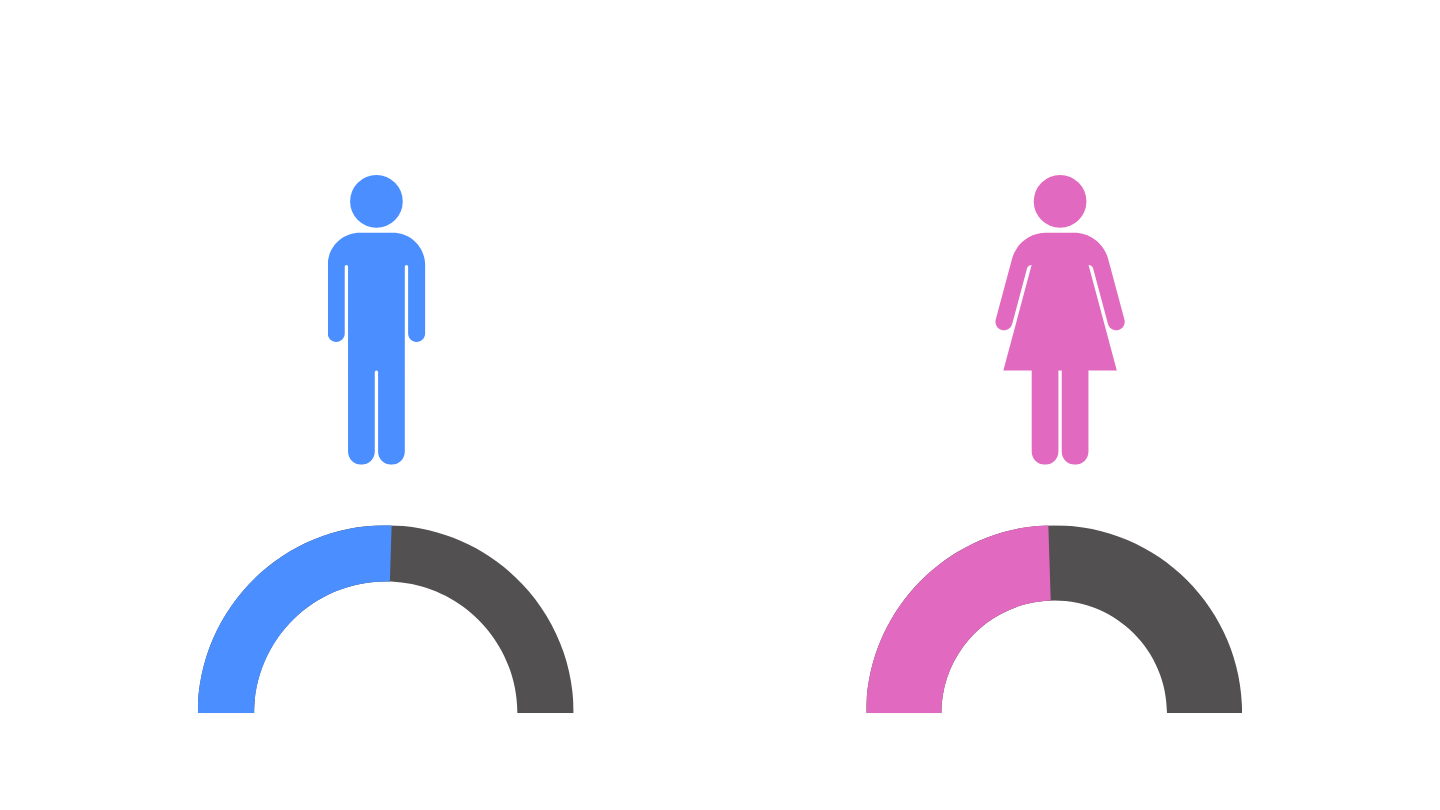

According to the SELL study, there are 37.4 million players in France, of which 32.8 million are adults (18 or older), and 4.6 million are children aged 10 to 17. Seven out of ten adults play at least once a year.

The average gamer age is 40 for men, and 39 for women.

According to the SELL report, 53% of French people are active gamers, playing regularly. Of those, 97% play alone, though 60% also play with more than one person (online or offline). Meanwhile, 83% of children aged 10 to 17 play with others, while 57% of adults do not play alone.

Further exploring the social aspect, 32% of players feel that they belong to a gaming community. This figure rises to 47% among children, and drops to 30% among adults.

Among the players who feel part of the gaming community, 88% find it friendly and welcoming, 82% state they have made friends there, and 80% feel that their socializing extends beyond video games and brings participants together around other interests and topics.

Around 38% buy games, with 68% of all purchases being physical copies, and the remaining 32% digital. At the same time, physical games account for 68% of purchases, while online games account for 32%.

Here’s why French players prefer physical games:

- 42% enjoy owning or collecting games.

- 40% want to be able to sell them later.

- 38% wish to have the option to trade them or lend them to friends.

- 37% prefer to give a physical copy as a gift.

- 16% don’t have enough onboard memory on their consoles.

- 15% don’t have a good enough internet connection to download games.

- 3% have other reasons.

General Player Statistics

Source: www.sell.fr

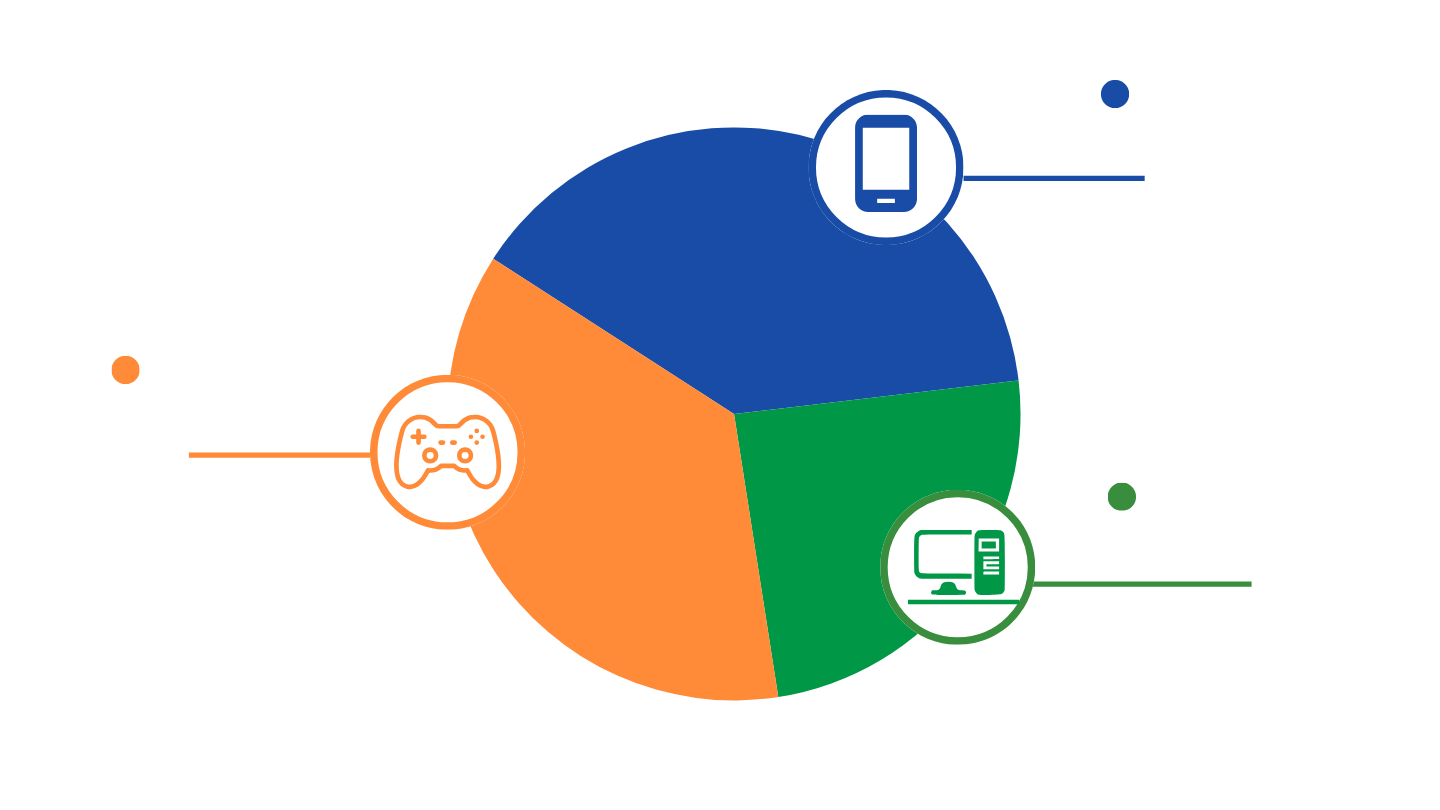

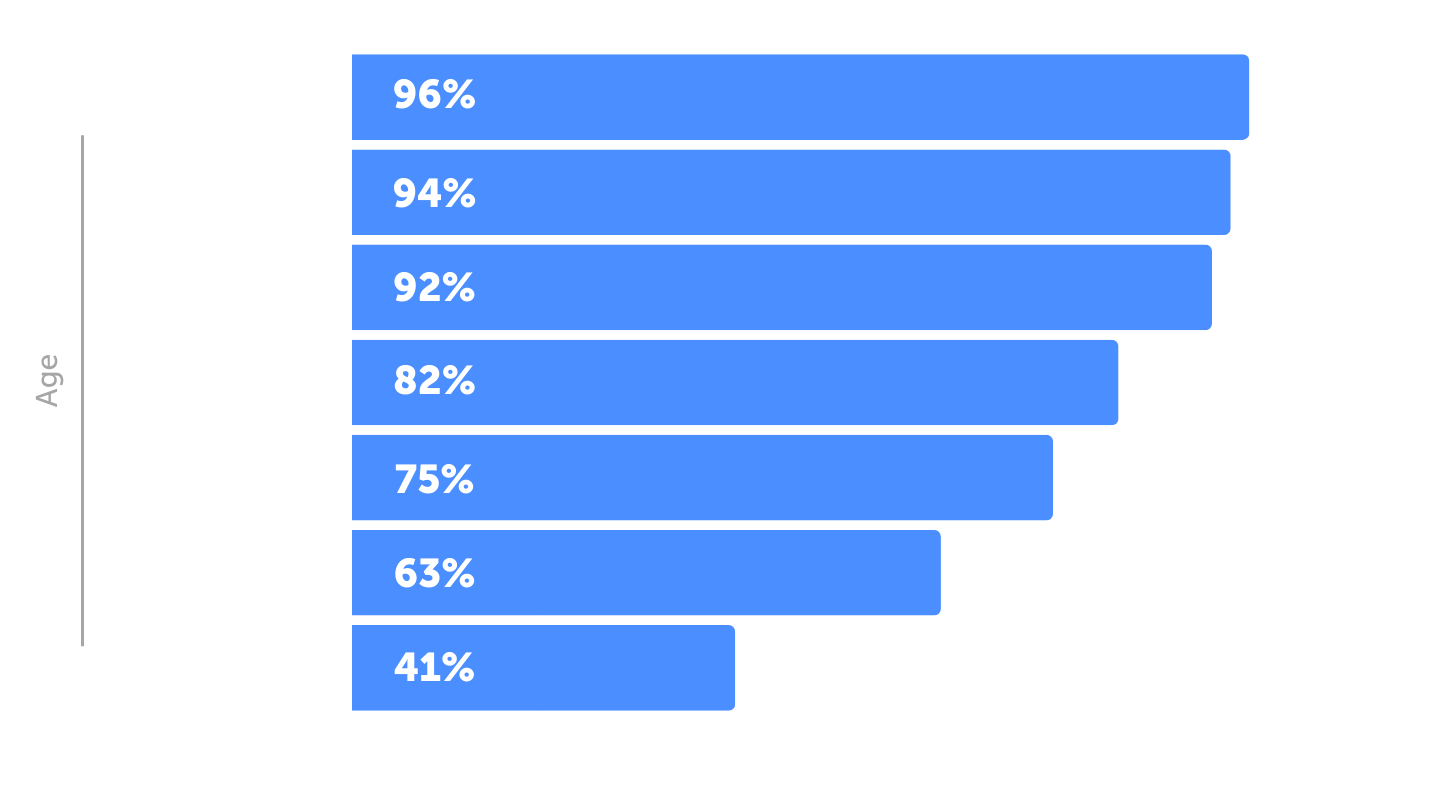

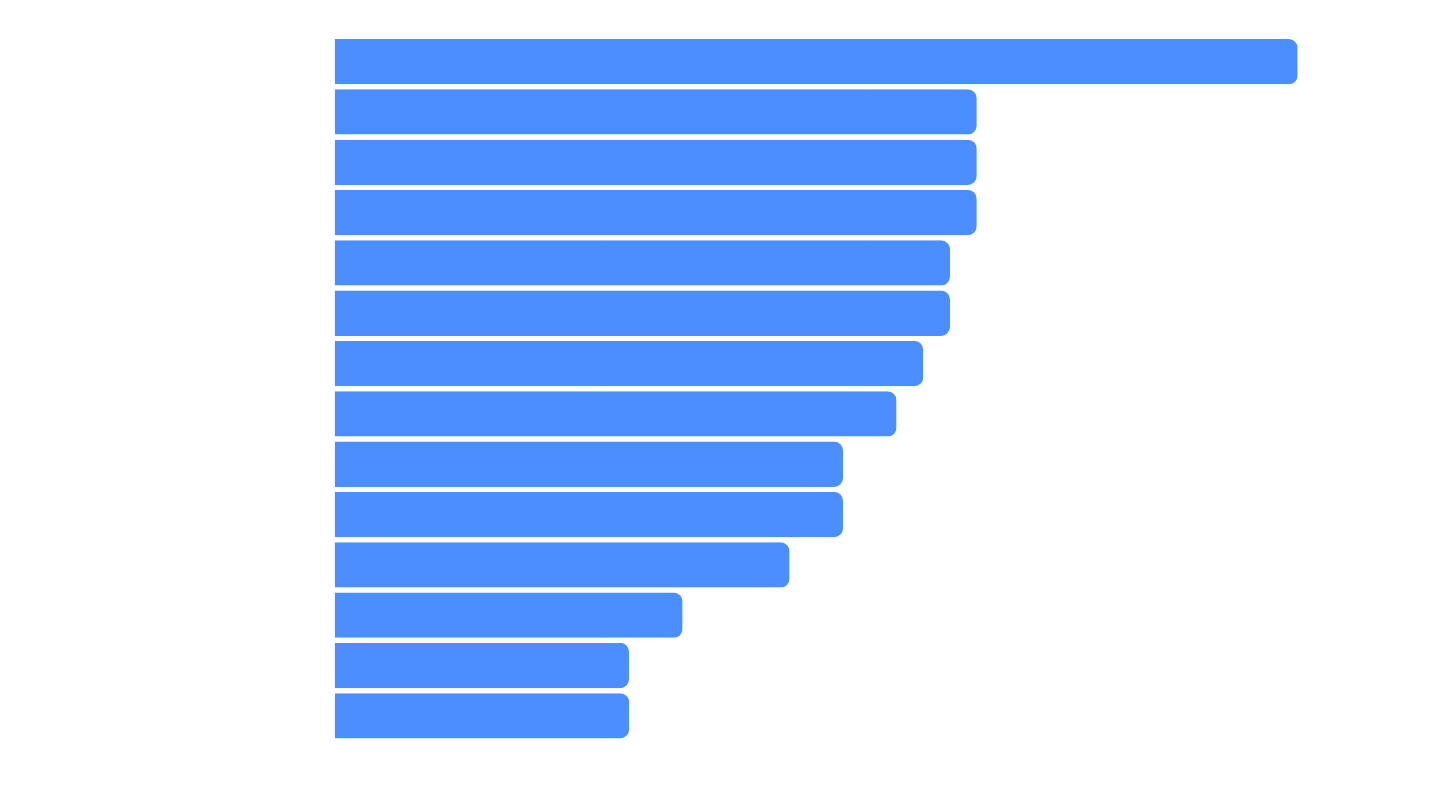

Source: www.sell.frAge Distribution

Source: www.sell.fr

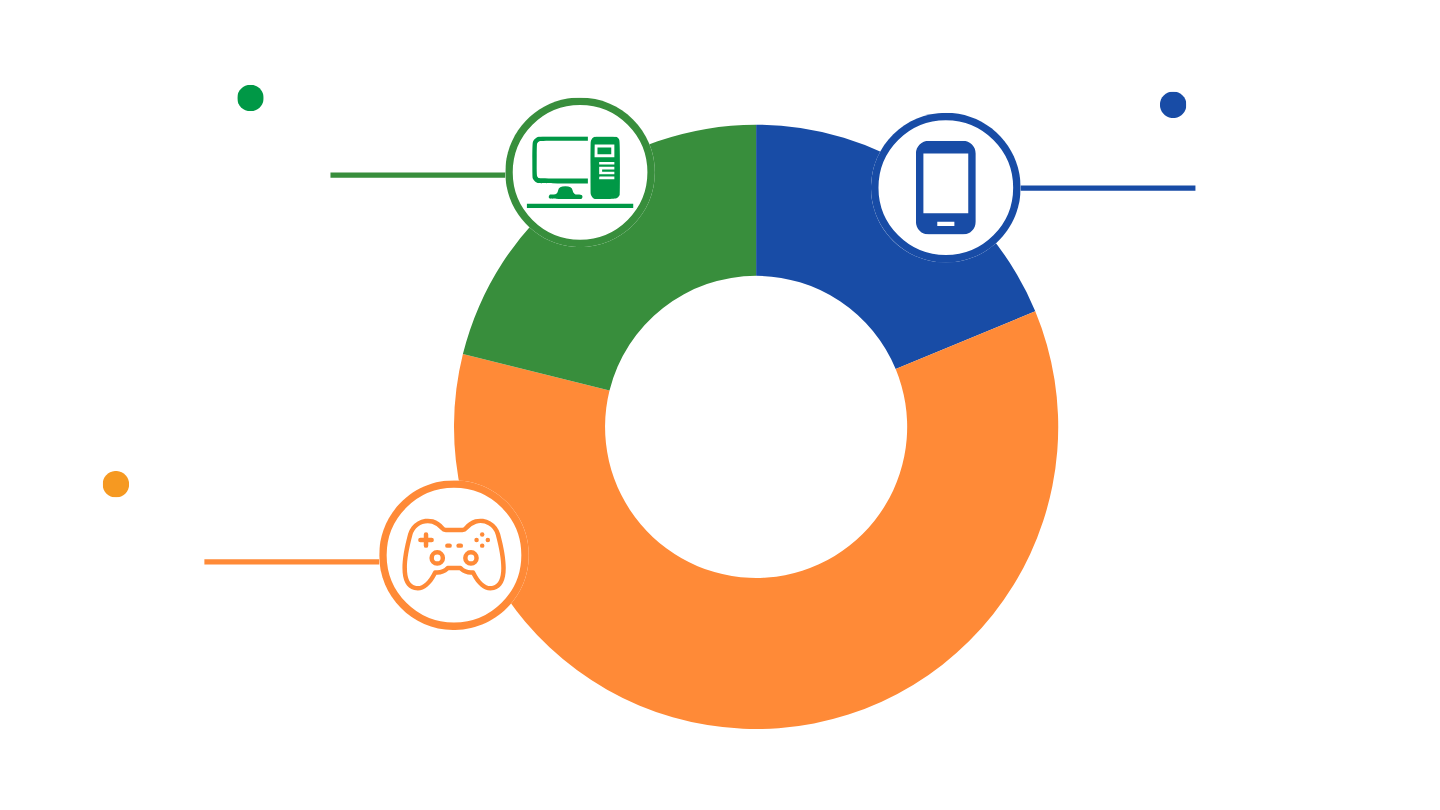

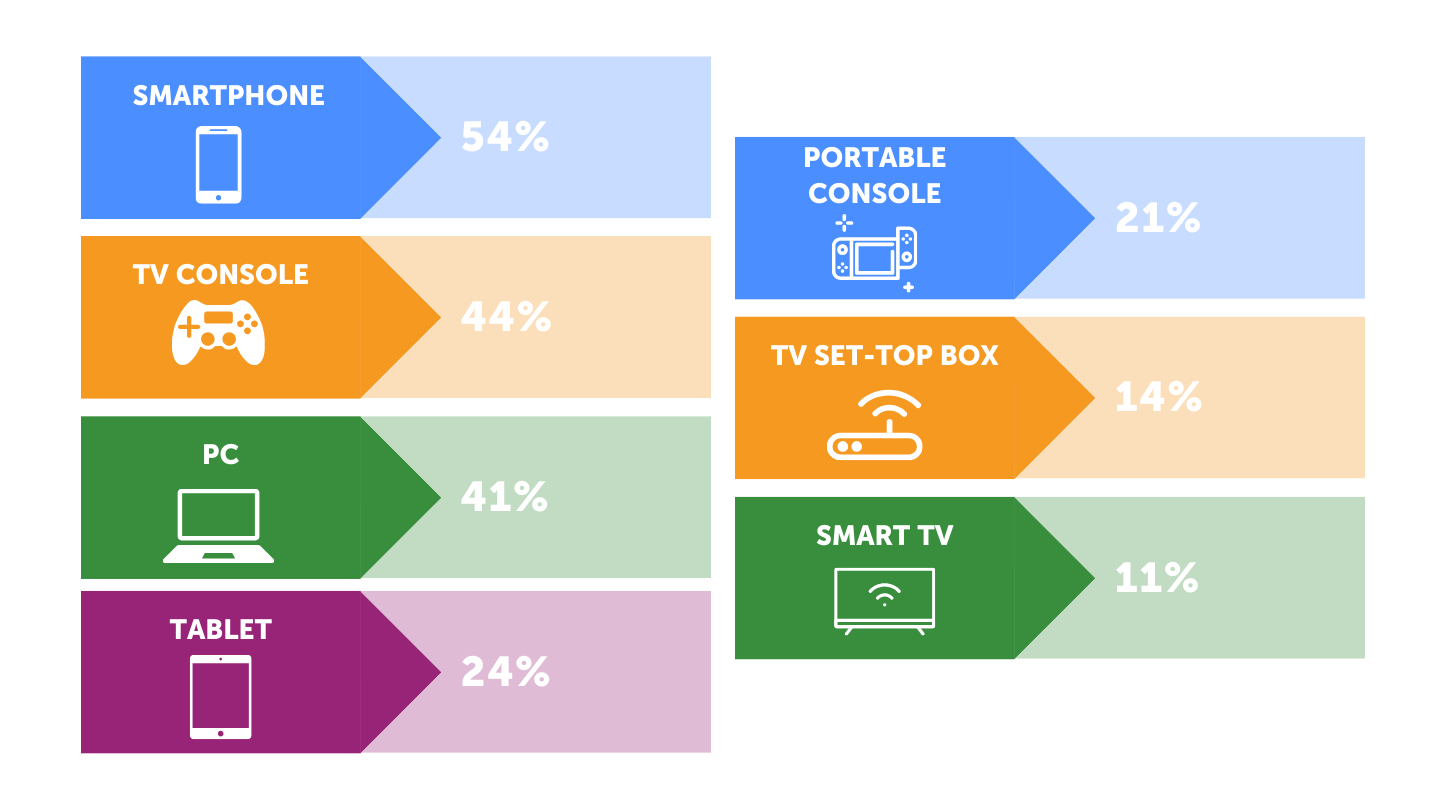

Source: www.sell.frFrench Gamers by Platform

Source: www.sell.fr

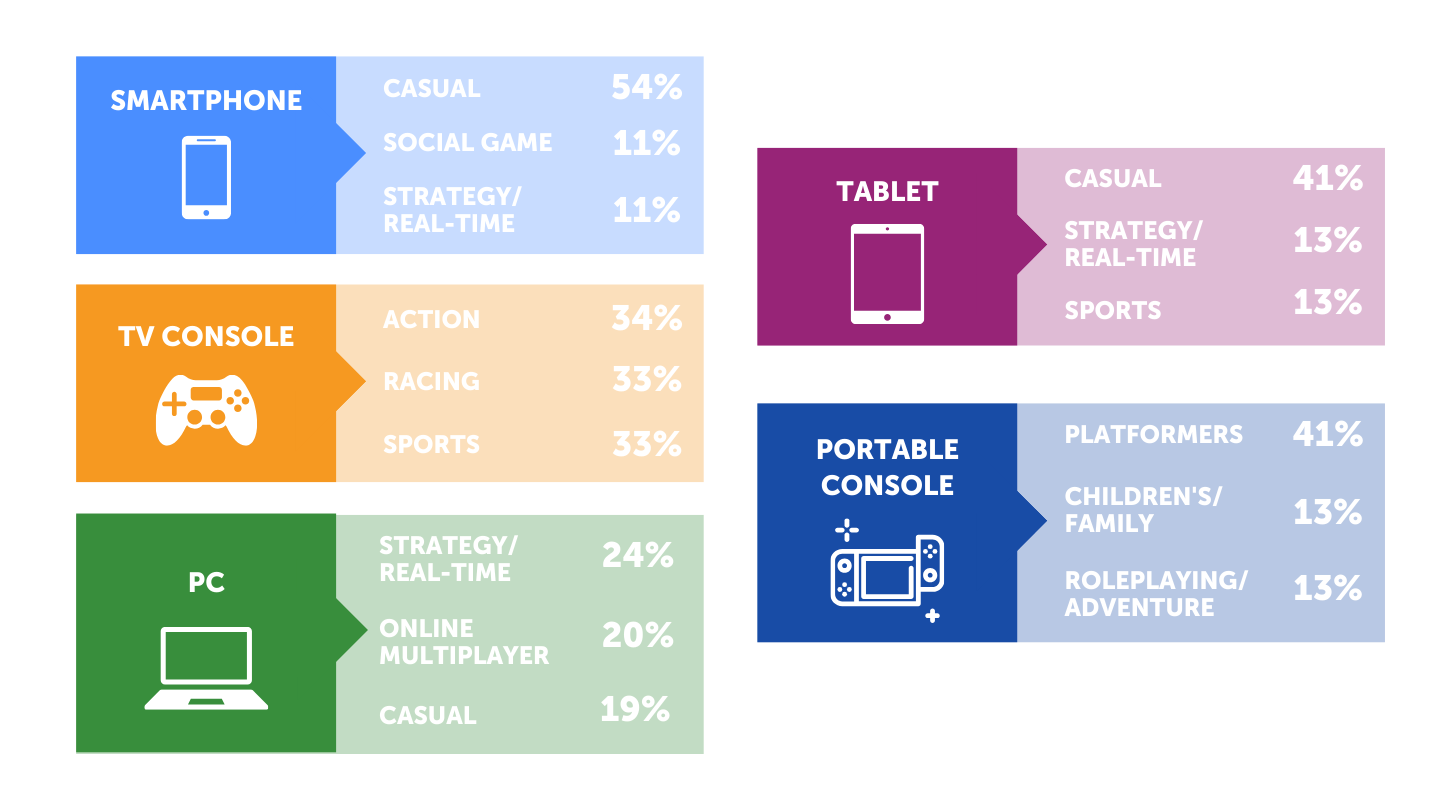

Source: www.sell.frPopular Game Genres

Source: www.sell.fr

Source: www.sell.frTop 3 genres of video games by platform

Source: www.sell.fr

Source: www.sell.frHow often French gamers play

| Several times a day | Every day / almost every day | Once or twice a week | 1–3 times a month | Rarely | |

| All players | 23% | 29% | 24% | 9% | 15% |

| Children | 29% | 37% | 25% | 6% | 4% |

| Adults | 22% | 28% | 23% | 9% | 17% |

Source: www.sell.fr

Reasons people play games

Source: www.sell.fr

Source: www.sell.frTop 5 reasons why players buy games

Source: www.sell.fr

Source: www.sell.frOS Distribution

Source: gs.statcounter.com

Source: gs.statcounter.comAverage Internet Speed

Source: www.speedtest.net

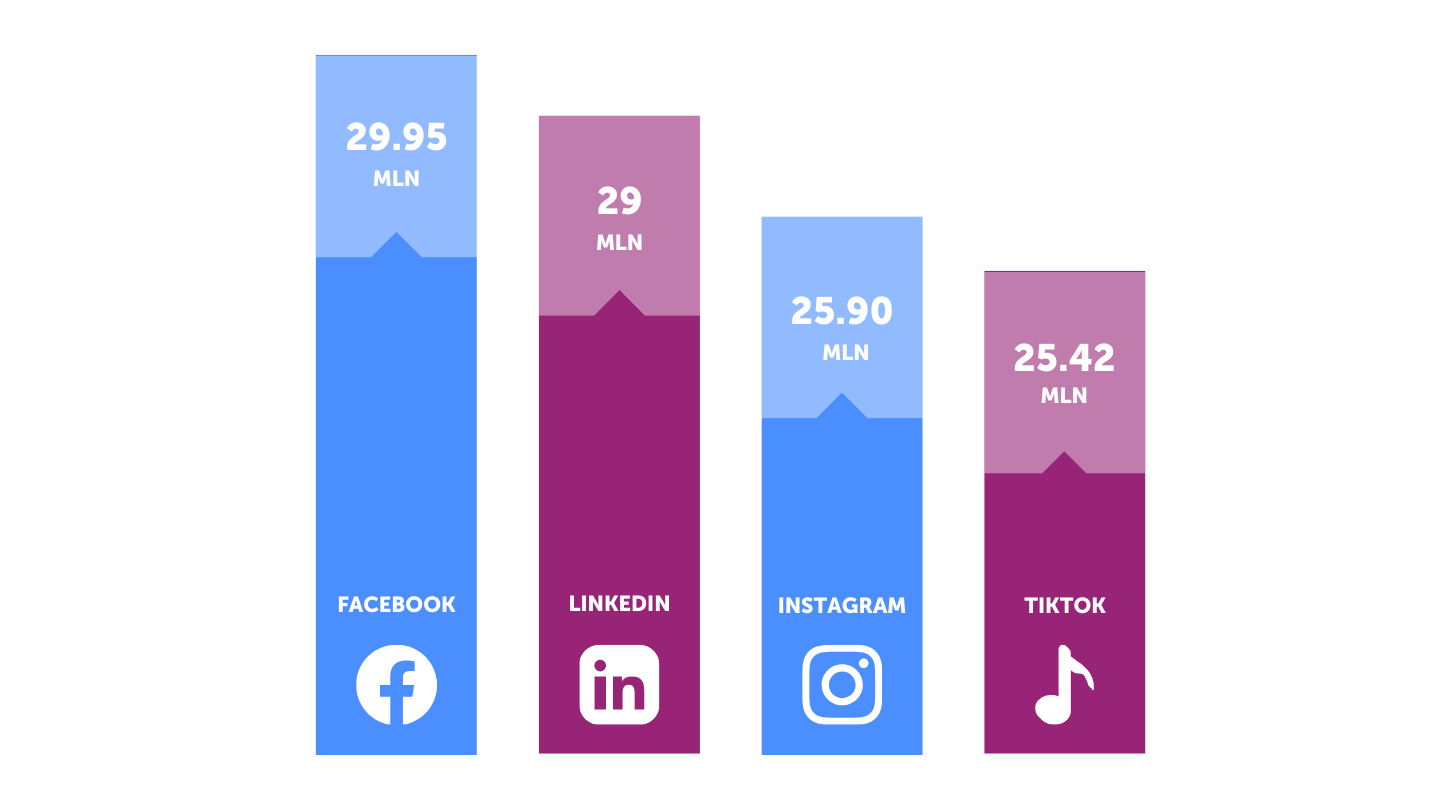

Source: www.speedtest.netPopular Social Media

Source: datareportal.com

Source: datareportal.comPopular Game Genres

| Genre | PC | Console | Mobile | Total |

| Adventure | $155 mln | $373 mln | $91.5 mln | $620 mln |

| Shooter | $191 mln | $386 mln | $18.9 mln | $596 mln |

| Battle Royale | $63.8 mln | $403 mln | $44.4 mln | $511 mln |

| Sports | $53.4 mln | $421 mln | $19.8 mln | $495 mln |

| Role-Playing | $99.3 mln | $171 mln | $73.5 mln | $344 mln |

| Puzzle | $25.9 mln | $17.3 mln | $194 mln | $237 mln |

| Racing | $34.9 mln | $167 mln | $5.02 mln | $207 mln |

| Fighting | $26.8 mln | $163 mln | $16.5 mln | $206 mln |

| Sandbox | $39.7 mln | $128 mln | $19.4 mln | $187 mln |

| Platformer | $23.8 mln | $121 mln | $33.6 mln | $178 mln |

| Simulation | $73.0 mln | $77.7 mln | $24.7 mln | $175 mln |

| Strategy | $53.3 mln | $24.6 mln | $91.6 mln | $169 mln |

| Idle | $7.10 mln | — | $75.6 mln | $82.7 mln |

| Card Battle | $25.7 mln | $8.54 mln | $37.2 mln | $71.5 mln |

| Arcade | $23.8 mln | $34.2 mln | $4.46 mln | $62.5 mln |

| Battle Arena | $27.7 mln | $10.9 mln | $15.6 mln | $54.2 mln |

| Tabletop | $6.41 mln | $10.6 mln | $16.4 mln | $33.4 mln |

| Casino | $2.37 mln | $495,000 | $27.7 mln | $30.5 mln |

| Hyper Casual | — | — | $13.0 mln | $13.0 mln |

| Music | $7.31 mln | $4.75 mln | $705,000 | $12.8 mln |

| Educational | — | — | $6.56 mln | $6.56 mln |

Source: platform.newzoo.com

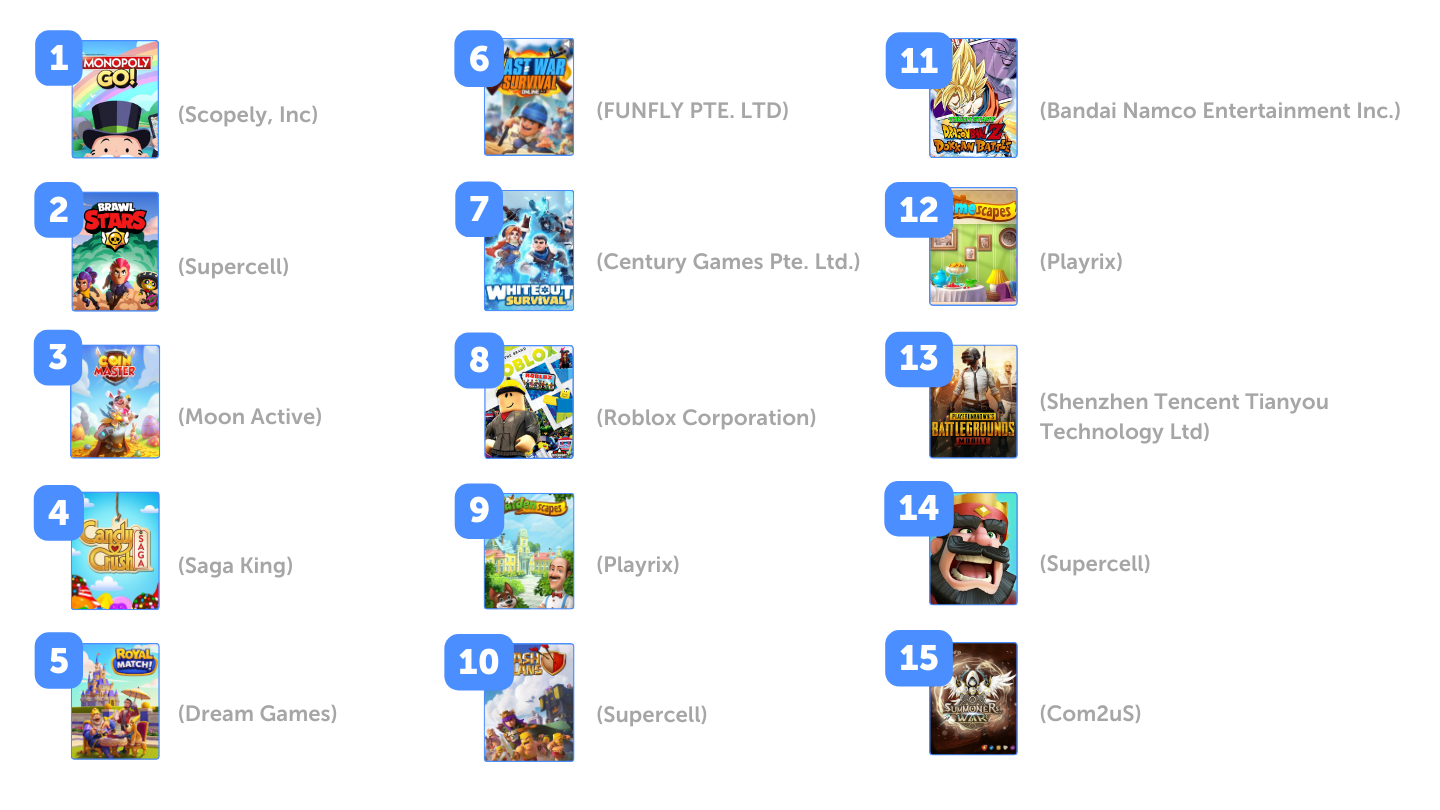

AppMagic’s Top Mobile Games, France (2024 AppMagic)

1. MONOPOLY GO! (Scopely, Inc.)

2. Brawl Stars (Supercell)

3. Coin Master (Moon Active)

4. Candy Crush Saga (King)

5. Royal Match (Dream Games)

6. Last War:Survival (FUNFLY PTE. LTD.)

7. Whiteout Survival (Century Games Pte. Ltd.)

8. Roblox (Roblox Corporation)

9. Gardenscapes (Playrix)

10. Clash of Clans (Supercell)

11. DRAGON BALL Z DOKKAN BATTLE (Bandai Namco Entertainment Inc.)

12. Homescapes (Playrix)

13. PUBG MOBILE (Shenzhen Tencent Tianyou Technology Ltd)

14. Clash Royale (Supercell)

15. Summoners War (Com2uS)

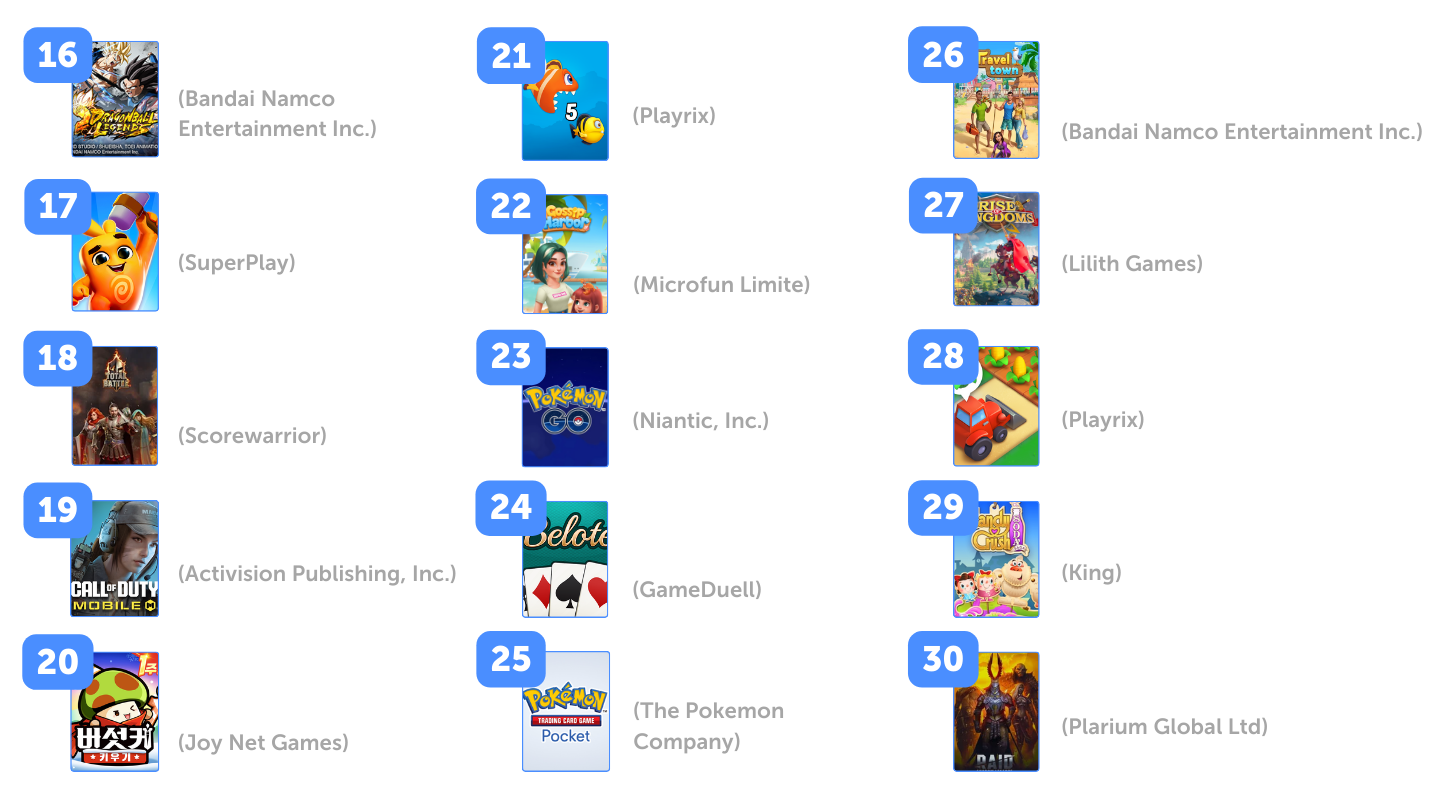

16. DRAGON BALL LEGENDS (Bandai Namco Entertainment Inc.)

17. Dice Dreams™️(SuperPlay)

18. Total Battle: Tactical Wars (Scorewarrior)

19. Call of Duty®: Mobile (Activision Publishing, Inc.)

20. 버섯커 키우기-1주년 혜택 대방출! (Joy Net Games)

21. Fishdom (Playrix)

22. Gossip Harbor®: Merge & Story (Microfun Limited)

23. Pokémon GO (Niantic, Inc.)

24. Belote.com – Belote & Coinche (GameDuell)

25. Pokémon TCG Pocket (The Pokemon Company)

26. Travel Town – Merge Adventure (Moon Active)

27. Rise of Kingdoms (Lilith Games)

28. Township (Playrix)

29. Candy Crush Soda Saga (King)

30. RAID: Shadow Legends (Plarium Global Ltd)

Source: appmagic.rock

Source: appmagic.rock