The Japanese Gaming Market

Japan (officially the State of Japan) is an archipelagic country in East Asia. It is located in the Pacific Ocean, east of the Sea of Japan, China, North and South Korea, and Russia.

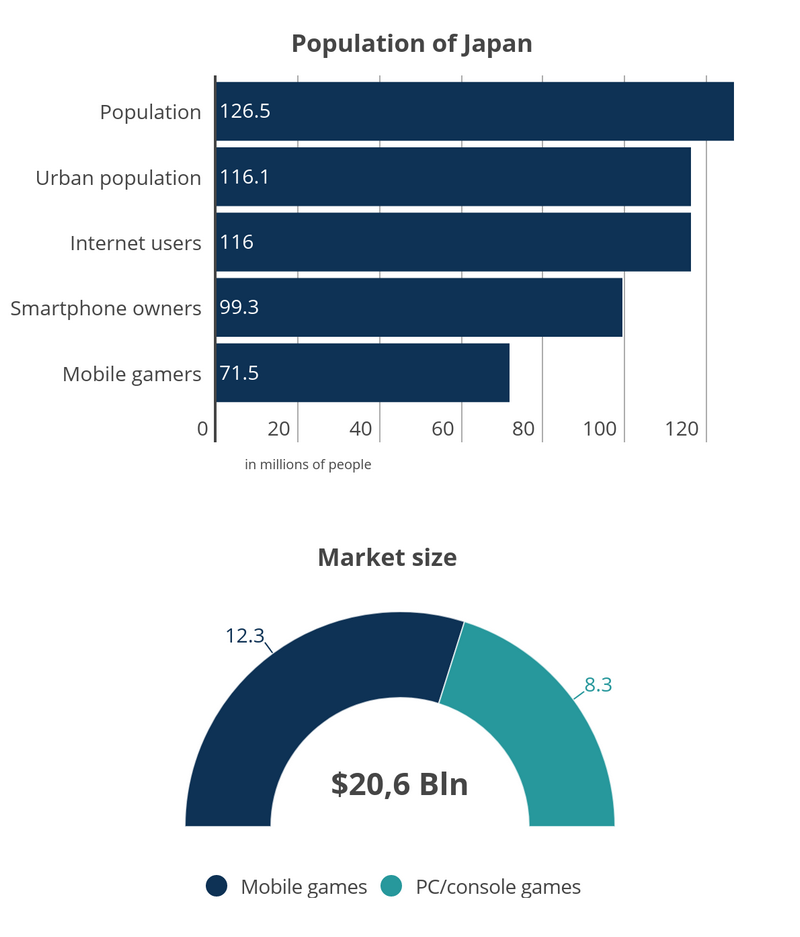

Japan is located in the Japanese archipelago, which is made up of 6,852 islands. The four largest islands are Honshu, Hokkaido, Kyushu, and Shikoku. They account for 97% of the archipelago’s land. With almost 126 million inhabitants, Japan has the 11th highest population in the world. Greater Tokyo, which includes the Japanese capital Tokyo and several surrounding prefectures, has a population of over 30 million and is the largest metropolitan area in the world.

Japan is third in the world in terms of nominal GDP and fourth in terms of GDP adjusted for purchasing power parity. The country is also quite developed, with a very high standard of living (19th in the Human Development Index). In addition, Japan has one of the highest life expectancies and one of the lowest infant mortality rates in the world. At the same time, the country is experiencing a strong demographic shift toward an elderly population (29% of citizens are over 65) and a natural population decline (0.2% per year).

Population: 126 476 461 (Worldometers)

Average Age: 48.4 (Worldometers)

GDP: $5 Billion (World Bank) – 2019

Official language: Japanese

The Gaming Market

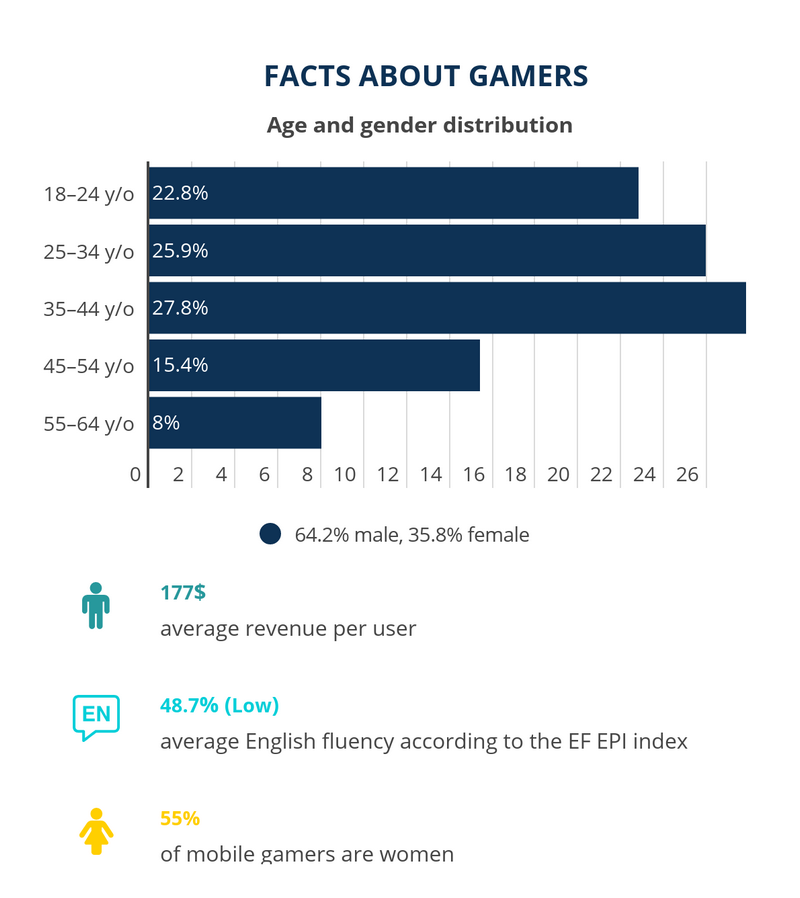

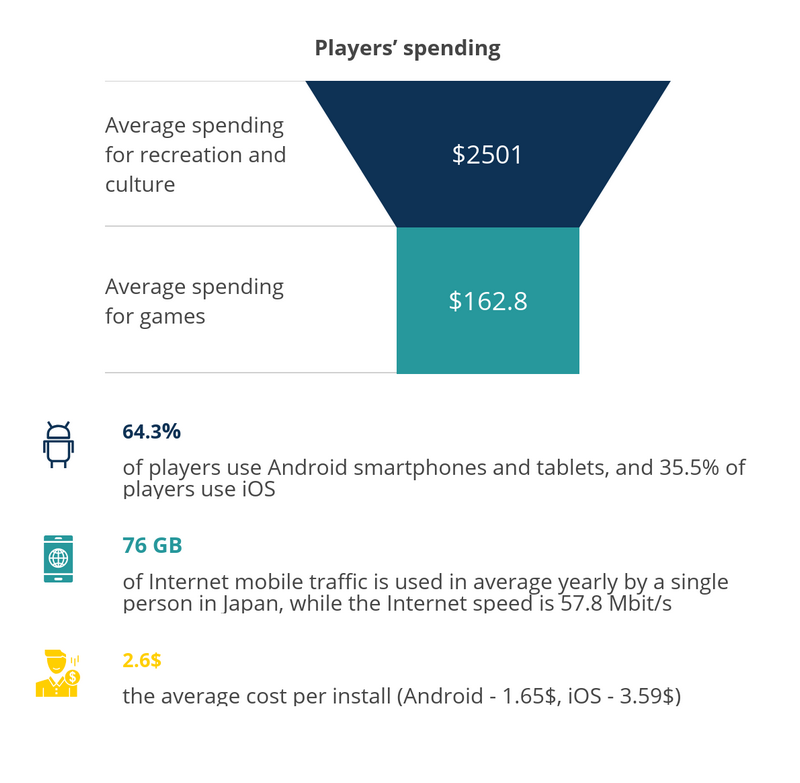

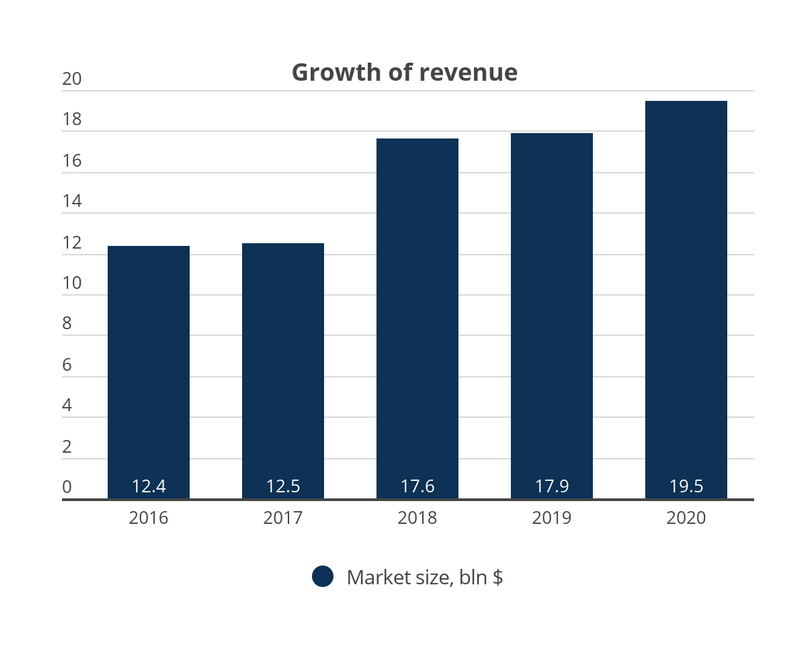

The Japanese gaming market was one of the world’s first gaming markets and is currently the third largest, after China and the US. Japan is a country with highly advanced technology, and it’s also the birthplace of brands such as Nintendo, Sony PlayStation, and Sega. Because of these factors, Japan has always been a significant contributor to the development of the gaming industry. In Japan, gaming is more than just a part of the economy — it’s part of the culture. As a result, Japanese people dedicate a lot of time to games (an average of 6.7 hours per week for mobile games) and are willing to spend more money on them, as evidenced by the high ARPU of $177. However, the user acquisition cost in Japan is one of the highest in the world.

The release of the Nintendo Switch console in 2017 (which is one of the best-selling consoles in history) and the PlayStation 5 in 2020 has also influenced the industry. The monumental launch of 5G networks in March 2020 will boost Japan’s gaming market too, including the cloud gaming market.

As for eSports, which play a smaller role, they have seen a 27% growth over the past year. However, this is likely to change in the coming years with the help of the Japanese government. The Ministry of Economy, Trade, and Industry has ambitious plans to expand the Japanese eSports industry by supporting companies and experts who are developing major tournaments (esportsobserver.com, KADOKAWA Game Linkage research).

Player Statistics

The most up-to-date information on Japanese gamers:

- Japanese people spend a lot of time playing games: on average 6.7 hours per week on mobile games (App Annie).

- Women are very avid gamers: 54% of female gamers play five or more times per week, while only 44% of men do so (Newzoo).

- In Japan, the percentage of mobile gamers who pay for games is high, as is the percentage of mobile gamers who continue playing after the first week. This guarantees the acquisition of users with good paying capacity ($371 per year).

What should perhaps be considered when entering the Japanese market is the aging of the population (29% of the population is over 65).

Marketing

Popular game genres:

1. JRPG (JapanRPG: Dragon Quest, Final Fantasy) deserves its own genre

2. RPG

3. Action

4. Adventure

5. Fighting

For mobile games:

1. Battle Royale

2. RPG

3. Action

4. Adventure

5. Puzzle

Developers

The list of Japanese developers includes world-renowned companies, several of which were founded as far back as the 70s and 80s:

- Sony Interactive Entertainment

- Nintendo

- Capcom

- Bandai Namco

- Square Enix

From the smaller names in the market, it’s worth noting the following:

- GungHo Online Entertainment (Puzzle&Dragons)

- Altus (Persona 5)

- FromSoftware (Demon’s Souls, Dark Souls, Bloodborne, Sekiro)

- Monolith Soft (Dragon Ball Z: Attack of the Saiyans)

- LINE Corporation (many casual games in the LINE Games series)

- Geisha Tokyo, Inc. (casual projects)

Localization

The vast majority of the population speaks Japanese. English is mandatory in school starting in the 5th grade, although many people do not speak it fluently by the time they graduate.

Students have difficulties learning English due to its fundamental differences in grammar and syntax, as well as important differences in pronunciation in comparison with Japanese. This leads to significant difficulties when it comes to using English effectively. Another problem is the potential fear that Japan will lose its identity if too much English penetrates the country.

Localizing games for Japan requires a great amount of work; translating into Japanese is fairly difficult due to certain specific aspects of the language. Here are some nuances of the language and culture that must be kept in mind when adapting games:

- Japanese has several writing systems (kanji, hiragana, katakana, and romaji) and two computer input methods, which makes it quite a difficult language right from the start. The official writing systems, called kanji and kana, as well as the polite forms, are reviewed annually by the Japanese Ministry of Education.

- Japanese is an extremely rigid language. It has different levels of politeness that depend on the hierarchical status of the person you are speaking with, their relationship to you, their social status, and more. The so-called “neutral” level of Japanese can sound very polite and sterile. On the other hand, English source texts tend to be fairly informal, which makes it impossible to translate directly into Japanese for the Japanese market. The text would come off as harsh. The imperative form is too strong in Japanese and could give the wrong impression.

- Some topics would be perceived negatively in Japanese video game culture. Avoid promoting any religion, tobacco products, or drugs in your game. Furthermore, when using cultural elements or beliefs in localizations, be sure to check that they are, in fact, Japanese and not Chinese. The two cultures are often confused by outsiders, and Japanese gamers do not tolerate such confusions. Murder, torture, blood, and other depictions of violence are censored in Japan. Players are advised not to take on the role of murderers, and children and innocent people should not be victims of violence.